CASE STUDY: Estate of Matthew T. Mellon II v. IRS

By: Sid Peddinti, Esq.

How the IRS Is Using Estate-Tax Valuation Rules to Challenge Cryptocurrency Discounts

By Sid Peddinti, Esq.

1. BACKGROUND

Matthew Taylor Mellon II, heir to the Mellon banking fortune, died unexpectedly in April 2018.

At death, he held a massive position in the cryptocurrency XRP, with partial restrictions related to agreements with Ripple.

Key estate facts (per cited sources):

- Reported value (Form 706): approx. $151 million after applying valuation discounts.

- IRS adjustment: IRS claims FMV closer to $242 million (disallowing most discounts).

- Proposed deficiency: Estimated additional estate tax in the tens of millions.

(Source: TI-Trust briefing)

The dispute centers on whether the estate may apply marketability, volatility, and contractual restriction discounts to the cryptocurrency holdings.

2. LEGAL AND TAX ISSUES

- Whether XRP tokens held by the decedent qualify for valuation discounts under IRC §2031 and its regulations.

- Whether contractual sale restrictions, liquidity limitations, and crypto-market volatility justify a lower FMV than quoted exchange prices.

- Whether the IRS may disregard discounts because crypto is treated as a readily tradable asset for tax purposes.

3. APPLICABLE LAW AND CODES

A. IRC § 2031 — Definition of Gross Estate; Fair Market Value

“The value of the gross estate shall be determined by including the value at the time of death of all property…”

FMV defined under Treas. Reg. §20.2031-1(b):

– Price between a willing buyer and willing seller,

– Neither under compulsion,

– Both having reasonable knowledge of relevant facts.

B. Valuation Doctrines

1. Lack of Marketability (LOM) Discount

Permitted where the asset cannot be readily sold in the market.

2. Lack of Control (LOC) Discount

Permitted for minority business interests.

3. Blockage Discount

Treas. Reg. §20.2031-2(e) allows discounts when selling a large block would depress market price.

4. Contractual Restrictions

Case law allows valuation adjustments if legal or contractual limits prevent immediate sale.

C. IRS Position on Cryptocurrency

IRS Notice 2014-21:

- Crypto is treated as property, not currency.

- FMV is typically determined by market-quoted price.

This creates tension:

Crypto is “property,” but its market does not behave like traditional securities, especially when restricted.

4. ANALYSIS – IRAC [Legal] FRAMEWORK

Legal Issue

Did the estate correctly discount the value of XRP based on:

– Extreme volatility,

– Illiquidity due to contractual restrictions,

– Large position size (blockage),

– Difficulty of immediate access and transfer?

Applicable Rule

IRC §2031 requires FMV at death.

Regulations and cases permit discounts where appropriate.

Crypto raises unique questions about “marketability.”

Legal Analysis

A. Volatility

XRP demonstrated extreme price swings. High volatility normally supports a marketability discount.

B. Contractual Restrictions

According to trust analysis and reporting, Mellon’s holdings were subject to sale/transfer restrictions, including limitations on volume and rate of liquidation.

These restrictions reduce true FMV because the asset cannot be sold at quoted price.

C. Blockage Effect

Mellon held a massive position.

Selling it would signal to the market and depress price — classic blockage discount circumstances.

D. Digital Asset Access Issues

Reports indicate Mellon used multiple phone-based wallets and private decision-making, making access complex.

Difficulty of accessing or controlling crypto wallets is itself a marketability risk.

E. IRS Counter-Position

IRS argues that regardless of restrictions:

– XRP had a public exchange price,

– Crypto is readily tradable property,

– Restrictions were “personal to Mellon” and shouldn’t reduce FMV.

Conclusion

The case will establish whether crypto-based valuation discounts are legitimate and how §2031 applies to:

– Token volatility,

– Restricted tokens,

– Liquidity constraints,

– Blockage discounts.

A ruling will affect every wealthy crypto holder.

5. BENT LAW™ [Business, Estate, Nonprofit, and Tax™] ANALYSIS

B — Business

XRP’s value tied to Ripple’s ecosystem.

