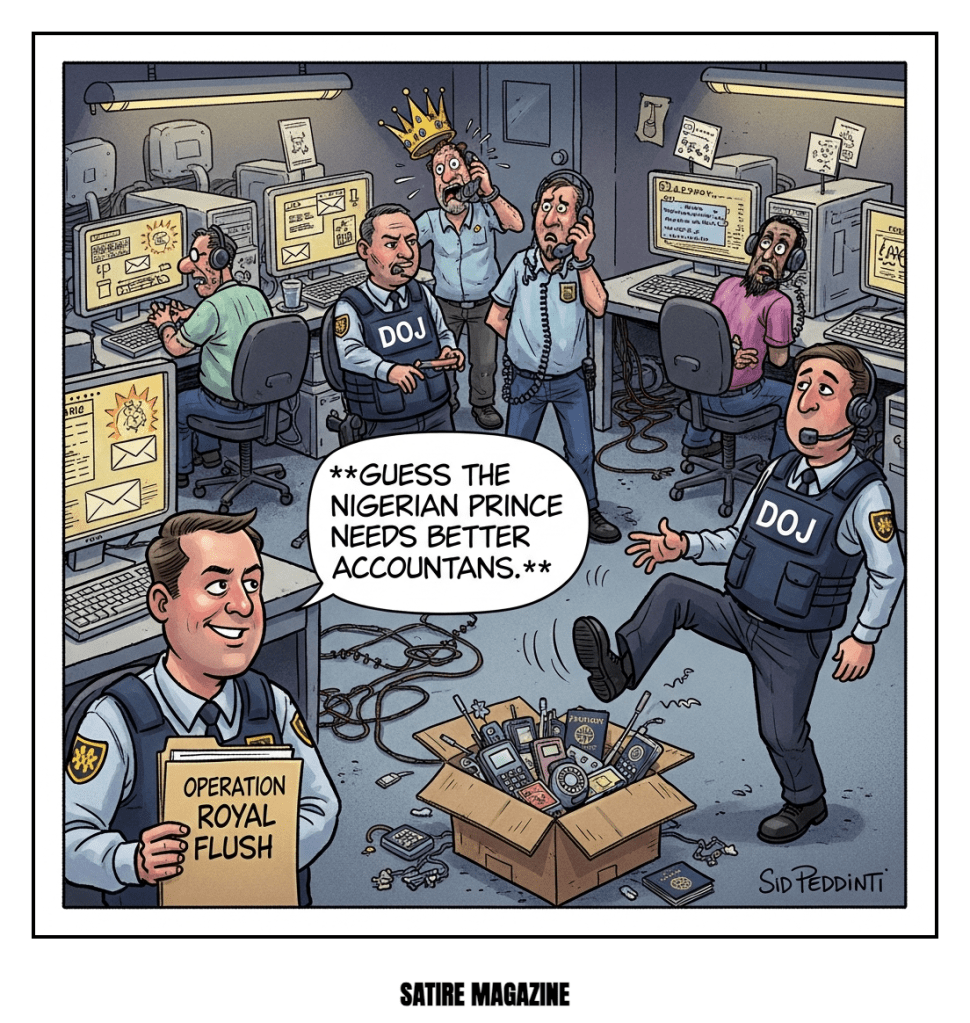

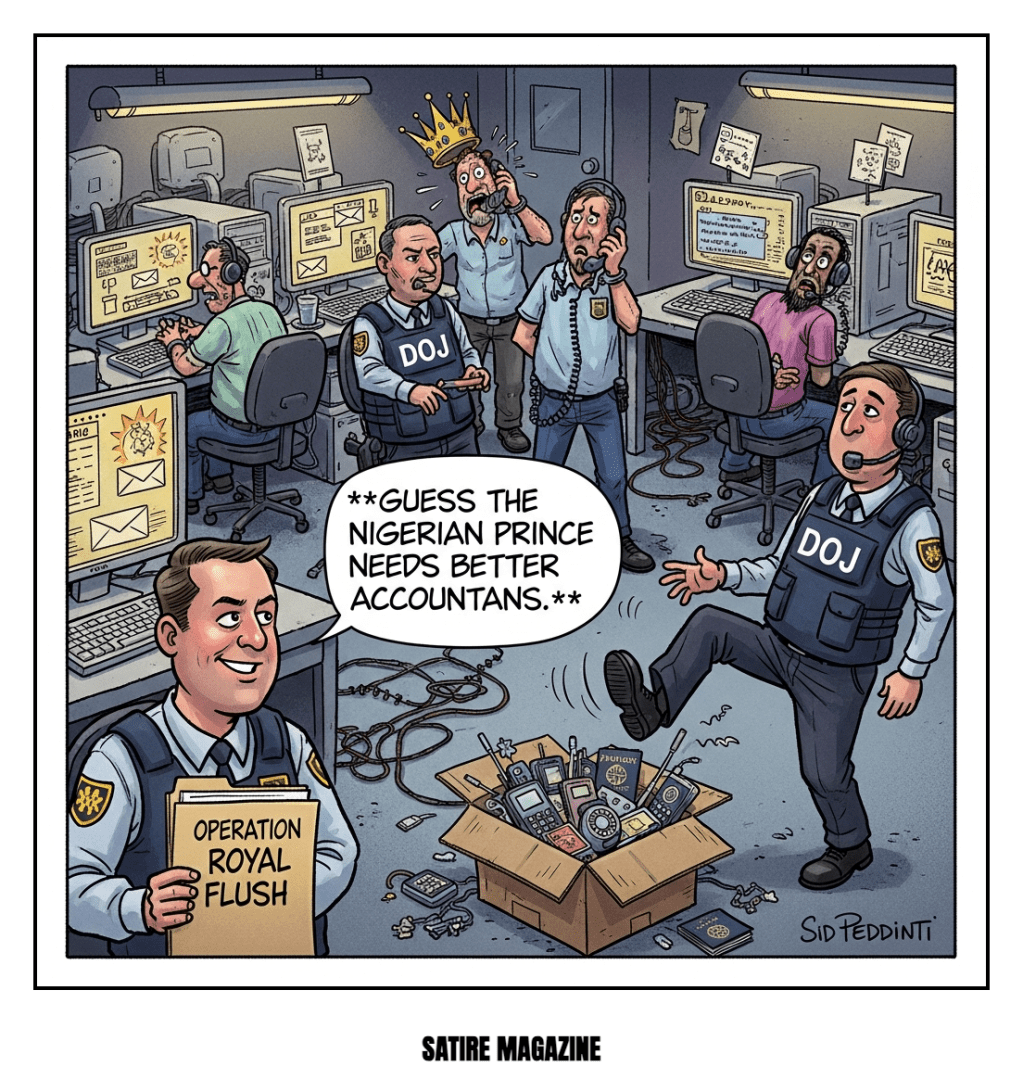

#TLDR: Beware Of Scams That Double, Triple, and Even 10x Your Money

By Sid Peddinti | November 24, 2025

The promise is intoxicating: “Double your money overnight.” Whether it’s the classic Nigerian Prince scheme or a slick, modern cryptocurrency arbitrage opportunity, the message is always the same. Instant, exponential wealth is just one wire transfer away.

For decades, these scams were treated as humorous footnotes in the digital age, a test of common sense. But for many victims, the consequences are anything but funny. I’ve personally helped dozens of people who fell for these schemes, not just losing their savings, but dangerously escalating their risk by taking out second mortgages on their homes.

The end result? Total loss of capital, crushing debt, and the heartbreaking reality of foreclosure. The modern investment scam has evolved far beyond the clumsy email, and the stakes for average families have never been higher.

The Psychology of Instant Wealth

Why do financially savvy people fall for obvious cons? The answer lies in basic human psychology, amplified by sophisticated social engineering. Scams exploit two powerful forces: greed and the “Fear of Missing Out (FOMO)”.

Scammers understand that a small initial success validates the entire process. They often allow the victim to withdraw a small, early profit. This builds trust, establishing a psychological commitment bias that makes the subsequent, larger loss seem acceptable or temporary.

