Become A Philanthropist™

The Myth of ‘Just Giving’ – 10 Reasons a Private Foundation is Your Ultimate Wealth Builder

Today I want to explore the world of private foundations. I call it the ultimate wild card, because no other legal structure gives you the same combination of strategy, control, tax leverage, and legacy power.

For business owners, investors, families, and anyone planning a major liquidity event, a foundation is one of the most overlooked tools in the entire estate and tax universe.

Years ago, a close friend of mine sold his legal tech company. Brilliant guy, great exit, and suddenly facing a capital gains tax bill of about 3.5 million. Like most entrepreneurs, he went straight to the internet and asked for advice.

He showed me a Facebook group thread full of suggestions. It was a flurry of opinions from well meaning founders and investors, but not a single licensed attorney, accountant, or M&A expert had weighed in.

That thread looked exactly like what the internet has become. A mix of confident voices, strong opinions, and people who have never actually set up an entity, filed a tax form, or negotiated with the IRS.

It was a reminder that the loudest person in the room is rarely the most experienced. Be careful who you listen to.

The suggestions poured in. Buy a yacht. Run everything through a trust. Donate it all. Restructure the deal. Move states. Delay the sale. Everyone had a theory.

Not one person mentioned the most strategic option on the table. Not one person talked about a private foundation, and no one suggested making a charitable gift before the sale instead of scrambling after the tax bill arrived.

This is the blind spot I see over and over again, even among extremely successful families. The foundation is one of the most powerful legal structures you can establish.

It protects assets, lowers taxes, directs family governance, supports long term vision, and becomes a financial engine that outlives you. It is the only entity that allows you to turn taxable income into philanthropic capital without giving up control.

I asked my friend one simple question. Would you like to convert one hundred percent of the tax bill into social investments and charitable capital that you and your family control for generations?

He said yes without hesitation.

The path was clear.

- Create a private foundation structured as a 501c3.

- Donate a portion or all of the business interest to the foundation before the sale.

- Claim a personal income tax deduction for the donation.

- Let the foundation sell the asset and pay its flat 1.39% excise tax.

- Allocate the proceeds across investments and charitable initiatives.

- Meet the foundation’s annual distribution requirement of roughly 5 percent through qualified grants or mission aligned investments.

Done correctly, this structure transforms a tax bill into a war chest for impact, investing, legacy building, and long term wealth preservation. It is completely legal, time tested, and used by every major philanthropic family in the country.

Here are the ten core reasons why private foundations and nonprofit structures form the blueprint for managing and growing serious long horizon capital:

Reason 1: You Get an Immediate and Massive Income Tax Break

Takeaway: When you put money or assets into your foundation, the IRS treats it as a donation right now. This is a huge win. If you have a massive income year – maybe you sold a company or hit a huge bonus – moving that cash into your foundation immediately drops your taxable income for that year. It’s a legal, immediate way to pay less tax now, freeing up cash that would have gone to the government to instead start working for your family’s mission.

Reason 2: The Money Grows 100% Tax-Free – Forever

Takeaway: This is the real magic trick. Once the assets are inside your foundation, every dollar they earn – through stock market gains, real estate appreciation, or bond interest – is completely tax-free. Your personal investment account gets hit with capital gains taxes and dividend taxes every year, but your foundation’s portfolio does not. This allows compounding to work faster and harder, turning your charitable pot into a massive, untouchable family endowment.

Reason 3: You Skip Capital Gains Tax on Giant Assets

Key Action: Do you own stocks that have exploded in value, real estate that’s sitting on massive profit, or a piece of a private company? If you sell those assets yourself, you pay a massive capital gains tax bill on the profit. If you donate those appreciated assets to your foundation instead, you get a tax deduction for the full fair market value of the asset, and you completely skip the capital gains tax you would have paid. This is how smart families move huge blocks of wealth tax-efficiently.

Reason 4: Total Control Over Your Investment Strategy

Takeaway: Unlike giving to a big community fund where your cash is managed by strangers, a private foundation gives you almost total control. You and your family are the board members. You decide the investment strategy – growth stocks, bonds, alternative assets, whatever you want. This means you can keep investing your charitable money the way you invest your personal money, aligning your financial skill with your mission.

Reason 5: It’s the Ultimate Generational Wealth Training Tool

Key Action: Wealth often dies in the third generation because kids aren’t taught how to manage money. A foundation is a perfect, low-risk training ground. You can put your kids and grandkids on the board. They have to learn about governance, reading financial statements, making investment decisions, and distributing grants. It turns theoretical ‘money lessons’ into real-world, high-stakes experience, ensuring the next generation understands stewardship, not just entitlement.

Reason 6: Ironclad Asset Protection from Legal Claims

Takeaway: When you transfer assets out of your personal name and into a legally formed, irrevocable foundation, those assets become separate property. If you ever face a lawsuit, bankruptcy, or personal financial trouble, the money and investments held by your foundation are generally protected because they legally belong to the charitable entity, not to you personally. It’s a powerful layer of legal armor.