Large, restricted holdings function more like a business asset than a retail crypto purchase.

E — Estate

Estate liquidity crisis: high tax bill + illiquid crypto.

Lack of structured estate planning for digital assets is a central failure.

N — Nonprofit

Had Mellon pre-positioned crypto into:

– A private foundation,

– CRT,

– NIMCRUT,

– DAF,

large appreciation could have bypassed estate tax entirely.

T — Tax

IRS disallowed a ~$90 million discount.

Demonstrates IRS readiness to apply aggressive valuation standards to crypto.

6. SECONDARY BENT (Behavior, Entity, Numbers, Timing)

Behavior

Mellon self-managed large crypto positions without institutional safeguards.

Entity

Held personally – not via:

– LLC,

– Trust,

– Foundation,

– FLP.

This exposed value to full estate tax.

Numbers

$151M reported vs. $242M IRS.

Difference = ~$90M valuation gap.

Estate tax ≈ 40%.

Potential deficiency ≈ $30–40 million.

Timing

Death in April 2018 – a volatile XRP period.

FMV swings near death date heightened complexity.

7. WHY THIS CASE IS CRITICAL

This is the first high-profile estate tax battle over cryptocurrency valuation.

It will likely influence:

- Digital asset appraisal standards

- IRS audit approach

- Estate planning for crypto millionaires/billionaires

- Entity structuring practices

- Blockage discount applications to digital assets

- Treatment of restricted tokens

- Executor duties for digital keys

8. MAJOR TAX LESSONS

(1) IRC §2031

FMV of all property included in gross estate.

(2) Treasury Regulation §20.2031-1(b)

Defines FMV and governs appraisal standards.

(3) IRC §2001

Imposes estate tax on the taxable estate.

(4) Treas. Reg. §20.2031-2(e)

Allows blockage discounts.

(5) IRS Notice 2014-21

Clarifies taxation of cryptocurrency as “property.”

(6) Case Law Supporting Discounts

Even though this case is ongoing, courts historically allow discounts when:

– Asset is restricted

– Large block depresses price

– Marketability limited

– Hypothetical buyer cannot instantly liquidate

These doctrines will be tested against digital assets for the first time.

9. PRACTICAL PLANNING IMPLICATIONS

Crypto requires:

– Entity ownership (LLC, FLP)

– Trust planning (IDGT, dynasty trust)

– Charitable planning (private foundation/DAF to avoid estate tax)

– Key-management protocols

– Digital asset instructions for executors

– Professional valuation before death

– Liquidity planning to pay taxes

Most crypto millionaires have none of these.

10. THE MINI FAMILY OFFICE™ SOLUTION SUITE

How High-Net-Worth Families Prevent a “Mellon Catastrophe” Using Entities, Planning, and AI Coordination

A preview of our proprietary Estate & Tax Planning and Visualization Portfolio Tool – to help you gain clarity and avoid mistakes.

The solution to this problem comes down to one word: ALIGNMENT.

The Mellon case demonstrates a core truth you teach inside the Mini Family Office™: Wealth is rarely lost because of market collapse; it is lost because of structural failure.

Crypto, real estate, business equity, private investments, intellectual property, and digital assets all collapse at the intersection of:

– Estate law

– Tax law

– Business entity law

– Risk management

– Timing

– Liquidity

– Market volatility

The Mini Family Office™ solves that collapse by creating a unified architecture, not a siloed “piecemeal” plan.

Below, I will present an alternative pathway to “generating, protecting, and preserving” wealth across all fronts. We’ll tackle all the issues in Mellon v. IRS case – as every single one of those “rules and regulations” ALSO apply to you.

The law is not “separate” for millionaires and billionaires – don’t fall for that marketing hype – your estate can face the same “legal process” that we explored above.

Below, I’ll present an operating model that I call “Flow Like Water” – taking in the philosophies of Bruce Lee – Water flows downstream and takes the path of least resistance. It does not try to breakdown the obstacles in the way, but it flows around it.

This is a mindset shift – one that allows you to lower friction, resistance, and also help you avoid scams, fraudsters, and Ponzi schemers that you’ll face along the way.