Furthermore, they employ strict “Urgency”. “This opportunity closes in 48 hours.” “The price is skyrocketing now.” This pressure bypasses critical thinking, forcing the victim to operate under what behavioral economists Daniel Kahneman calls “System 1” thinking: fast, intuitive, and often error prone.

Modern Scams: More Than Just Phishing

While the old 419 letter still circulates, today’s high-yield scams are masked by technological veneer and social sophistication. They often appear as legitimate investment platforms, highly effective “wealth management groups,” or exclusive crypto trading circles.

One of the most devastating trends is the rise of “Pig Butchering (Sha Zhu Pan)” schemes. These scams originate on dating apps or social media, where the scammer builds a long-term, romantic relationship with the victim before introducing a “secret” investment platform guaranteed to provide amazing returns.

These fraudsters specifically target high-net-worth individuals or those with significant home equity, knowing they have access to major capital outside of simple savings accounts.

The Real Financial Devastation

The worst financial outcome is not losing the original $5,000 investment. It is the cascading effect of leveraging existing assets based on false promises. Victims, desperate to capture the projected “10x return,” drain retirement accounts, cash out life insurance policies, or, most tragically, secure a second mortgage on their primary residence.

When the platform inevitably disappears or locks the victim out, they are left facing two simultaneous crises: the immediate loss of all invested capital and the inability to service the high-interest second loan. This rapid acceleration towards default and foreclosure is a common, documented outcome.

The scale of this problem is enormous. The FBI’s Internet Crime Complaint Center (IC3) reported that total reported losses due to internet crime exceeded $12.5 billion in 2023, a significant portion of which involved investment fraud. Analysts estimate that only a fraction of these crimes are ever reported, suggesting the true financial damage is likely far greater.

According to a recent report published by the Financial Industry Regulatory Authority (FINRA), the sophistication of these operations, often based overseas, makes recovery almost impossible once funds are transferred.

Three Rules to Protect Your Principal

Protecting yourself from schemes offering rapid wealth requires a strict adherence to proven financial discipline and a healthy dose of skepticism. If a guaranteed return sounds too good to be true, it is because it is fraudulent.

Here are three essential rules to follow before committing any capital, especially money tied to secured assets like your home:

- Verify Registration: Before investing in any vehicle, check the legitimacy of the firm and the individual offering the deal. Use the resources provided by the **SEC (Securities and Exchange Commission)** and FINRA’s BrokerCheck tool. If the entity is foreign and unregistered in the U.S., treat it as radioactive.

- Understand the Mechanics: If you cannot explain exactly *how* the money is being doubled or tripled without using vague jargon (“proprietary arbitrage algorithms”), do not invest. Legitimate investments have transparent strategies and verifiable assets.

- The “Leverage Line”: Never borrow money against secured assets (like your home equity) to fund an investment promising exponential, guaranteed returns. Legitimate investment opportunities do not require you to jeopardize your housing stability. Financial experts consistently caution that secured debt should never be used for highly speculative or unverified ventures.

The Prudent Path Forward

The goal of sound financial management is long-term stability and measured growth, not instant gratification. As the volatility in crypto and high-tech markets continues, the temptation to chase unrealistic returns will only increase.

Remember that Warren Buffett’s two key rules of investing are: Rule #1: Never lose money. Rule #2: Never forget Rule #1. Protecting your principal, particularly the assets that ensure your family’s shelter, must always outweigh the pursuit of a fleeting, phantom 10x gain. Vigilance is your best defense against schemes designed to strip you of everything you own.

Thanks for reading, I’d love to hear your thoughts on common red flags you’ve seen in the comments below. Stay safe out there.

Cheers,

Sid Peddinti, Esq.

Lawyer. Mythbuster. AI Innovator.

#InvestmentFraud #FinancialLiteracy #ScamAlert #ForeclosureRisk #SEC #BusinessEditorial #SatireMagazine

Disclaimer: This article is for informational and entertainment purposes only and does not constitute legal or financial advice.

© 2025 Satire Magazine™

Leave a comment