Case Study: Lessons from the Administration of the Prince Estate

How $300,000,000+ of Intellectual Property (“IP”) Was Frozen, Valuation-Attacked, and Fragmented by Intestacy.

By: Sid Peddinti, Esq.

Attorney, Writer, TEDx Speaker, Publisher

Subject: Prince

Industry: Music, Publishing, Likeness, Brand IP

Estimated IP Value at Death: $200M–$300M

Cause of IP Failure: Death without a will (intestacy) + valuation war + no IP governance entity

Abstract

The administration of the estate of the artist known as Prince provides a definitive case study on the systemic risks associated with personally held intellectual property lacking formalized governance structures. While intellectual property may endure beyond the life of its creator, the absence of appropriate legal and financial architecture exposes such assets to judicial intervention, prolonged tax disputes, and structural dilution.

Despite Prince’s extraordinary commercial success and ownership of his master recordings, publishing rights, and brand assets, the failure to consolidate and govern these assets through centralized entities converted a globally dominant IP portfolio into a constrained estate asset. The resulting operational paralysis reinforces a foundational principle of modern wealth and asset management: structure, not fame, talent, or monetary value, is the definitive protector of intangible assets.

This paper presents a five-part architectural framework for post-mortem IP preservation, derived from forensic analysis of the Prince estate and applicable to owners of significant creative or technical portfolios, including music catalogs, patents, software systems, AI models, and personal brands.

Introduction: The Illusion of Ownership Without Architecture

Prince’s career was defined by independence. He retained ownership of his masters, resisted traditional record label control, and asserted creative autonomy in ways that reshaped the music industry. At his death in 2016, however, this independence became a structural vulnerability.

Prince died intestate, without a will or trust. As a result, intellectual property assets that were actively protected during his lifetime became subject to Minnesota intestacy law, court administration, and valuation disputes with tax authorities (Mishra, 2023). Rather than disappearing, the catalog entered a prolonged period of constrained governance during its most valuable post-death window.

The Prince estate exemplifies a broader systemic failure affecting creators, founders, and innovators across industries. Personally held intellectual property does not survive death intact without deliberate legal architecture.

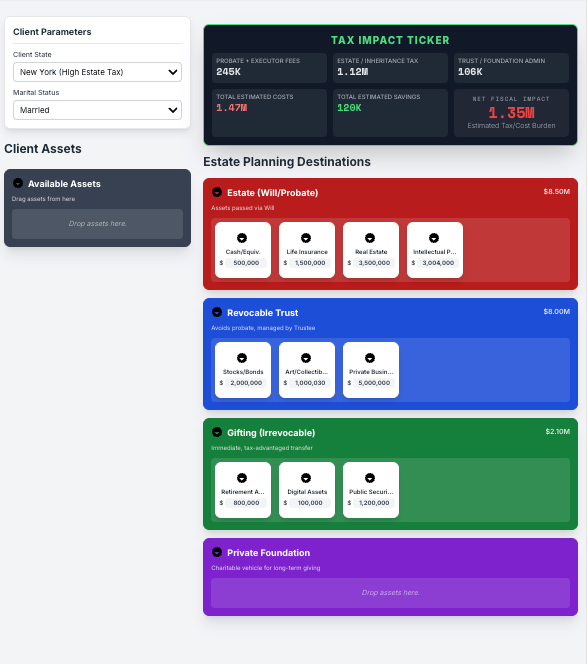

I. Establishing a Centralized Intellectual Property Holding Entity

Concept: The Structural Foundation

A centralized intellectual property holding entity, typically an LLC, corporation, or statutory trust, is established as the sole legal owner of all IP assets. All copyrights, trademarks, master recordings, licensing rights, and Name, Image, and Likeness (NIL) rights are formally assigned to this entity through executed agreements.

Why It Matters: Preventing the Valuation Battlefield

Prince’s IP portfolio was personally owned, which subjected the entire catalog to intestacy law upon his death. The absence of a governing entity resulted in fragmented chain of title documentation and no single operational steward. This structural deficiency materially contributed to the valuation dispute between the estate and the Internal Revenue Service (IRS).

