The Problems With Social Media Experts…

The Day The Family Group Chat Turned Into A Legal Strategy Meeting

Every family has that one group chat that starts off with vacation photos and ends in absolute chaos.

I remember one particular “legal teachable moment” that unfolded inside a family chat I had been added to for coordination.

It began with a simple message:

“Hey, quick question, if we just put everything in Mom’s name, that avoids tax, right?”

Twelve people responded in three minutes.

We had:

- One sibling suggesting they “just make her a beneficiary on everything”

- Another insisting that “if the house is in an LLC, the IRS cannot touch it”

- An uncle forwarding a TikTok about “rich people tax secrets”

- A cousin suggesting they “just open a trust on LegalZoom and be done”

- And a friend of the family chiming in, “My barber said you can write everything off if you have an LLC.”

By the time I scrolled through, the group had accidentally designed a tax fraud case, a probate disaster, and a family lawsuit.

All in under an hour.

Humor Hides Real Risk

It was funny in the moment. The mix of half-truths, hearsay, and overconfidence is something I see every week. But behind the jokes, there was something serious.

This was a real family with real assets:

- A house with no clear long-term plan

- Retirement accounts with outdated beneficiaries

- A small business without a succession strategy

- Informal loans between family members

- No coordinated estate plan

Yet they were trying to handle it in the same way people decide where to order takeout.

The Three Biggest “Group Chat Myths”

From that and many similar experiences, I can tell you what shows up most often:

- “We will just put it in someone else’s name.”

- “We will worry about probate later.”

- “We will figure out the taxes when the time comes.”

Each one hides a serious problem.

- Putting assets in someone else’s name without structure can trigger gift tax, future creditor issues, and total loss of control.

- It can even be reversed or voided if a creditor has a valid claim before it is transferred into another’s name.

- Ignoring probate planning means accepting court control, delays, legal fees, and public exposure.

- Waiting on taxes means missing the window when planning is still possible.

What I Told That Family

I finally replied.

I told them that if they kept going like this, they would accidentally:

- Create gift and estate tax problems

- Leave the house exposed to creditors and probate

- Cause fights about who “deserves” what

- Waste money cleaning up mistakes instead of planning properly

Then I did something very un-dramatic.

I pulled their data into one of the estate and entity visualization tools we built. Once everything was on a single screen, the group chat went silent.

They could see:

- Which assets had no plan

- Where ownership made no sense

- Who was exposed legally

- How an illness or death would affect each person

The jokes stopped.

The planning began.

We pointed out:

- The state tax liability

- The probate exposure

- The step-up basis on assets

- Inheritance costs

- Estate taxes (over the limit)

- The probate timeframe

It comes down to the age-old saying: An ounce of planning is better than a pound of cure.

Why Humor Is Often A Mask For Confusion

Most people are not avoiding planning because they are irresponsible. They are overwhelmed. So they use humor, delay, or quick-fix ideas as a defense.

Once you show them the real picture, with clarity and without judgment, it becomes much easier to act.

How Our AI Tools Fit Into These Real-Life Moments

We did not build AI tools to impress anyone.

We built them because we wanted clarity in our own portfolios.

We built them for group chats like this – where many generations are impacted.

We’ve partnered with Google’s AI dev team to fine-tune these AI innovations and bring them to the marketplace so you can leverage these tools – for yourself and for your clients. Some of these include:

- An Estate and Trust Portfolio Visualization Tool that turns scattered information into one coherent picture

- A Family Risk and Probate Exposure Scanner that shows who is exposed and how

- A Business and Personal Entity Map that overlays legal, tax, and estate pathways

When people see their lives in that format, they cannot unsee it.

