5 Ways To Reinvest Proceeds After A Liquidation Event While Eliminating or Reducing Capital Gains Taxes

I. Introduction

The disposition of highly appreciated assets, whether through the sale of a controlling business interest, significant concentrated stock holdings, or high-value real estate, creates immediate, substantial exposure to federal capital gains taxation pursuant to Internal Revenue Code (IRC) Sections 1221 and 1231.

For ultra-high net worth (UHNW) principals, the challenge is not merely tax compliance, but the strategic deployment of highly liquid proceeds to preserve capital velocity and intergenerational integrity.

Effective post-liquidation planning necessitates a rapid, integrated legal framework that shifts realized gains into structures that either permanently exclude, indefinitely defer, or strategically convert tax liability into philanthropic capital.

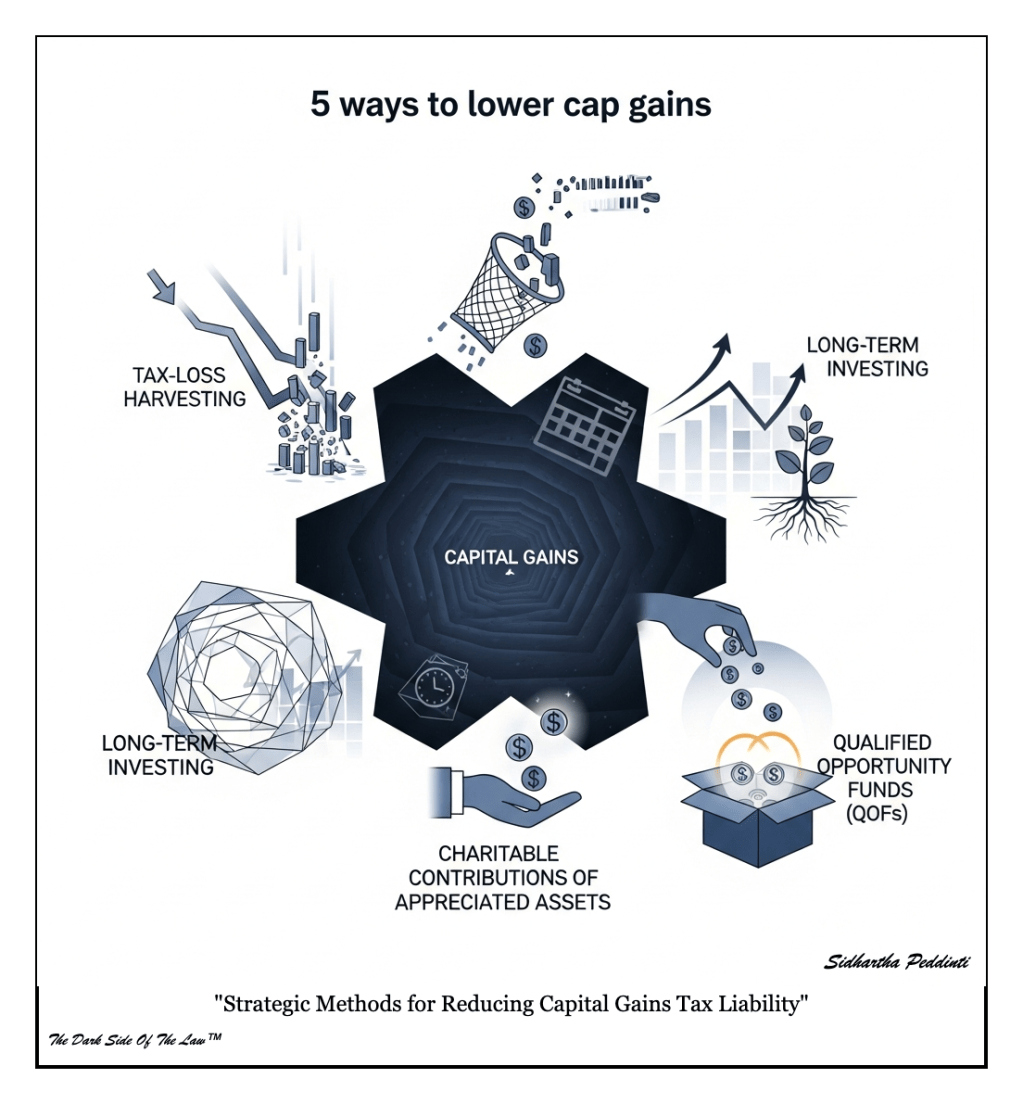

This analysis reviews five primary legal methodologies employed to mitigate or restructure the capital gains recognized following a significant liquidity event.