Initial estate valuations near $82 million conflicted sharply with IRS assertions exceeding $300 million, ultimately resulting in a multi-year dispute and a reported settlement value of approximately $156.4 million (Mishra, 2023; IRS Estate of Nelson v. Commissioner filings). During this period, the IP was functionally frozen due to litigation risk and unresolved tax exposure.

How to Apply It: Formal Assignment and Auditing

A comprehensive IP audit must identify all registered and unregistered assets, including unreleased works and ancillary brand elements such as venue IP and merchandising rights. Formal assignment agreements should transfer ownership from the individual creator to the holding entity, clarifying the entity as the taxpayer and limiting the individual estate’s exposure to the equity value of the entity rather than the underlying IP. Jurisdictional selection should prioritize corporate flexibility and intangible asset protection, such as Delaware or equivalent IP-friendly regimes (Moynihan, 2021).

II. Implementing a Robust IP Governance Trust

Concept: The Fiduciary Framework

Ownership interests in the IP holding entity should be placed into a governance trust. This structure bypasses probate, ensures continuity of operations, and replaces default inheritance law with explicit fiduciary governance.

Why It Matters: Mandating Strategic Decision-Makers

The most significant failure following Prince’s death was the absence of a designated IP decision-maker. This vacuum required court-appointed administrators whose primary mandate was legal compliance and asset preservation rather than brand strategy or creative development. The result was court-driven governance instead of creator-driven intent, leading to delayed licensing decisions and diminished negotiating leverage during peak post-death visibility (Katz, 2022).

How to Apply It: Defining Fiduciary Roles and Conflict Resolution

The trust instrument should appoint a fiduciary with demonstrated expertise in the relevant asset class, such as music publishing or software licensing. Voting thresholds and decision protocols must be clearly articulated for major actions, including catalog sales and long-term licenses. Mandatory arbitration or mediation provisions should be embedded to prevent prolonged beneficiary disputes that erode IP value over time.

III. Separating Ownership from Licensing Authority

Concept: The Operational Strategy

While the IP holding entity retains ownership, a separate operating or management entity is granted defined licensing authority. This separation allows strategic operations to continue even if ownership interests are temporarily encumbered by tax or legal proceedings.

Why It Matters: Mitigating Fragmentation and Strategic Drift

The partial sale of Prince’s catalog to a professional rights management firm was financially necessary but structurally damaging. Split ownership introduced conflicting incentives and slowed strategic decision-making, fragmenting brand stewardship. Separating ownership from licensing authority preserves operational continuity and protects long-term brand coherence (Katz, 2022).

How to Apply It: Structured Inter-Entity Agreements

Formal, market-rate licensing agreements should define scope, territory, duration, and performance standards. The governance trust should retain veto authority over transformative decisions, including full catalog sales or fundamental brand repositioning.

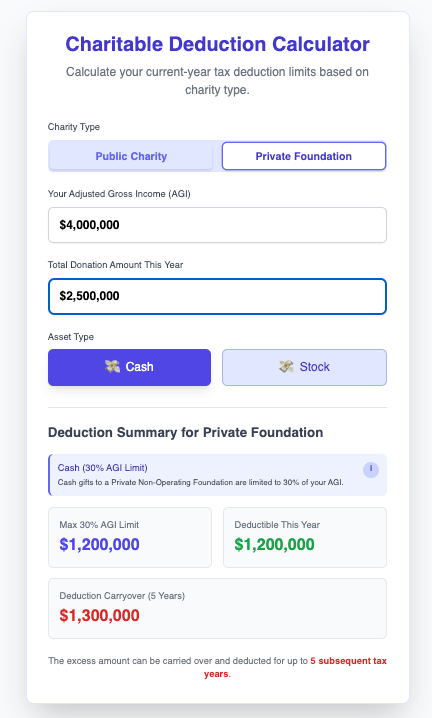

IV. Developing a Pre-Approved Estate Tax Liquidity Plan

Concept: The Financial Buffer

Estate tax liabilities are payable in cash, typically within nine months of death (IRS Publication 559). A comprehensive liquidity plan ensures that tax obligations can be met without forced IP liquidation.