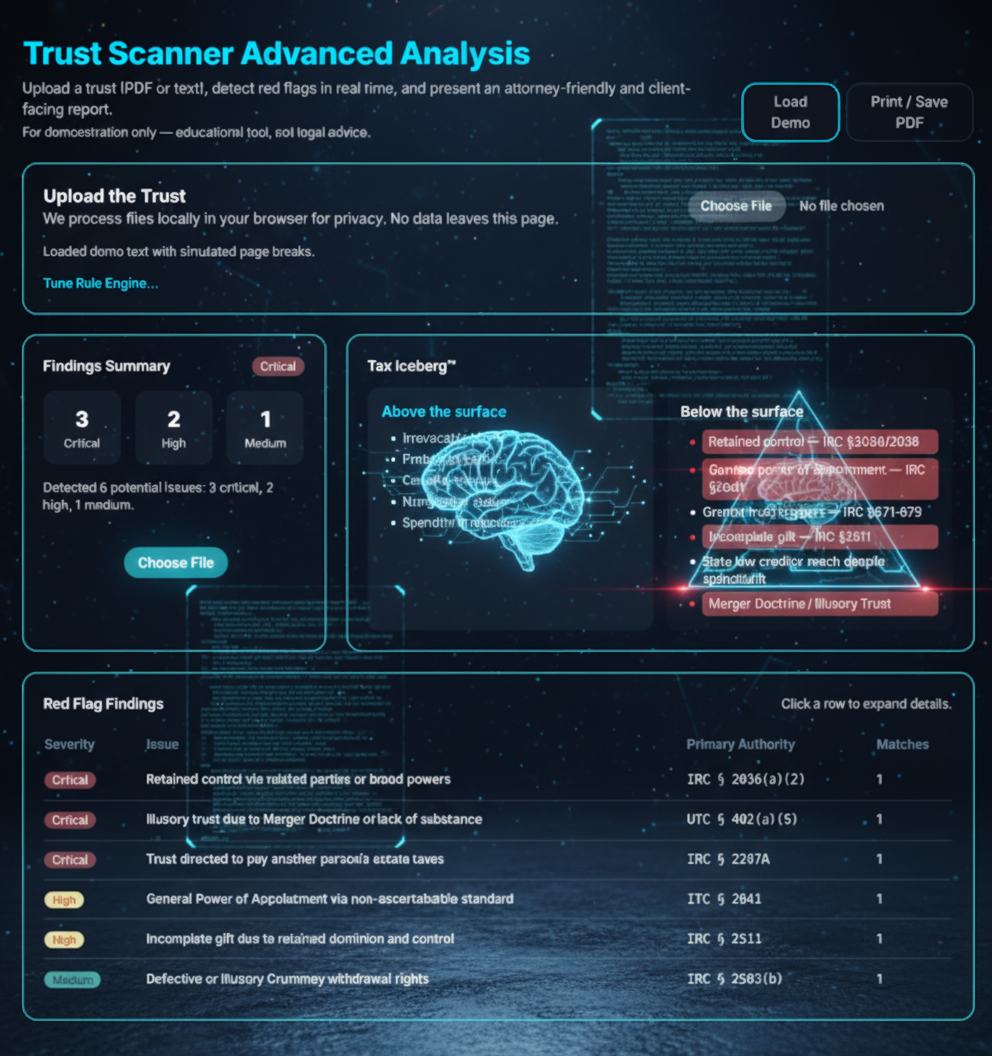

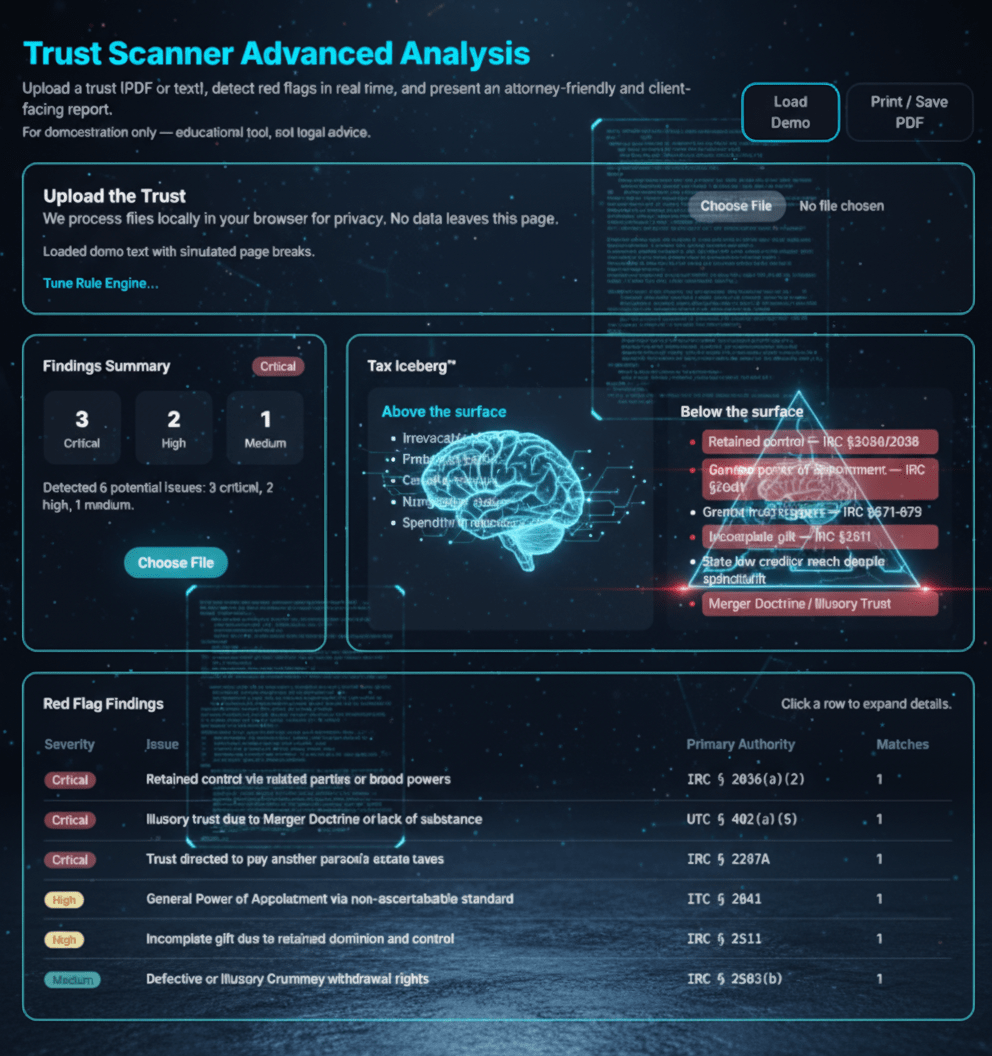

Here’s another tool – the Trust Scanner™ – that is trained to scan through 100s of pages of complex terms and conditions and find mismatched terms that can trigger probate or reversal of transfers. These tools can change the way your family controls wealth across multiple generations with confidence.

A Pro Bono “Family Map” Session

If your family chat feels like that one, with ideas flying and no clear plan, we can quietly map everything out.

Our network of attorneys and CPAs offers a free pro bono session where we:

- Gather the core data

- Run it through the visualization and risk tools

- Show you what actually happens if nothing changes

You do not have to hire anyone. You do not have to commit to a strategy on the spot. You simply get to see the truth in one place.

Then, the next time someone in the group chat says, “We will just put it in Mom’s name,” you will know exactly what that really means.

Thanks for reading – I hope you gained some insights from this case study.

Sid here.

Chat soon.

Disclaimer

This article is for educational purposes only and does not constitute legal, tax, or financial advice.

Topics Discussed:

#FamilyWealth #EstatePlanning #ProbateReality #TaxHumor #WealthStructure #LawAndTaxMagazine

Leave a comment