Reason 7: The Structure for Managing Complex, Hard-to-Sell Assets

Key Action: Ever tried to donate an entire apartment building or a piece of a functioning business to a local soup kitchen? It’s a nightmare. Foundations are built to handle complex assets like real estate, limited partnership interests, or illiquid business shares. They can manage and hold these assets, maximizing the income they generate (tax-free) and using that income for the foundation’s mission, long before they are sold. This is how you unlock value from non-cash wealth.

Reason 8: Building a Legacy That Outlives You – In Perpetuity

Takeaway: A standard will or trust can be challenged or run out of money. A foundation is set up to last in perpetuity. This means the name, the mission, and the financial structure you build can continue generating impact and wealth for 100 years or more. It’s a tangible, lasting monument to your values, ensuring your family’s influence and work doesn’t stop just because you did.

Reason 9: A Legal Structure to Centralize Family Compensation (The Right Way)

Key Action: While you cannot use a foundation to just pay personal bills, you can use it to legally hire family members for services rendered to the foundation (like running operations, managing programs, or doing administrative work) at market-rate salaries. You can also establish specific scholarship funds for family education or hardship grants (under strict rules). This provides a centralized, legal way to manage certain types of family cash flow and employment opportunities.

Reason 10: Eliminating the ‘Constant Solicitation’ Problem

Takeaway: If you are wealthy, your personal email inbox is a mess of donation requests from every organization on the planet. Setting up a foundation gives you one centralized, organized, and private place to handle all giving. You can now politely direct all requests to the foundation’s formal process, which provides a professional barrier, maintains your privacy, and removes the emotional stress of constant public or personal solicitation.

The core idea is simple: structure your giving before you pay the tax. A private foundation or nonprofit isn’t an expense; it’s an investment vehicle that shelters assets, trains your kids, and lets you keep full control over your biggest financial decisions.

What’s the one thing holding you back from setting up a structure that could literally last for generations?

If you are ready to stop leaving your biggest assets to chance and want a proven blueprint to structure your wealth, let’s chat.

WE LOVE SETTING UP FOUNDATIONS AND HELPING PEOPLE BECOME PHILANTHROPISTS.

It all comes down to one simple formula: profit + impact can be accomplished together!

I invite you to explore the wonderful world of nonprofits and foundations by visiting our Nonprofit and Foundation website to explore the nuances of these structures. Link is in the footnotes section.

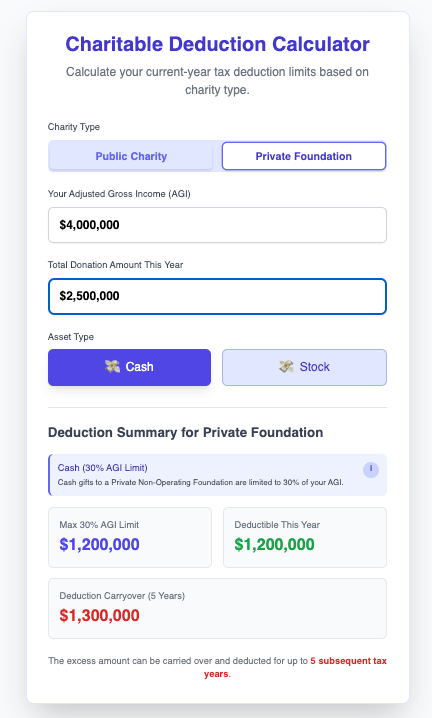

We have also built several AI tools to help you get clarity – we’d love to run a few simulations and figure out how you can lower your taxable income by a big chunk every year or before an exit.

This tool is being tested and developed by our partners – Google AI Cloud experts – who are bringing these innovations to life. We are building the world’s most comprehensive suite of AI tools for philanthropists and we’d love to offer you the opportunity to test out these tools – 100% free – no strings attached – no sneaky sales pitches involved.

Here’s a quick look at one of these tools:

Well – that’s it for now – thanks for reading.

I hope you leave inspired and ready to transform a portion of your financial success into grants and donation to empower society.

Cheers,

Sid Peddinti, Esq.

Tax Lawyer & Impact Investor.

Resources:

- Nonprofits and foundations website: https://nonprofitsandfoundations.com

- Forbes Business article on foundations: https://www.forbes.com/councils/forbesbusinesscouncil/2024/05/24/how-business-owners–entrepreneurs-can-transform-into-purpose-driven-philanthropists-by-incorporating-a-private-foundation/

- IRS links for foundations: https://www.irs.gov/charities-non-profits/private-foundations

This article is for informational and educational purposes only and is not intended as legal, tax, or financial advice. The benefits of private foundations and nonprofits depend on your specific financial situation and jurisdiction. Consult with a qualified legal and tax professional before making any financial decisions regarding foundations or charitable giving.

#WealthManagement #PrivateFoundation #GenerationalWealth #TaxStrategy #NonprofitTips #FamilyFinance #FinancialFreedom

Leave a comment