By Sid Peddinti, Esq. | November 2025

THE $200 WILL VERSUS THE $200,000 COURT BATTLE: HOW BEING CHEAP DESTROYS YOUR LEGACY

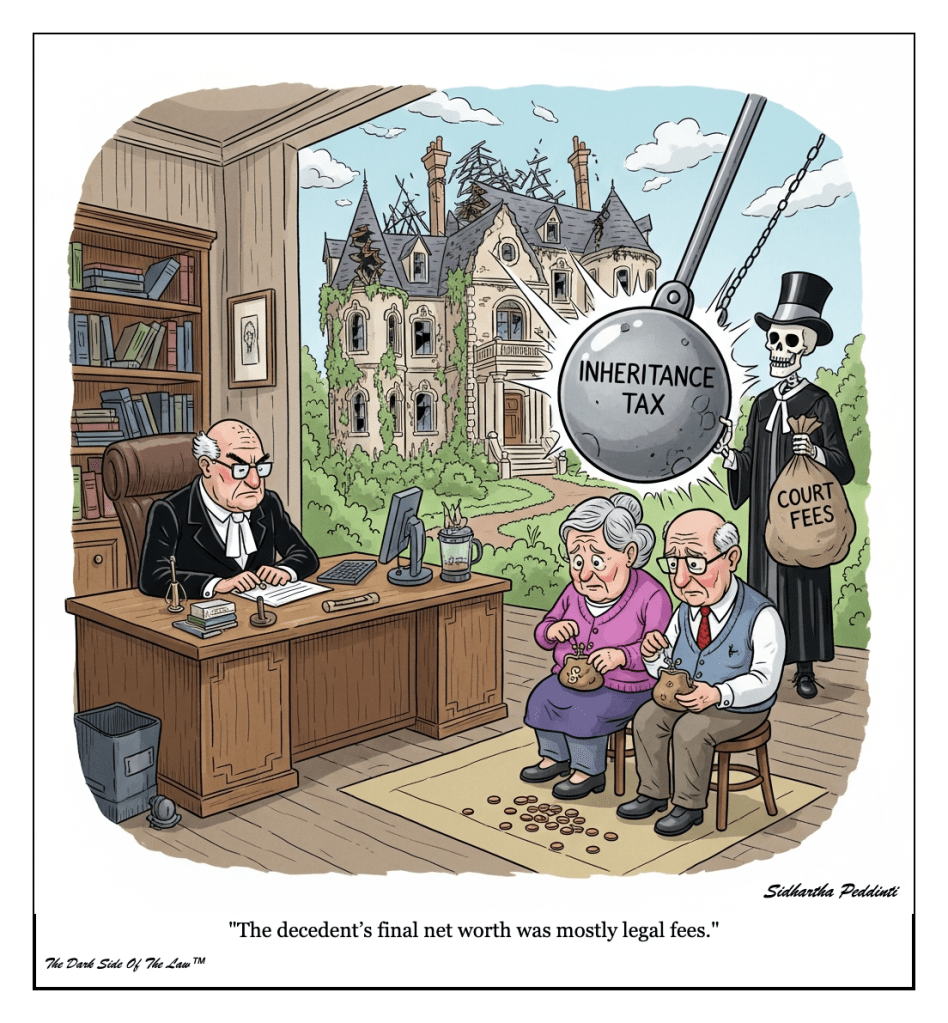

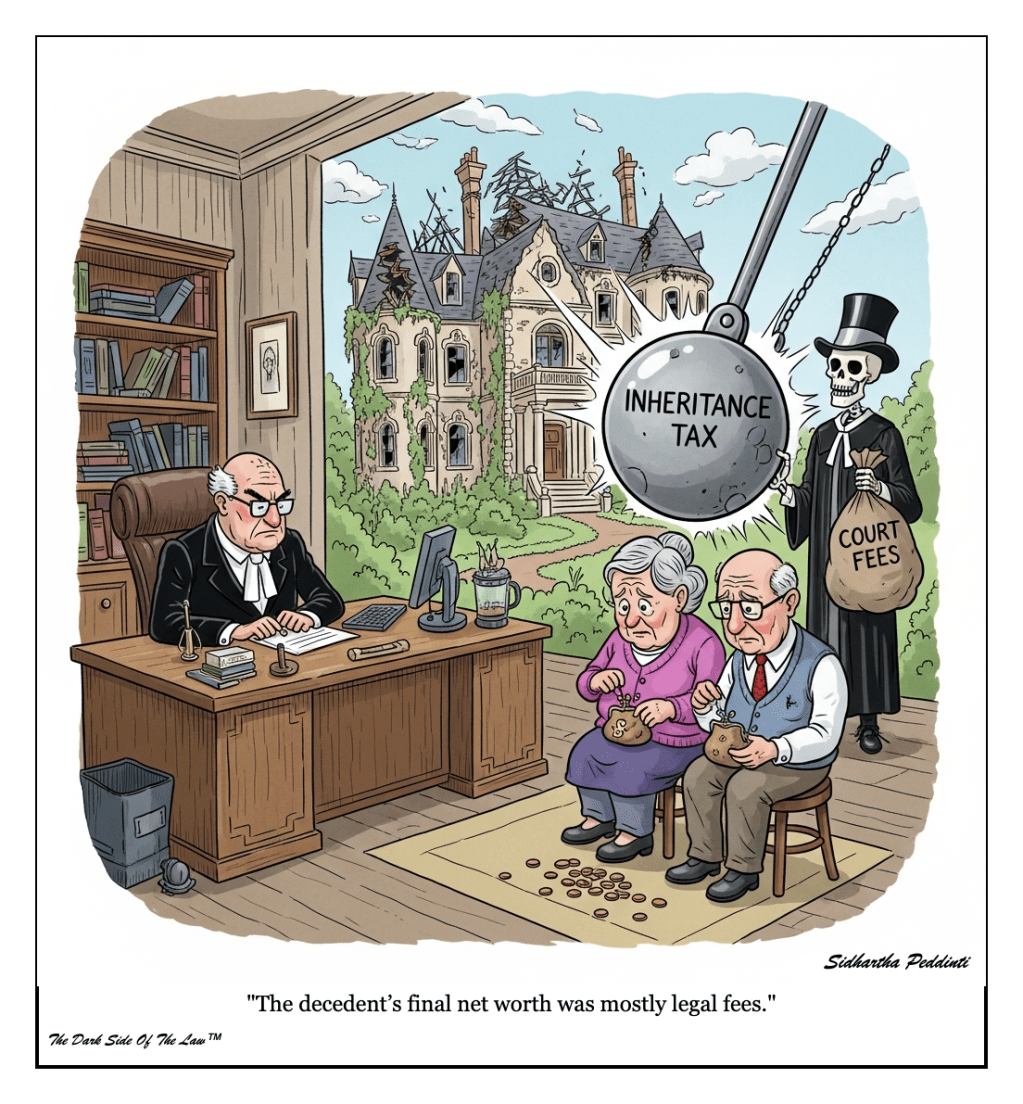

The cartoon is stark: A vintage, single-panel drawing illustrating the financial folly of poor estate planning. The image is text-free, but the implied caption -circulated widely among frustrated probate attorneys and family litigators -tells the whole story: “The decedent’s final net worth was mostly legal fees.”

This cynical visual is not hyperbole; it is a brutal encapsulation of what happens when successful individuals prioritize minimizing immediate professional expenses over maximizing long-term, generational protection.

We are talking about the quintessential “penny wise, pound foolish” debacle, where the estate, intended to provide comfort and security, is instead consumed entirely by the very legal and tax systems it was meant to avoid.

For the high net worth individual, or even the middle-class professional with significant illiquid assets like real estate, this neglect transforms a structured transfer of wealth into a chaotic, emotionally draining, and financially devastating public dispute. The false economy of skipping comprehensive planning is perhaps the most expensive financial mistake any individual can make.

- THE ILLUSION OF EFFICIENCY: WHY DIY FAILS

In the digital age, the temptation to handle complex financial tasks independently is powerful. Online services promise quick wills and trusts for a few hundred dollars, marketed heavily toward the financially savvy who pride themselves on efficiency and cost savings.