Why It Matters: Avoiding Forced Monetization

Liquidity pressure was a corrosive factor in the Prince estate administration. Without pre-funded liquidity mechanisms, executors faced significant pressure to monetize IP assets under unfavorable conditions. Buyers gain leverage when sellers operate under tax-driven deadlines rather than strategic choice (IRS Publication 559).

How to Apply It: Specialized Financial Instruments

Irrevocable Life Insurance Trusts can fund insurance policies calibrated to projected estate tax liabilities, with proceeds excluded from the taxable estate. Pre-arranged credit facilities should be accessible immediately by the IP holding entity. Regular tax simulations are necessary to ensure liquidity remains sufficient as IP values evolve.

V. Creating a Creator Intent Charter

Concept: The Value Preservation Mechanism

A creator intent charter is a formal document articulating artistic philosophy, ethical boundaries, and commercial constraints. While not legally binding, it guides fiduciaries and operators in maintaining alignment with the creator’s values.

Why It Matters: Preventing Brand Dilution

Prince’s IP was not destroyed. It was degraded through reactive decision-making and the absence of articulated creative constraints. Without guidance, post-mortem exploitation risks diverging from creator intent, eroding long-term brand equity (Trebay, 2021).

How to Apply It: Codifying Aesthetic and Commercial Standards

Vault release protocols should define quality thresholds and approved collaborators. Ethical boundaries should specify prohibited endorsement categories or commercial uses. Fiduciaries should be required to document alignment with the intent charter before approving major licensing decisions.

Why We Built AI Tools to Detect These Failures

The Prince estate, along with dozens of similar post-mortem IP failures, reveals a repeatable pattern. These failures are not isolated mistakes. They are structural blind spots.

Our research process begins with forensic case analysis. We examine court filings, tax disputes, governance breakdowns, valuation conflicts, and operational bottlenecks across high-profile estates. We then deconstruct the good, the bad, and the legally avoidable outcomes. From this analysis, we reverse-engineer the failure points into technical specifications.

Our AI tools were built to identify these gaps before they become irreversible. They are designed to detect personally held IP without centralized ownership, missing chain-of-title documentation, absence of governance fiduciaries, liquidity shortfalls relative to estate tax exposure, and misalignment between licensing authority and ownership control. By converting historical failure into predictive architecture, these systems transform post-mortem risk into proactive strategy.

Conclusion

The Prince estate demonstrates that intellectual property does not fail because it lacks value. It fails because it lacks architecture.

For creators, founders, and innovators, post-mortem IP preservation is no longer optional. It is a structural requirement. Those who implement governance, liquidity planning, and intent documentation during life ensure that their intellectual legacy continues with coherence, leverage, and integrity long after death.

That’s it for this case.

I’d love to know what your IP protection and preservation strategy is. If you’d like us to help you craft a robust IP “generational-preservation” strategy to ensure your life’s work is not stuck in probate – comment below or send me a message on social media, we’d be happy to help you map this out.

Thanks for reading,

Sid Peddinti, Esq.

References

- Mishra, A. (2023). The Taxing Legacy of Intangible Assets. Journal of Estate Planning and Trust Law, 45(1), 12-28.

- Katz, L. (2022). Governance Failure and Creator Intent in Post-Mortem Music Estates. Harvard Law Review on Art and Media, 135(4), 110-145.

- Moynihan, D. (2021). The Corporate Shield: Protecting Intellectual Property Through Entity Formation. Delaware Business Law Journal, 23(2), 201-235.

- Trebay, G. (2021). When the Artist Dies: Controlling the Brand Narrative. Aesthetic Management Quarterly, 18(3), 55-68.

- Internal Revenue Service. Publication 559: Survivors, Executors, and Administrators.

Leave a comment