A Law & Tax Magazine Special Report

Regulatory Risk for Financial Advisors: The Silent Threat No One Warns You About

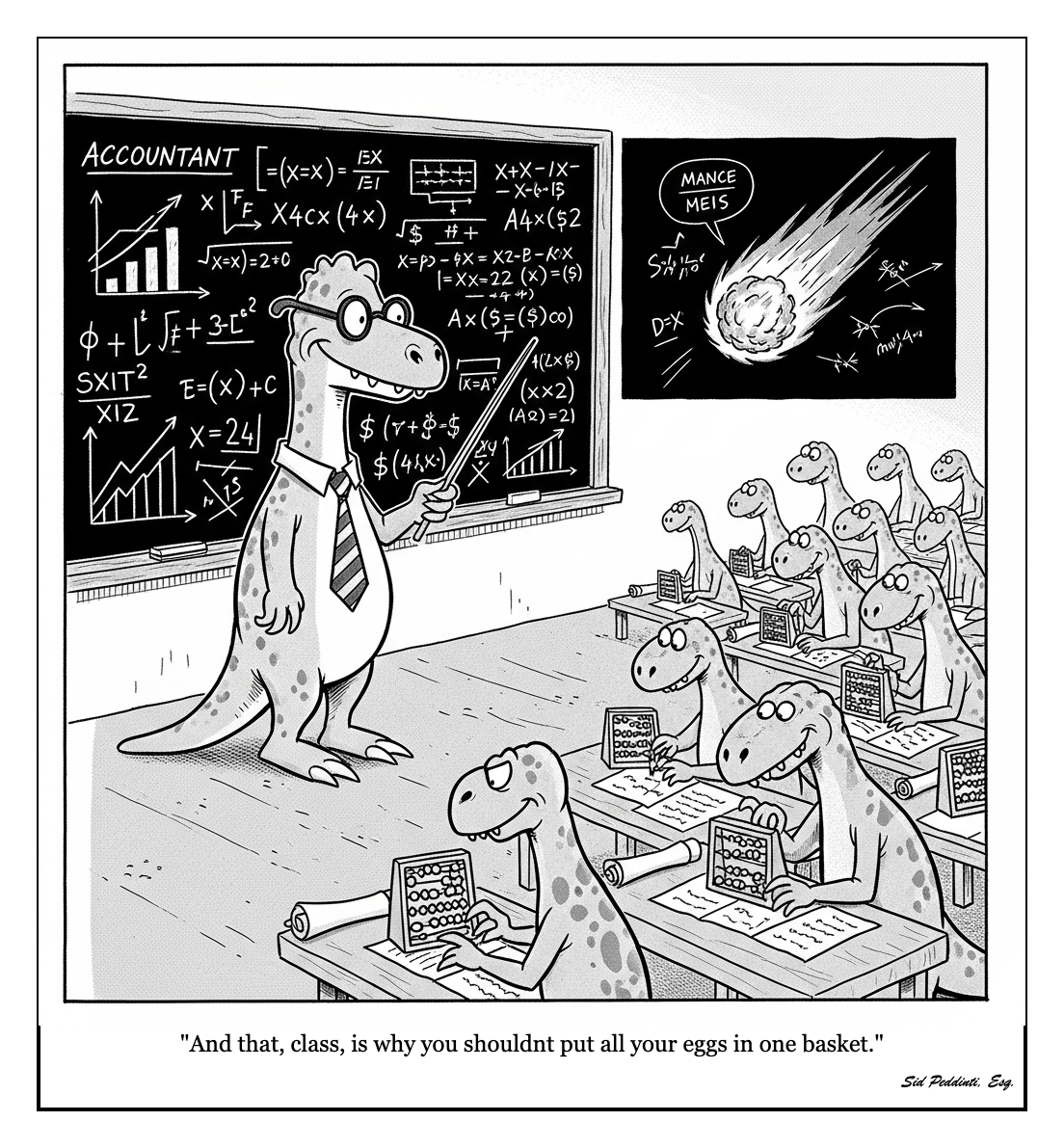

By Sidhartha Peddinti, Esq.

Dear Advisor,

Clients trust you with their money, their fears, their future, and in many cases, their entire family legacy. But trust is not protection.

Every year, advisors lose licenses, face sanctions, or become subjects of investigations because they unknowingly crossed into legal or tax advice.

This article is the in depth, fully expanded version covering Regulatory Risk. It is designed to protect you, elevate your practice, and give you a safe, compliant blueprint for offering more value without risking your career.