However, efficiency in documentation often results in devastating inefficiency during execution. Estate planning is not merely the creation of documents; it is the establishment of a robust fiduciary structure designed to withstand legal scrutiny and navigate unforeseen family dynamics.

A document generated by a template service cannot account for state-specific common law regarding property ownership, complex beneficiary contingencies, or the highly individualized implications of federal and state estate tax exemptions. It is a paper shield against a legal battle requiring professional armor.

The true cost of a cheap, ambiguous, or poorly funded estate plan is measured not just in the eventual legal fees, but in the opportunity cost of liquidated assets, the duration of probate – which can stretch years—and the permanent fracturing of familial relationships caused by decisional friction.

- THE PSYCHOLOGY OF PROCRASTINATION AND AVOIDANCE

If estate planning is so critical, why do highly motivated, successful people – who meticulously manage their businesses or investment portfolios – put it off? The answer lies in a combination of cognitive biases common in behavioral finance.

First is the inherent mortality aversion. Planning for one’s own death or incapacity is psychologically taxing, leading to procrastination that is continually reinforced by the perception that the problem is not urgent.

Second, successful individuals often suffer from overconfidence bias. They believe their personal organization – their detailed spreadsheets and clear spoken intentions – will naturally translate into a smooth asset transfer, misunderstanding the rigid, technical requirements of probate law.

Finally, the perceived high immediate cost acts as a strong deterrent. The cost of hiring an experienced estate attorney (often thousands of dollars) is tangible and immediate, whereas the potential future cost of litigation (upwards of hundreds of thousands of dollars in many cases) is abstract and deferred. Humans are programmed to avoid immediate pain over deferred disaster.

- THE SIX CRITICAL FAILURES THAT TRIGGER LITIGATION

The bulk of estate litigation that drains net worth stems not from malicious intent, but from technical deficiencies in the planning structure. Here are the most common and costly failures professionals observe:

- FAILURE TO UPDATE BENEFICIARY DESIGNATIONS

This is arguably the single largest cause of unintended asset transfer. Retirement accounts (401k, IRAs), life insurance policies, and annuities transfer via contract, entirely outside the provisions of a Will or Revocable Trust. If the beneficiary designation is outdated – for instance, listing a deceased spouse or an ex-spouse following divorce – the asset flow is dictated by the contract’s default provisions, often forcing the asset into probate or to unintended relatives.

- IMPROPER TRUST FUNDING

The purpose of a Revocable Living Trust is to hold title to assets, allowing them to bypass probate. The Trust document itself is merely the roadmap; the actual execution requires “funding” – retitling assets (real estate deeds, brokerage accounts) into the name of the Trust. A complex, perfectly drafted Trust is worthless if the assets remain in the individual’s name. When a high-value asset, like the primary residence, is never titled into the Trust, the estate pays significant fees to put that asset through probate anyway.

- THE AMBIGUOUS OR VAGUE WILL

Template wills often rely on generic language that is susceptible to multiple interpretations, particularly when describing personal property distribution or real estate intentions. If a document uses terms like “divided equitably” or “given to those who cared for me,” it invites heirs to sue one another to determine the definition of those terms, ensuring the majority of the estate is spent clarifying the decedent’s intent in court.

- TENANCY AND TITLING ERRORS

Joint tenancy with right of survivorship (JTWROS) is a common form of ownership, frequently used by married couples to simplify transfers. While efficient, JTWROS overrides any Will or Trust provision. Furthermore, if a joint owner is added strictly for convenience (e.g., adding an adult child to a bank account), that child legally inherits the entire account upon the decedent’s passing, regardless of the decedent’s stated intention to share it with siblings – a primary driver of family feuds.

- NEGLECTING TAX EFFICIENCY

The state and federal governments operate with different estate and inheritance tax thresholds. An individual may be safely below the federal exemption (which is currently high but scheduled to sunset in 2026), yet severely above their specific state’s exemption limit. Without professional guidance, the estate can face significant state inheritance taxes—or state-level estate taxes – that could have been mitigated through planning tools like irrevocable life insurance trusts (ILITs) or sophisticated gifting strategies.