A. ENTITY STACK STRUCTURING

A deliberate legal entity stack lowers and prevents IRS valuation attacks, liquidity crises, probate disasters, and executor chaos.

1. Operating LLC (Digital Asset LLC)

Holds:

– crypto wallets

– cold storage

– digital contracts

– nodes/validators

– exchange accounts

– licensing rights

Benefits:

– separates digital assets from personal estate

– allows interest gifting

– enables valuation discounts legitimately

– creates clean FMV boundaries

– permits professional management

– reduces IRS visibility into personal holding patterns

2. IDGT (Intentionally Defective Grantor Trust)

Best structure for large crypto.

Employees:

– freezes value for estate tax purposes

– future appreciation stays outside the estate

– units/interests giftable at discounted valuation

– trustee control without triggering §2036 or §2038 inclusion issues

3. Dynasty Trust / Multi-Generational Trust

Crypto is extremely high-growth.

Legacy trusts prevent 40% estate tax every generation.

Mellon’s estate would have preserved over $40M–$80M per generational transfer.

4. FLP (Family Limited Partnership)

Excellent for crypto positions.

Used for:

– valuation discounts

– centralized investment management

– passing minority interests to children

– audit defensibility

5. Private Foundation Layer (The Philanthropy Lever)

In my Humble Opinion – This is the single largest tax arbitrage tool Mellon did not use.

A foundation solves the exact IRS valuation nightmare by:

– transferring appreciated crypto into a tax-exempt entity

– avoiding all capital gains on liquidation

– bypassing estate tax

– providing ongoing control (completely legal under §4940-§4945 rules)

– instantly solving liquidity constraints

– bypassing the probate process and court interference

B. TAX BLUEPRINT AND LIQUIDITY SUITE

Preventing Mellon’s Post-Death Liquidity Crisis

The Mini Family Office™ requires a pre-engineered Tax Liquidity Blueprint, which includes:

1. Pre-death valuation protocols

Crypto requires:

– quarterly valuations

– forensic access documentation

– discount analysis

– “restriction memoranda”

This makes estate tax FMV defensible.

2. Pre-arranged liquidity facilities

– structured life insurance

– pre-approved credit lines

– liquidity tranches linked to entity value

– foundation liquidation strategy

– multi-exchange liquidation rules

– protective hedging

This prevents forced sales under duress.

3. Integrated tax simulations

Every large asset class is pre-modeled under:

– market spikes

– market crashes

– regulatory freezes

– wallet-loss scenarios

– IRS audit triggers

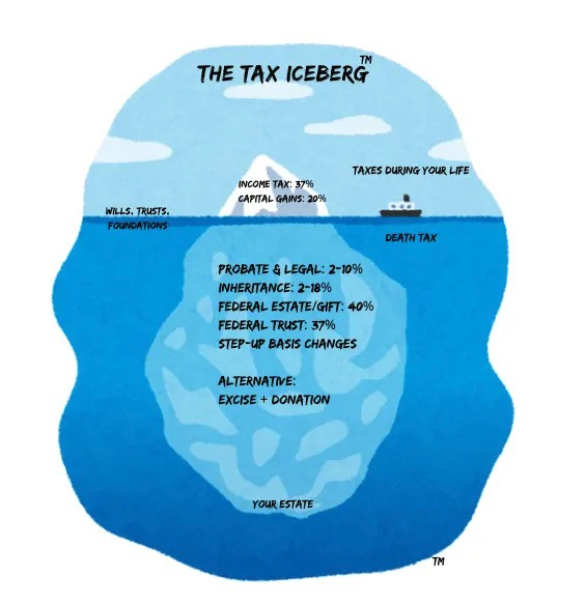

We’ve already built the tax-death simulations with a range of Tax Iceberg™ tools. These strategies and tools would have saved the Mellon estate tens of millions.

C. DIGITAL ASSET GOVERNANCE

Mellon’s estate collapsed because of access issues — not because of XRP.

