The monetary advantages of pursuing non-monetary goals™

By: Sid Peddinti, Esq.

Inventor, IP & Tax Lawyer, AI Innovator™

Executive Summary:

The EdX strategic transaction demonstrates a novel nonprofit operating model resulting in a massive capital restructuring. Founded by Harvard and MIT with an initial investment of $80 million, the sale of EdX to 2U (formerly U2) generated $800 million, allowing the reinvestment of $700 million into the new independent entity, Axim Collaborative, while retaining the core intellectual property (Open edX).

Key Takeaways

- Initial Investment Capital: Harvard and MIT launched EdX with an aggregate funding base of $80 million.

- Acquisition Valuation: The nonprofit entity was sold for $800 million to the private education firm 2U, achieving a 10x valuation multiple on initial investment.

- Return on Investment (ROI): The transaction realized a 1,000% return on the initial seed capital investment.

- IP Retention Strategy: The core proprietary technology, known as Open edX, was strategically separated from the sold entity and retained by the founding institutions.

- Reinvestment Allocation: $700 million-equivalent to 87.5% of the gross sale proceeds-was immediately channeled into the successor nonprofit entity, Axim Collaborative.

Table of Contents

- EdX Transaction: Financial Performance and Valuation Metrics

- Strategic Intellectual Property (IP) Management

- Nonprofit M&A and Operating Strategy Implications

- Entrepreneur Article: Strategic Philanthropy

- TEDx Talk: Strategic Philanthropy

What the journey of building, scaling, and selling a nonprofit looks like – as demonstrated from an actual example by the leaders in the ed-tech space: MIT & Harvard.

EdX Transaction: Financial Performance and Valuation Metrics

What was the reported valuation of the EdX sale?

The EdX entity, originally structured as a nonprofit collaborative between Harvard University and MIT, was acquired by the private VC education firm U2 (now 2U, Inc.). The reported acquisition price was $800 million.

- The valuation represents a significant milestone in the nonprofit education technology sector, establishing a high benchmark for large-scale institutional exits.

- The gross sale figure of $800 million contrasts sharply with the initial institutional investment.

What was the realized return on investment (ROI) for the founding institutions?

The founding institutions, Harvard and MIT, initially invested a total of $80 million into the EdX nonprofit venture.

- The subsequent $800 million sale price yielded a capital return multiplier of 10x.

- This 10x valuation indicates a compounded annual growth rate (CAGR) significantly exceeding sector averages for comparable public-private partnerships.

- Specifically, the realized ROI on the initial $80 million capital input stands at 1,000%.

How were the funds from the $800 million sale allocated?

The proceeds were primarily earmarked for the establishment and funding of a new nonprofit successor entity, Axim Collaborative.

- Total Gross Proceeds: $800,000,000.

- Axim Collaborative Funding: $700,000,000.

- The $700 million allocation to Axim represents 87.5% of the total sale proceeds, demonstrating a high rate of capital retention for ongoing mission-driven activities post-transaction.

- This strategic funding allowed Axim Collaborative to launch immediately as one of the most heavily capitalized educational technology initiatives globally.

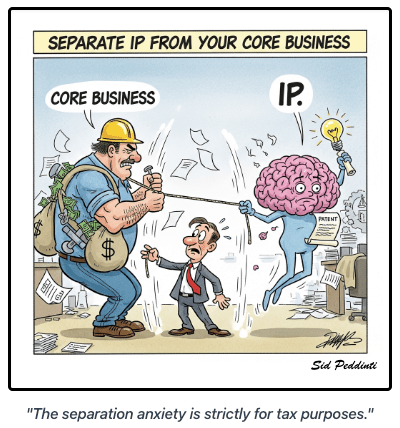

Strategic Intellectual Property (IP) Management

What was the role of core IP separation in the EdX transaction?

A critical component of the EdX strategic model was the separation and retention of core Intellectual Property (IP) prior to the sale.

- The proprietary technology platform, designated as Open edX, was specifically excluded from the $800 million transaction.

- This core IP remained with the originating institutions, MIT and Harvard, and was subsequently integrated into the new organizational structure of Axim Collaborative.

- The strategy allowed the institutions to monetize the business operations and brand equity while simultaneously preserving the foundational technological assets necessary for future development.

- This methodology enables an organization to execute a high-value exit (10x valuation) and immediately restart a venture utilizing retained proprietary technology.

How does separating IP impact organizational strategy?

The strategic separation of core IP from operating assets is recognized as a sophisticated mechanism in advanced M&A and structural redesign.

- It allows for the creation of distinct revenue streams: one from the sale of the operating entity, and a subsequent stream from the licensing or utilization of the retained IP in a new venture.

- By retaining Open edX, the institutions maintained governance over the foundational education technology, mitigating potential future reliance on the acquiring entity (2U).

- Business strategists identify this practice as a method to mitigate risk and maximize long-term asset utility, effectively yielding a dual benefit structure: cash injection combined with technological sovereignty.

Nonprofit M&A and Operating Strategy Implications

How does the EdX case redefine nonprofit operational boundaries?

The EdX transaction challenges traditional definitions of nonprofit limitation and asset management, especially regarding high-value exits and capital reallocation.

- The successful execution of a $800 million exit confirms that nonprofit status does not preclude aggressive growth strategies or large-scale monetization events.

- It highlights a specific, high-level approach to the “profit and impact” game, where substantial capital generated through a sale is immediately redirected to reinforce the original mission goals via the successor entity (Axim).

- This framework suggests that nonprofits can structure operations initially to permit a high-multiple exit, provided the generated funds are appropriately governed and reinvested toward public benefit, satisfying stringent regulatory requirements.

What are the unique complexities of nonprofit M&A deals?

Mergers and acquisitions involving nonprofit entities diverge significantly from standard corporate M&A procedures, primarily due to specialized regulatory and tax requirements.

- Tax Nuance: The transaction requires extensive, specialized tax consultation focused on asset transfer, regulatory compliance, and the maintenance of tax-exempt status across multiple jurisdictions.

- Asset Transfer Constraints: Unlike for-profit entities, nonprofit assets are generally restricted by specific public benefit covenants, complicating the transfer process to private, for-profit ownership.

- Regulatory Oversight: Attorney General and state-level regulatory review is often mandatory to ensure the sale is in the public interest and that the resulting capital is properly stewarded for mission continuation.

“The operational strategy required to execute a high-value nonprofit exit, separate mission-critical IP, and immediately fund a $700 million successor entity is a nuanced discipline requiring expertise often unavailable in standard M&A practice.”

This specialized M&A niche involves operating game mechanics that are not widely understood or offered as a core strategic service by general business practitioners.

References

Harvard University and MIT EdX Foundation Disclosure

2U, Inc. (U2) Acquisition Announcement

Axim Collaborative Establishment Documentation

TEDx Talk, 2020 – found below

Entrepreneur Magazine – article – Click here

Interested in exploring how an IP Knowledge Hub, structured as a nonprofit, designed to boost goodwill, trust, and profits – can be created for your business?

Fill out the survey and secure a complimentary and confidential, and pro bono – nonprofit integration sessions with us.

100% Complimentary, Private, and Confidential.

No strings attached.

We would love to hear from you. Take a second to comment below.

Share this story on your social media and boost your profile, visibility, and empower your connections.

Leave a comment