————————————————————

Regulatory Risk: Why It Is the Most Dangerous Threat to Your License

Regulatory risk is not dramatic. It is quiet. It is technical. And it is enforced aggressively because regulators are charged with protecting the public from unlicensed legal and tax advice.

Below is the expanded overview every advisor should understand before discussing trusts, taxes, estate planning, or legal structures with clients.

————————————————————

1. Providing Legal Advice Is Considered the Unauthorized Practice of Law (UPL)

Every state bars unlicensed individuals from:

- Interpreting legal documents

- Advising which legal entity or trust structure to create

- Explaining how specific laws apply to a client

- Drafting or modifying legal forms

- Evaluating the validity of an estate plan

Even if you understand the material better than the client, the regulator does not care. The rule is absolute.

Examples of prohibited statements:

- “You should put your home into a revocable trust.”

- “Your operating agreement needs these clauses.”

- “This trust will protect you from lawsuits.”

- “Use an irrevocable trust to avoid estate tax.”

You may educate, but you cannot advise.

————————————————————

2. You Cannot Interpret the Tax Code or Recommend Tax Structures

Only Attorneys, CPAs, and EAs can interpret the Internal Revenue Code in a personalized way.

Examples that cross the line:

- “You should convert your LLC to an S corp to save taxes.”

- “A CRT will eliminate your capital gains exposure.”

- “Gift the property now to avoid estate tax.”

- “Here is how to structure your income to drop into a lower bracket.”

Even if the strategy is correct, recommending it is not permitted.

————————————————————

3. You Can Lose Your License Even if the Client Is Happy

Most advisors assume they are safe as long as no one complains. This is false.

Regulatory bodies can sanction you even when:

- The client agreed

- The client benefited

- No complaint was filed

- No financial harm occurred

Violations are based on rule breaches, not client satisfaction.

Consequences include:

- License suspension

- Loss of carrier appointments

- FINRA sanctions

- State AG investigations

- Mandatory reporting to other regulators

This is why advisors who “talk trusts” often lose careers they spent decades building. Refer to the DOJ press release link below.

————————————————————

4. Compliance Departments Are Not Overreacting

When firms warn you not to discuss specific legal topics, it is not fear based. It is history based.

Firms have already seen:

- Lawsuits over failed trust funding

- Complaints about misinterpreted tax rules

- Client losses blamed on advisor explanations

- Advisors investigated for simple statements

Your firm’s restrictions exist because they have already paid the price of someone else crossing a line.

————————————————————

5. Clients Now Show Up With YouTube Law and TikTok Tax Strategies

This creates a dangerous trap.

If you say too little, they may follow a harmful strategy.

If you say too much, you may accidentally practice law.

The safest script is:

“This is an important legal or tax topic. Let me educate you broadly, then connect you with vetted professionals who can advise you legally.”

That is compliant. That is safe. That protects your license.

————————————————————

6. Education Is Allowed. Personalized Advice Is Not.

You are allowed to:

- Teach general principles

- Share IRS publications

- Explain how planning works in theory

- Discuss risks in buying cheap online estate plans

- Provide factual information

You are not allowed to:

- Interpret legal consequences

- Suggest specific structures

- Evaluate their documents

- Recommend attorneys in a directive manner

- Modify legal forms

The distinction is subtle but essential.

————————————————————

7. The Nonprofit Education Model Is the Safest Platform for Advisors

We have generally recommended our law, tax, and finance partners to structure nonprofit education centers if they want to educate their marketplace on various legal and financial topics.

Your educational nonprofit can:

- Publish educational content

- Host webinars

- Share IRS links and court cases

- Interview attorneys and CPAs

- Create guides and public resources

- Refer to a vetted independent legal network

- Serve as a firewall between your license and legal discussions

This structure is fully compliant because you are not providing legal advice. You are providing public education.

You are sharing valuable resources.

You are sharing scams, news updates, and Ponzi schemes that clients should avoid.

Elevate your positioning from that of a “service provider” into an educator, reporter, journalist, publisher, Insurance or Finance news anchor, and the “Watchdog” that’s there to protect and serve.

That one shift in “positioning” can change the trajectory of your business, your career, and your potential. You go from “selling” to “serving”, building social and relationship capital – which goes far beyond “good sales copy” that sells.

People buy from those who they “trust” – establish trust, credibility, and authority as the go-to advisor who is there to protect and serve the public through their “tax-exempt, grant-funded, educational news and educational platform”.