The Mini Family Office™ standardizes:

1. Key-Management Protocols

– assignments and transfers

– threshold signatures

– institutional custody

– executor passphrases

– encrypted backups

– timed key-release structures

2. Wallet Governance Charter

Document defining:

– who can transact

– who can liquidate

– who can audit

– disaster recovery process

– compliance logging

3. Digital Asset Will + Executor Instruction Set

This single document would have prevented 80% of the Mellon issues.

D. RISK MANAGEMENT + MULTI-ASSET COORDINATION

Crypto interacts with all other categories:

– real estate

– business equity

– trusts

– insurance

– litigation/subpoena risk

– bankruptcy risk

– tax enforcement risk

The Mini Family Office™ pulls these into one coordinated system, allowing:

– unified reporting

– gap detection

– advanced tax reduction

– multi-jurisdiction protection

– liquidity sequencing

TIP: To beat probate and the various layers of taxes that are imposed on your estate, you must treat each asset independently AND also as a part of your entire estate.

That’s how the law treats it, anyway.

12. THE AI TOOL SUITE™ — THE FUTURE OF ESTATE & TAX INFRASTRUCTURE

Mellon’s case is the perfect demonstration of why AI-powered legal and tax infrastructure is the future.

Below is the Suite of AI Tools™ that complement the Mini Family Office™ Method covering all fronts: wealth generation, protection, and preservation.

A. The AI Valuation Engine™

An automated valuation assistant for:

– crypto

– business assets

– restricted assets

– large-block holdings

– FLP units

– LLC membership interests

Capabilities:

– volatility analysis

– restriction modeling

– discount calculation

– FMV simulation under §2031

– IRS audit risk scoring

– exportable valuation memoranda

This is the exact tool Mellon needed.

B. Estate & Trust Scanner™

Performs a full structural review:

– entity ownership

– control strings

– §2036 and §2038 inclusion triggers

– probate exposure

– state inheritance tax exposure

– gift tax violations

– incidents of ownership under §2042

– trust defects

– liquidity gaps

– charitable optimization

Produces:

– red/yellow/green flags

– recommended restructuring

– tax calculation impact

C. Digital Asset Executor Kit™ (AI)

An AI agent that:

– inventories wallets

– verifies keys

– detects missing assets

– maps wallet relationships

– reviews exchange statements

– executes liquidation plans

– monitors price during estate administration

– reduces risk of lost crypto

This solves Mellon’s executor-access problem instantly.

D. Private Foundation Compliance AI

Works with:

– Form 990-PF

– §4940 excise tax

– self-dealing (4941) tests

– jeopardizing investments (4944) tests

– charitable use verification

– fiduciary oversight

This is the “philanthropy engine” that converts large appreciated assets (like crypto) into tax-exempt generational legacies.

E. The Tax Iceberg Simulator™

Real-time simulations of:

– probate

– inheritance tax

– state estate tax

– federal estate tax

– capital gains conditions

– step-up scenarios

– income tax overlays

– multi-generational tax obligations

Perfect for showing clients how crypto or business holdings collapse under death scenarios.

F. The AI Compliance & Audit Shield™

Watches:

– entity governance

– trust distributions

– corporate minutes

– annual filings

– valuation reports

– transfer logs

– digital asset records

Alerts user of:

– self-dealing

– prohibited transactions

– taxable gifts

– missing corporate formalities

– audit-trigger patterns

This is how you prevent post-mortem IRS attacks like the one on Mellon’s estate.

