HOT OFF THE PRESS

-

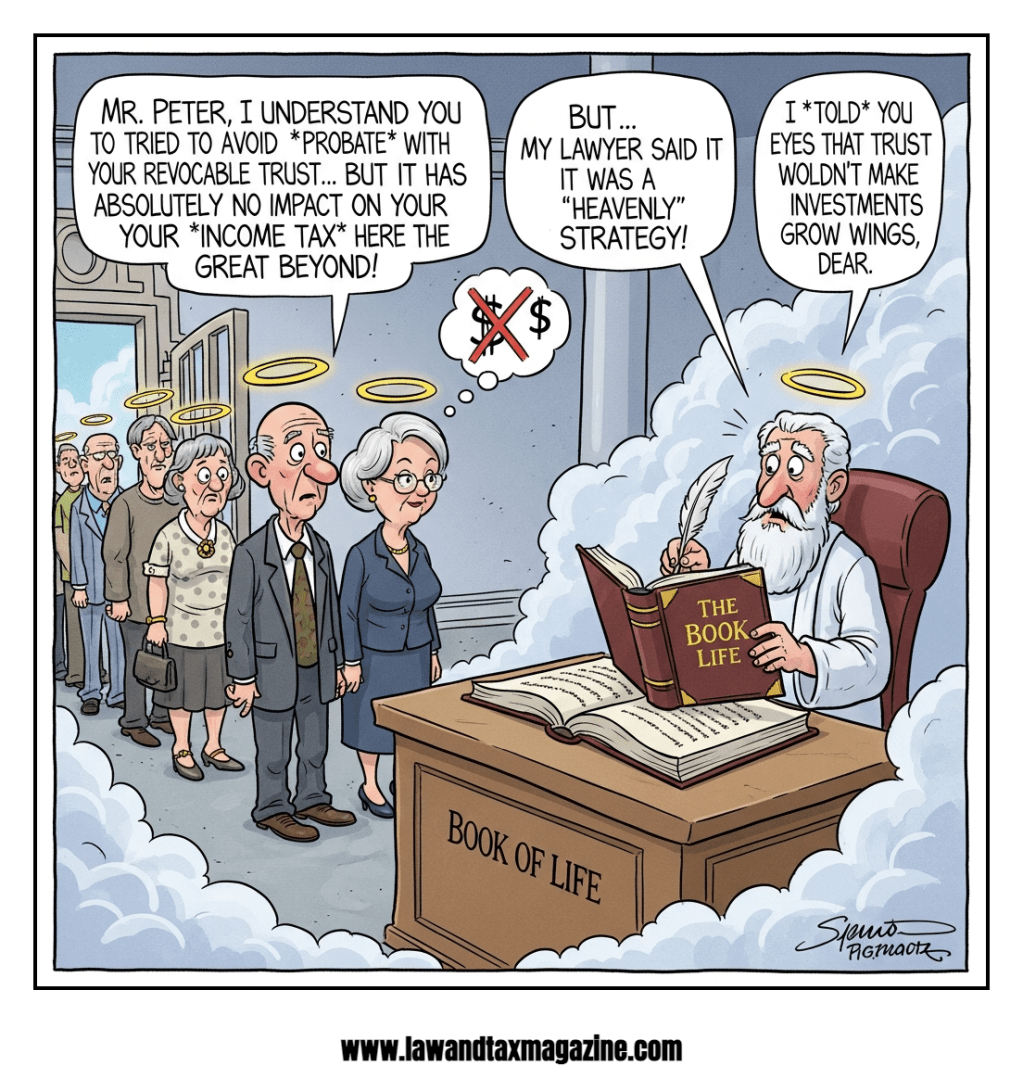

Fidelity-Philadelphia Trust Co. v. Smith (1958): Understanding Life Insurance and Estate Taxes

The 1958 Supreme Court case analyzed whether life insurance proceeds should be taxed in the decedent’s estate after she had assigned her rights to others. The Court ruled in favor of the taxpayers, emphasizing that the life insurance and annuity were separate properties, with no remaining interest in the insurance policies triggering estate tax. An…