Read that again – that’s powerful!

————————————————————

8. A Magazine Is the Modern, Compliant Authority Engine

A magazine bypasses almost all compliance concerns because it is:

- Educational

- Public

- Not personalized

- Filled with third party professional insight

- Backed by IRS sources, tax law citations, and case references

- Offers unbiased knowledge sources

Advisors can finally talk about:

- Probate

- Estate taxes

- Trust failures

- Gifting mistakes

- IRS audits

- Capital gains traps

- Case studies

- New laws

- Insurance missteps

- Business succession pitfalls

All without crossing into UPL.

No other competitor in your field is doing this at scale.

You instantly stand out.

And, not to mention the extraordinary “AI and search-optimized” content that will be published on your platform, helping you rank on top of all competitors.

The bottom line – consider structuring an educational nonprofit digital publication that positions you are the preeminent advisor, educator, and “source of knowledge” in your marketplace while side-setting the traditional risks involved in helping clients fix their “legal and tax” work.

Check multiple boxes in one move.

————————————————————

9. Our Proprietary Suite of AI Tools Solve the Exact Problem Advisors Face

We recently partnered with Google’s AI team of developers to bring several of our AI Solutions to the marketplace for advisors and experts to leverage.

These tools have been tested extensively to ensure the output is “hallucination-free” – trained with cases and codes that are verifiable.

Your suite of tools was built specifically for this gap:

- Trust Compliance Scanner

- Estate and Probate Exposure Analyzer

- Nonprofit and Foundation AI Tools

- Pierce The Veil Scanner (Predictive AI)

- Decode The Code (Tax Calculators)

- Cases and Codes™ Research Bots

- Insurance Compliance Scanners

- FTC, Bar, SEC, and Marketing Compliance Bots

- AI Assisted Legal Research And Writing Studio for Magazines

These tools serve three roles:

- They help you educate clients safely.

- They empower vetted attorneys to provide the legal guidance you cannot.

- They protect your license by eliminating unauthorized interpretation.

————————————————————

Conclusion

Regulatory risk is not theoretical. It is active, it is enforced, and it is the leading cause of advisor license loss in the estate and tax domain.

But with the right structure, the right educational platform, and a vetted legal ecosystem, you can elevate your value, protect your clients, and grow your influence without ever crossing a legal boundary.

You do not need to dilute your expertise. You need to deliver it compliantly.

————————————————————

The Next Steps

If you want to:

- Launch your own nonprofit education platform

- Build a compliant magazine that positions you as an authority

- Access our vetted national attorney and CPA network

- Use our trust and tax scanners for client education

- Generate 500+ educational articles a year using our AI systems

- Gain influence, goodwill, and referral partners

- Protect your license while providing more value

You can request a pro bono educational assessment.

There is no obligation to hire, retain, or refer any professional. This session is about clarity, safety, and elevating your advisory practice.

Thanks for reading – I hope you have found this guide to be valuable and insightful – please leave your comments below – I’d love to hear your thoughts.

Thank you,

Sid Peddinti, Esq.

Inventor, Tax & IP Lawyer, AI Innovator, Writer & Editor

————————————————————

Sources and Footnotes

- American Bar Association – Unauthorized Practice of Law Guidelines

https://www.americanbar.org/groups/professional_responsibility/committees_commissions/commission_on_uph/ - IRS Circular 230 – Regulations Governing Practice Before the IRS

https://www.irs.gov/tax-professionals/circular-230 - FINRA Rule 2210 – Communications With the Public

https://www.finra.org/rules-guidance/rulebooks/finra-rules/2210 - CFP Board – Standards of Conduct and Fiduciary Duty

https://www.cfp.net/ethics/standards-of-conduct - NAIC Model Regulations for Insurance Producers

https://content.naic.org - State Bar Unauthorized Practice of Law Committees

(Example: Texas UPL Rules)

https://www.texasbar.com/AM/Template.cfm?Section=UPL - IRS Publications on Estate, Gift, and Trust Taxation

https://www.irs.gov/publications

————————————————————

Related Topics

#LawAndTaxMagazine

#EstatePlanning

#UPLCompliance

#FinancialAdvisorRisk

#TaxStrategyEducation

#ProbateAwareness

#TrustsAndTaxes

#WealthPreservation

#AIForAdvisors

#NonprofitEducation

#RegulatoryCompliance

#FiduciaryStandards

————————————————————

Leave a comment