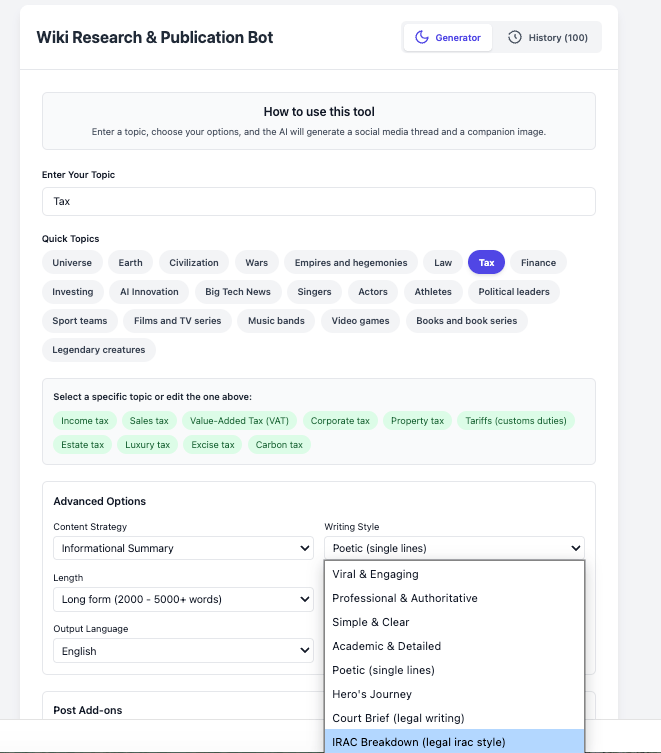

G. The Research Bots

Your AI Legal Research That Scans:

– court documents

– DOJ, FBI, IRS, FTC, and SEC updates

– IRS cases and publications

– Cases and Codes across law, tax, and finance niches

– myth-busting breakdown of concepts

– publication option to share your research with others (monetize your research and findings)

Don’t just sit on the sidelines and watch – be the advocate who can change people’s lives. Share your research and help your family and friends also protect their hard-earned crypto.

13. THE CLOSING ARGUMENT: WHY MELLON’S CASE IS THE WARNING SHOT OF THE NEXT DECADE

The Matthew Mellon estate case is not about crypto.

It is about the collapse of fragmented professional advice.

He had:

– no estate liquidity plan

– no entity structuring

– no trust freeze

– no discount-protected ownership

– no philanthropic tax shield

– no digital governance

– no executor key-access plan

– no AI-driven valuation

– no Mini Family Office™ model

The result:

– tens of millions in additional estate tax exposure

– valuation litigation

– delayed administration

– asset loss

– public drama

– legacy erosion

This is what we are on a mission to solve.

Well – that’s it for me.

I hope you’ve found this case and this comprehensive guide informative, educational, and worthy of bookmarking and sharing with your community as well – because we’re all in the same boat.

Talk soon,

Sid Peddinti, Esq.

Legal Mythbuster™, Tax Attorney, AI Innovator.

SOURCES

- Estate Planning Council Heckerling Summary (2023) – includes Tax Court docket.

https://www.estateplan-hc.org/assets/Councils/HampdenCounty-MA/library/2023%20Heckerling%20update.pdf - TI-Trust Quarterly Briefing (2022) – valuation numbers and dispute summary.

https://www.ti-trust.com/wp-content/uploads/2022/11/Third-Quarter-Briefing-2022.pdf - TrueST Law – narrative on crypto estate issues.

https://truestlaw.com/billionaire-banking-heirs-cryptocurrency-fortune-disappears-after-his-death/ - DailyDot – reporting on digital asset access issues.

https://www.dailydot.com/irl/death-internet-cryptocurrency-matthew-mellon/ - IRS Notice 2014-21 – classification of crypto as property.

https://www.irs.gov/pub/irs-drop/n-14-21.pdf - Primary Citation:

Estate of Matthew Mellon II v. Commissioner of Internal Revenue, U.S. Tax Court, Docket No. 18446-22 (filed 2022).

(Sourced from: Hampden County Estate Planning Council Heckerling Summary, 2023)

Source: https://www.estateplan-hc.org/assets/Councils/HampdenCounty-MA/library/2023%20Heckerling%20update.pdf - Supplementary Reporting & Analysis:

– TI-Trust Quarterly Briefing (Q3 2022), valuation dispute summary.

Source: https://www.ti-trust.com/wp-content/uploads/2022/11/Third-Quarter-Briefing-2022.pdf

– TrueST Law analysis, narrative on Mellon’s cryptocurrency fortune.

Source: https://truestlaw.com/billionaire-banking-heirs-cryptocurrency-fortune-disappears-after-his-death/

– DailyDot reporting on inaccessible crypto and estate complications.

Source: https://www.dailydot.com/irl/death-internet-cryptocurrency-matthew-mellon/

————————————————————

Leave a comment