II. Factual Background: The Liquidity Mandate

Assume a client has realized a nine-figure gain from the sale of a corporate entity, leading to a substantial realized capital gain that would otherwise be subject to the highest federal and state rates.

The objective is to redeploy these funds into new assets, whether active investments or passive portfolio growth, while maintaining the highest degree of principal protection against erosion from immediate tax obligations.

General investment structures alone are insufficient; specialized legal vehicles are required to effectively freeze value or shift the incidence of taxation.

This planning must be executed with meticulous compliance to avoid pitfalls such as the substance-over-form doctrine or potential challenges under IRC Section 2036 relating to retained enjoyment or control.

III. Legal Analysis: Strategic Deferral and Conversion Mechanisms

A. Qualified Opportunity Zone Funds (QOZF): Temporary Deferral and Basis Management

IRC Section 1400Z-2 permits taxpayers to defer the recognition of eligible capital gains by reinvesting those gains into a Qualified Opportunity Fund (QOF) within 180 days of the realization event.

The mechanism mandates that only the quantum of the gain, not the entire sale proceeds, must be reinvested into the QOF, providing immediate liquidity for the original basis.

The primary benefit is the deferral of the original capital gain recognition until the earlier of the date the QOF investment is sold or exchanged, or December 31, 2026, creating significant time value of money advantages.

Furthermore, if the QOF interest is held for at least ten years, the basis of the QOF interest is stepped up to its fair market value on the date the investment is sold or exchanged, eliminating capital gains on the QOF appreciation itself.

This strategy requires stringent regulatory compliance regarding the composition of the QOF’s assets (90 percent test) and strict adherence to the reinvestment timelines, making it suitable only for compliant, long-horizon investments.

B. Internal Revenue Code Section 1031 Exchange: Like-Kind Property Deferral

The IRC Section 1031 exchange allows a taxpayer to defer the recognition of capital gains on the exchange of property held for productive use in a trade or business or for investment, if such property is exchanged solely for like-kind property.

Following the passage of the Tax Cuts and Jobs Act of 2017 (TCJA), the applicability of Section 1031 is severely restricted, now covering only real property exchanges, excluding personal property, stocks, and business assets.

In the context of real estate holdings post-liquidation, this remains a powerful deferral tool, requiring the identification of replacement property within 45 days and completion of the exchange within 180 days.

Failure to adhere precisely to the identification and receipt requirements results in immediate recognition of the deferred gain, emphasizing the administrative complexity of simultaneous and delayed exchanges.

Furthermore, any ‘boot’ received-cash or non-like-kind property-results in taxable gain up to the amount of the boot, requiring sophisticated structuring to maximize the deferral.

C. Charitable Remainder Trusts (CRTs): Bypassing Immediate Gain Recognition

A Charitable Remainder Trust (CRT), established under IRC Section 664, provides a mechanism for highly appreciated, low-basis assets to be contributed to the trust, thereby avoiding the recognition of capital gain upon the subsequent sale by the CRT.

Because the CRT is generally tax-exempt, it can liquidate the assets without incurring immediate capital gains tax, and the proceeds are then invested to provide an income stream (annuity or unitrust payments) to the non-charitable beneficiaries for a specified term or life.

The contribution generates an immediate, partial income tax deduction for the present value of the remainder interest that will ultimately pass to charity, offering a dual benefit of tax mitigation and income generation.

Distributions from the CRT to the grantor or other non-charitable beneficiaries are governed by the four-tier accounting system (ordinary income, capital gains, tax-exempt income, and corpus), ensuring the capital gain character is recognized by the beneficiary only as payments are received.

This sophisticated conversion mechanism is particularly effective for assets where the primary goal is not perpetual retention within the family but rather optimizing cash flow and achieving significant philanthropic goals.

D. Leveraging Grantor Trusts: IDGTs and GRATs for Estate Freezing

While Grantor Retained Annuity Trusts (GRATs) and sales to Intentionally Defective Grantor Trusts (IDGTs) do not defer the initial capital gain recognized by the principal, they are critically deployed post-liquidity to shield future appreciation from the transfer tax system.

