The Satirical Guide to Estate Planning: Why Your Google Search Won’t Save Your Heirs

Part I: The Noble Excuses—When It’s “Okay” To Gamble Your Legacy

You’ve decided to tackle complex legal documentation using the same expertise you apply to changing the printer cartridge. We salute your optimism! Here are the only three situations where going DIY might make sense (and still carry catastrophic risk):

1. You Have Nothing to Lose (Literally)

If your entire estate consists of a slightly used toaster oven, a Netflix subscription, and $47 in a checking account, then yes, your planning is straightforward. You have few assets, no dependents, and wishes that likely boil down to: “Please just recycle the couch.” Your heirs can probably manage this without a JD.

2. The Emergency Holographic Will Scenario

You are trapped in a scenario requiring immediate action—a sudden trip, an unexpected medical crisis, or perhaps you’ve realized you need something enforceable *right now* before you can secure a real appointment. You need a legally acceptable stopgap, like a handwritten (holographic) will. Just remember, this is the legal equivalent of a spare tire: useful in a pinch, tragic if you rely on it long-term.

3. The “I Saved $400!” Delusion

You are attempting to save money on basic documents (a simple will, a standard power of attorney). This is a wonderful financial strategy, provided you are comfortable with those initial savings being magnified 100-fold into future legal fees for your children. Frugality is commendable; weaponized frugality is a time bomb.

Part II: The Experts Strike Back—Why Lawyers Are the Necessary Evil

You think your life is simple. The legal system knows otherwise. Here is why the professional gatekeepers exist to protect you from yourself.

4. Your Unique Life Does Not Fit Into a Generic Template

You have a blended family, a disabled relative who needs special care, or you own a quirky small business. State laws are a constantly shifting nightmare of specific requirements, and downloadable forms cannot account for your specific brand of chaos. Complexity requires customized protection, not a fill-in-the-blank PDF.

5. They Are Paid to Prevent the Great Family Civil War

Attorneys are masters of passive-aggressive clarity. They structure documents specifically to minimize the chance that your loved ones will end up screaming at each other in a courtroom over who gets the good silverware. This is less about legality and more about litigation prevention therapy.

