By: Sid Peddinti, Esq.

Which Entity Should You Scale With?

In business, structure is not paperwork — it is destiny. Whether you’re a startup founder, a solopreneur scaling operations, or an established enterprise preparing for capital raises or eventual exit, the legal architecture you choose shapes every strategic decision that follows.

The IRS defines a business structure as the legal form of an organization, but that dramatically understates its importance. The structure determines how profits are taxed, who bears risk when things go wrong, how creditors can reach assets, and how easy (or impossible) it becomes to grow, merge, or sell the company.

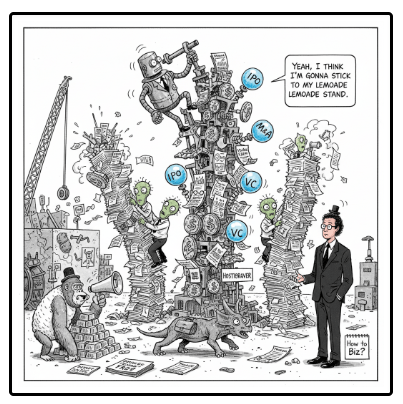

Most entrepreneurs choose a structure based on convenience or low cost. Others simply follow what they’ve seen online or what their accountant suggests during tax season.

But mistakes at this foundational layer cascade – turning routine growth into exposure, turning deals into liabilities, and turning success into a future lawsuit. It is no exaggeration to say that nearly every major business failure includes a structural error somewhere in its history.

The Four Dominant Structures – and What They Really Mean

The modern U.S. system recognizes several core formats – Sole Proprietorships, Partnerships, Corporations, S-Corporations, and Limited Liability Companies (LLCs). Each comes with distinct tax treatment, liability rules, and operational complexity.

Sole proprietorships and general partnerships remain common because they are easy to start, but they come with a hidden, often devastating cost: the owner is personally liable for all debts, obligations, and legal judgments. One unpaid vendor, one contract dispute, or one lawsuit can reach the owner’s home, savings, investments, and future income. Few business owners fully appreciate that a single legal dispute can follow them for decades.

LLCs, by contrast, offer liability protection with relatively low administrative burden. By default, LLCs are “pass-through entities,” meaning the profits and losses flow directly to the owner’s personal tax return – the structure itself does not pay taxes. This simplicity is why LLCs have become the most widely recommended format for small and mid-sized businesses.

Corporations, including C-Corps and S-Corps, are more rigid but bring different advantages. A C-Corp is taxed at the corporate level, and dividends are taxed again when distributed to shareholders. While this “double taxation” is often criticized, it is sometimes strategically beneficial – especially for high-growth companies seeking venture capital or planning an eventual public offering. Investors trust the predictability and governance requirements built into a corporate structure.

S-Corps provide pass-through taxation but with corporate governance rules layered on top. They’re powerful for owner-operators looking to optimize income tax, but strict eligibility requirements limit their use.

Pass-Through Entities — Simplicity and Risk Intertwined

At first glance, pass-through taxation seems like the ideal setup. The structure itself pays no federal income tax, and the owners report business income on their personal returns. However, many entrepreneurs misunderstand what else passes through.

Liability often does.

If the entity is poorly structured, undercapitalized, or commingled with personal assets, courts may “pierce the veil,” treating business actions as personal ones. In partnerships, each partner may be personally liable for the actions of the others, even without knowledge or consent. In LLCs, failing to respect proper legal formalities can dissolve legal protections.

The result is a structure that appears safe – until the day a contract dispute, lawsuit, or creditor exposes the underlying weakness.

Where Most Businesses Fail — Avoidable Structural Errors

The most common issue is not choosing the wrong structure – it is choosing without understanding. Entrepreneurs select an LLC but never sign an operating agreement. They form a corporation but fail to issue shares. They hire employees but never set up payroll tax compliance. They develop intellectual property but never secure ownership through proper assignments.

Contract risk is another silent killer. In many first-generation businesses, owners sign contracts personally instead of as the entity. One missing word — “its duly authorized representative” – can erase liability protection entirely.

There is also a growing crisis around intellectual property. Businesses assume that if they paid for a logo, website, or software, they own it. Under U.S. law, they often do not. Unless a proper “work-for-hire” clause or IP assignment exists, the creator often retains ownership, leaving the business exposed.

And then there’s the invisible compliance layer: permits, state filings, franchise taxes, EIN registration, employment law, insurance requirements, and IRS reporting obligations. These obligations vary dramatically by state, and missing even one can invalidate liability protections.

A Real-World Example: When Structure Determines Survival

Imagine two business owners with identical revenues and identical contracts but different structures.

Owner A operates as a sole proprietorship. A supplier dispute escalates into a lawsuit. The court rules against the business – and the judgment attaches to the owner’s home equity, personal bank accounts, and future income.

Owner B operates through an LLC with a clear operating agreement, proper compliance, and separate business accounts. The same lawsuit results in a judgment against the LLC – but the owner’s personal assets remain untouchable.

The only difference between ruin and protection was one structural choice made years earlier.

When Structure Should Change

Businesses evolve. What begins as a simple service can grow into a multi-entity organization involving separate IP holdings, real estate, management companies, and investment arms. Many business owners hesitate to restructure because of perceived cost, but restructuring can reduce tax obligations, protect assets, and position the business for sale or succession.

The most successful businesses undergo structural reviews every 12-18 months, particularly when:

• revenue crosses new thresholds

• new partners, investors, or employees are added

• intellectual property expands

• real estate is acquired

• new jurisdictions are entered

• the business prepares for exit

Structure is not static – it is a living system.

Conclusion

Business structure is not a formality. It is a strategic instrument that determines everything from taxation and liability to capital raising and long-term survival.

Entrepreneurs who treat formation as “paperwork” almost always learn the hard way. Those who treat it as architecture build companies that survive, scale, and eventually sell.

Build Your Business With Confidence

If you want a structural review of your business, a risk analysis, or a tax-efficient blueprint for growth, head over to the Law & Tax Hotline™ tab and schedule a call with us.

We’ll pair you with a vetted lawyer who can help you understand these nuances – 100% pro bono consultation – no strings attached – no pressure to retain us – no pressure to follow our explanations.

We’re educators, happy to contribute our knowledge – even if you don’t hire us!

Talk soon,

Sid Peddinti, Esq.

Lawyer, Educator, Legal Researcher

Sources & References

- IRS – Business Structures Overview

https://www.irs.gov/businesses/small-businesses-self-employed/business-structures - IRS – Limited Liability Company (LLC)

https://www.irs.gov/businesses/small-businesses-self-employed/limited-liability-company-llc - U.S. Small Business Administration – Choose a Business Structure

https://www.sba.gov/business-guide/launch-your-business/choose-business-structure - Cornell Law – Liability and Veil Piercing

https://www.law.cornell.edu/wex/piercing_the_corporate_veil - IRS – S-Corporations

https://www.irs.gov/businesses/small-businesses-self-employed/s-corporations

Disclaimer

No legal, financial, tax, or investment advice contained.

Content is for educational purposes only.

Copyrighted Material. © 2025 All Rights Reserved.

Mini Family Office™, The Tax Iceberg™, ARM Your Estate™, and Debunk the Myth™ are intellectual property of Become A Philanthropist™.

Concepts

#BusinessStructure

#TaxStrategy

#AssetProtection

#LLCFormation

#CorporateLaw

#Entrepreneurship

#WealthPreservation

#MiniFamilyOffice

#LegalPlanning

#ForbesStyleAnalysis

————————————————————

Leave a comment