By selling the liquid investment portfolio to an IDGT for a properly secured promissory note, the principal realizes the initial gain, but all subsequent growth and income derived from that highly liquid portfolio occur outside the taxable estate for estate and gift tax purposes.

This transaction is tax-neutral for income tax purposes due to the grantor trust rules (IRC Section 671 et seq.), preventing an income tax realization on the sale itself between the grantor and the IDGT, though the initial external liquidation gain remains.

The interest rate on the note must meet or exceed the applicable federal rate (AFR), ensuring compliance with IRC Section 7872 and avoiding characterization as a taxable gift.

Conversely, a GRAT, structured under IRC Section 2702, allows the principal to contribute the liquid assets and receive an annuity for a term of years, effectively zeroing out the initial gift value if the trust is properly structured (a zeroed-out GRAT).

If the assets appreciate above the Section 7520 rate, the excess value passes tax-free to the remainder beneficiaries, freezing the value of the highly liquid capital at the date of transfer, a vital component of multi-generational strategic legacy planning.

E. Private Foundation Structuring and Philanthropic Conversion

For principals with substantial philanthropic intent, the utilization of a private foundation (PF) or a donor-advised fund (DAF) provides a mechanism to legally convert significant tax liabilities into controlled charitable capital.

Contributing highly appreciated assets to a PF or DAF prior to liquidation allows the principal to claim an income tax deduction, subject to limitations (e.g., 30 percent of AGI for gifts of capital gain property to a PF).

If the assets have already been liquidated and the gain recognized, the PF remains a critical vehicle for offsetting ordinary income from the sale proceeds through cash contributions, subject to the higher 50 percent of AGI limitation.

This strategy repurposes realized tax liability into a charitable endowment over which the principal or their designated directors retain control regarding investment strategy and grant disbursement, enabling profound and controlled Strategic Legacy development.

The foundation must strictly adhere to complex rules regarding excise taxes, minimum distribution requirements, and self-dealing prohibitions to maintain its Section 501(c)(3) status and avoid punitive IRS penalties.

IV. Conclusion

The successful navigation of a significant liquidity event requires an immediate shift from transactional execution to proactive tax and estate structure design.

Integrating strategies such as the time-sensitive QOF deferral with robust estate freezing techniques (IDGTs/GRATs) and philanthropic conversion via Private Foundations yields optimized capital preservation.

These advanced methods are interdependent and necessitate continuous legal scrutiny, especially regarding the intersection of income tax deferral rules and transfer tax minimization objectives.

The selection and execution of these planning tools must be customized to the principal’s specific risk tolerance and long-term multi-generational preservation goals, mitigating the inherent risks of the Tax Iceberg™ that accompany sudden, substantial wealth creation.

Share this article with your family, friends, customers, followers, and loved ones. Education is the key to change and to wealth protection.™

Thanks for reading,

Sid Peddinti, Esq.

Researcher. Attorney. AI Innovator.

#TaxLaw #EstatePlanning #WealthPreservation #FiduciaryDuties #TrustFunding #SuccessionPlanning #ProbateAvoidance #TaxStrategy

Sources:

- I.R.C. § 1400Z-2 (2021) governs the deferral and exclusion of capital gains invested in Qualified Opportunity Zones.

- Treas. Reg. § 1.1400Z2(a)-1(c) mandates the 180-day reinvestment window for eligible gains.

- I.R.C. § 1031 (2021) dictates the rules for like-kind exchanges, severely limited to real property after the Tax Cuts and Jobs Act of 2017.

- I.R.C. § 664 establishes the requirements for Charitable Remainder Annuity Trusts (CRATs) and Charitable Remainder Unitrusts (CRUTs).

- I.R.C. § 2702 dictates special valuation rules for transfers in trust, key to the effective structuring of Grantor Retained Annuity Trusts (GRATs).

- Rev. Rul. 85-13, 1985-1 C.B. 184, confirms that transactions between a grantor and an intentionally defective grantor trust are generally disregarded for income tax purposes.

- I.R.C. § 2036 addresses transfers with retained life estate, a critical risk area when the grantor retains powers or control over assets transferred to irrevocable trusts.

- I.R.C. § 170 governs the deductibility of charitable contributions, establishing AGI limitations relevant to Private Foundations (PFs) and Donor-Advised Funds (DAFs).

Leave a comment