- IGNORING INCAPACITY PLANNING

Estate planning is not solely about death; it is equally about incapacitation. Without Durable Powers of Attorney for financial affairs and Advance Directives for healthcare, a period of incapacity forces the family into a costly and invasive guardianship or conservatorship proceeding. This legal process is slow, public, and expensive, granting a court-appointed third party control over the individual’s assets and medical decisions.

- THE LITIGATION TAX: THE HIDDEN EXPENSE OF PROBATE

The primary goal of professional estate planning is typically to avoid probate, especially for estates valued over state-specific small estate thresholds. When probate is unavoidable due to planning failures, the estate is subjected to the “litigation tax.”

This tax manifests in several ways that decimate the final distribution value.

First, the process is public record. All financial details, asset lists, debt statements, and family dynamics become accessible to the public, creating severe privacy risks and opening the estate to challenges from unknown creditors or predatory claimants.

Second, the fees are often calculated as a percentage of the gross estate value – not the net value. This percentage is statutory in certain states, meaning that even a relatively smooth probate process can involve fees exceeding six figures for large estates. These fees apply regardless of the amount of debt the estate holds.

Third, litigation dramatically extends the duration. Simple probates take six to twelve months; contested estates can languish in court for three to five years. During this time, liquid assets are tied up, investment opportunities are missed, and the estate often pays professional fiduciary fees for temporary administrators, further reducing the final net worth.

- YOUR ESTATE PLANNING DREAM TEAM

Sophisticated financial management demands specialized expertise. Relying on a single advisor for tax, legal, and financial planning is a common mistake. A high net worth or complex asset situation requires a coordinated strategy involving at least three key professionals, functioning as a synchronized team.

- THE FIDUCIARY ATTORNEY (The Architect): This individual is responsible for drafting the legal documents (Trusts, Wills, Powers of Attorney) that comply with current federal and state law. Their role is to structure the legal entities to achieve tax minimization and protect assets from liability and probate costs. Look for an attorney specializing in Trust and Estates (T&E), not general practice.

- THE CERTIFIED PUBLIC ACCOUNTANT (The Tax Strategist): The CPA assesses the tax implications of the attorney’s proposed structure. They focus on minimizing income tax during life and ensuring the estate plan capitalizes on state and federal exemption amounts, handling required tax filings (e.g., estate tax returns, annual trust income tax filings). The CPA ensures the plan is tax-efficient, not just legally compliant.

- THE CERTIFIED FINANCIAL PLANNER (The Executor): The CFP ensures the legal plan is practically implemented. Their task is to coordinate asset titling, review and update beneficiary designations on all qualified accounts, and ensure appropriate insurance coverage is in place (e.g., life insurance for liquidity, liability coverage for trust-held real estate). They turn the legal architecture into a functioning financial reality.

THE TAKEAWAY: A PROACTIVE FINANCIAL AUDIT

The single most effective action you can take right now to avoid the fate of the legal-fee-eaten estate is not to draft a new Will, but to conduct a rigorous audit of your non-probate asset transfers.

Pull the beneficiary designation forms for every qualified retirement account (IRA, 401k, etc.), life insurance policy, and annuity. Verify that the listed primary and contingent beneficiaries accurately reflect your current wishes and align with your overall estate strategy. This contractual transfer mechanism overrides every Will and Trust, and updating it often costs nothing but time.

Remember that true financial prudence is measured by the net result delivered to the next generation, not by the minimal fees paid today. Investing in comprehensive legal and tax guidance is not an expense; it is insurance against the catastrophic expense of litigation. The best estate planning eliminates the opportunity for conflict, safeguarding your wealth and your family relationships.

Well – That’s it for this “satirical” piece on “being penny-wise and pound-foolish” around estate planning.

Leave your thoughts – I’d love to hear from you.

Thanks for reading,

Sid Peddinti, Esq.

SUGGESTED READING

- The Wall Street Journal – Personal Finance Section

- Forbes – Investment and Wealth Management

- Financial Planning Magazine – Estate & Trusts Focus

Leave a comment