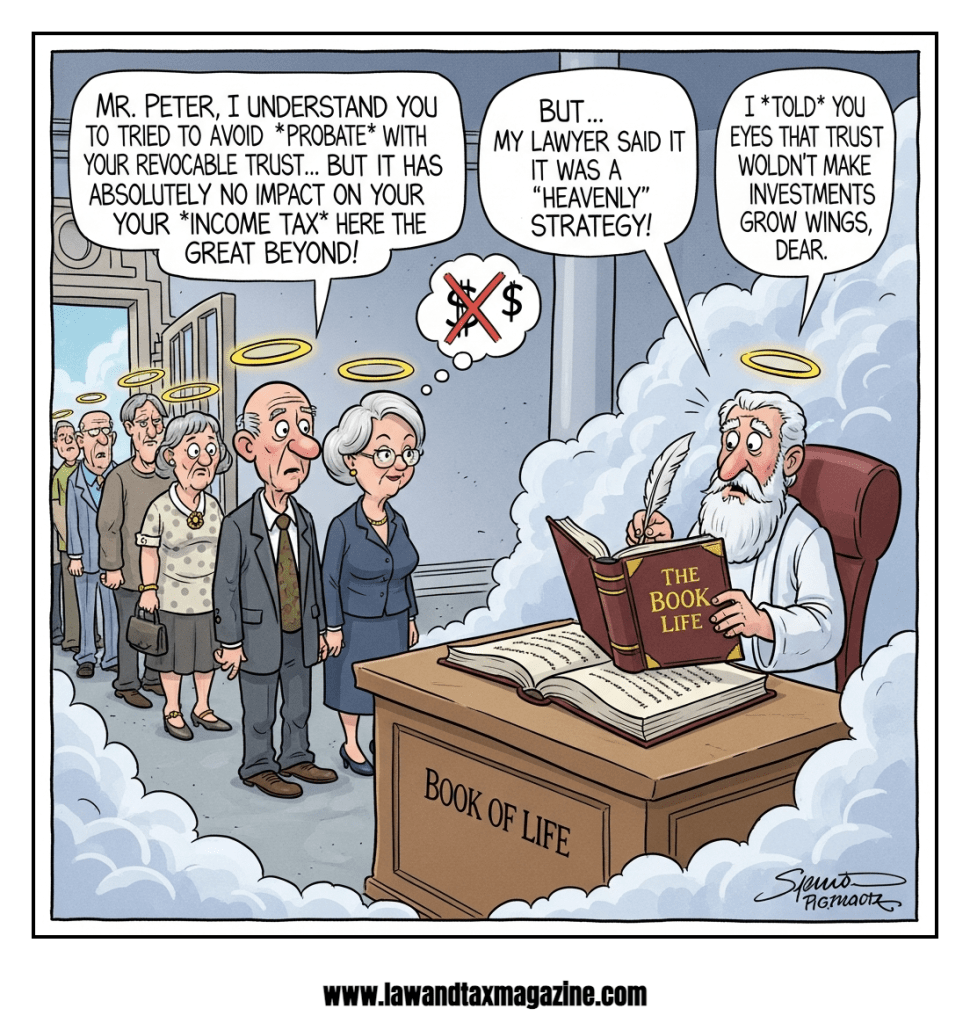

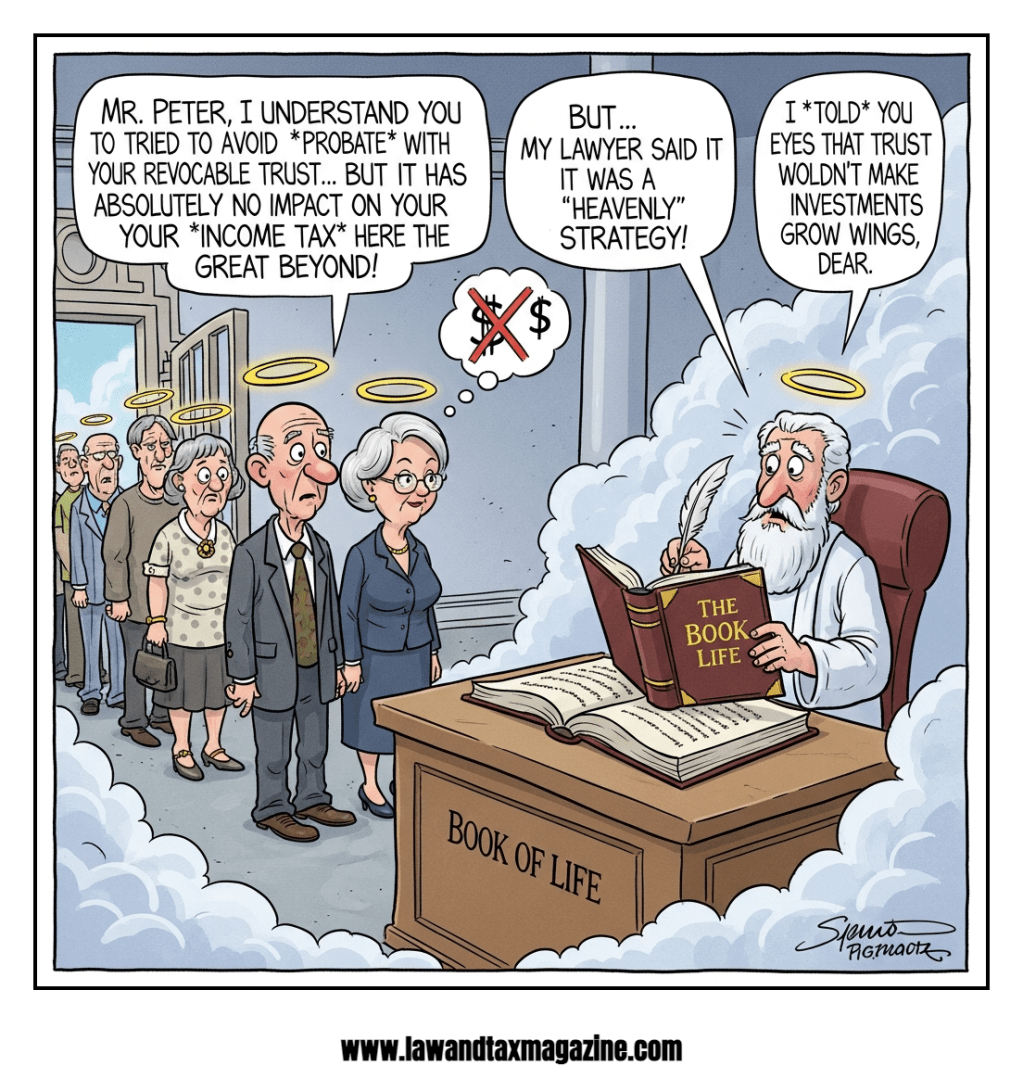

6. You Don’t Know What You Don’t Know (And It Might Cost You)

You came in for a Will. Your lawyer leaves you with a series of Trusts, tax minimization strategies, and medical directives you never knew existed. They don’t just draft documents; they advise on the entire complex ecosystem of death, taxes, and asset shielding. You simply aren’t privy to the advanced tools of the trade.

7. Enforceability: Avoiding the Fatal Legal Typo

The rules of execution are mercilessly strict. Did you use the right witnesses? Did you sign the correct page? Was it notarized in the proper jurisdiction? A lawyer’s biggest value is ensuring your final wishes don’t end up void because you failed to follow a 17th-century legal technicality.

Part III: Disaster Checklist—The Bleak Risks of DIY

Thinking about risking it? Read this list of potential outcomes and consider whether that $300 savings was worth turning your legacy into a dramatic courtroom saga.

8. The Ultimate Paperweight: Your Unenforceable Will

Minor errors—like the wrong kind of witness or missing a required affidavit—are enough to invalidate the entire document. Imagine spending hours crafting your perfect plan, only for a judge to declare it meaningless. The government now decides who gets your assets. Congrats!

9. The Costly Fixes That Erase Your Initial Savings

That $400 you saved on drafting fees? Prepare to spend $4,000 (minimum) in probate court fees to fix the problems caused by the inadequate documentation. DIY planning is typically just deferred, highly expensive litigation.

“If you think hiring an expert is expensive, try hiring an amateur.”

10. Unleashing the Unintended Consequence Monster

Generic forms cannot possibly account for your specific needs, like protecting assets from creditors or ensuring your estranged sister doesn’t accidentally inherit controlling interest in your limited partnership. You created a legal document meant to simplify matters, but you accidentally created a roadmap for future family conflict and asset loss.

The Bottom Line

If you value your legacy, the peace of mind of your loved ones, and the principle of not funding your state’s overburdened probate system, hire an attorney. DIY estate planning is not a smart shortcut; it’s a gamble, and the stakes involve everything you’ve worked for.

Leave a comment