CRYPTO TAX IRAC BREAKDOWN: 7 Rules Every HODLER MUST KNOW

#Cryptotax #XRP #Crypto

This is the ultimate, copy/paste-ready cheat sheet breaking down the most complex crypto tax issues from the IRS’s perspective, legal IRAC style (Issue, Rule, Application, Conclusion).

1/7 NOTICE 2014-21: The OG Rule

Issue: How does the IRS treat virtual currency for tax purposes?

Rule: Virtual currency is treated as property, not as currency, under existing general tax principles.

Application: Every transaction—buying, selling, trading, or paying for goods with crypto – is a taxable event (like selling a stock).

Conclusion: You must track and report your cost basis, holding period, and gain/loss for every single crypto disposal.

(Link to IRS Notice 2014-21: https://www.irs.gov/pub/irs-drop/n-14-21.pdf)

2/7 §1091 WASH SALE GAP: The Investor Loophole

Issue: Can a crypto investor immediately deduct a loss from selling and repurchasing a token (a ‘wash sale’)?

Rule: Internal Revenue Code §1091, which disallows wash sales, only applies to stocks and securities.

Application: Since most cryptocurrencies are not yet classified as securities, the wash sale rule currently does not apply, allowing for ‘tax-loss harvesting’ without a 30-day waiting period.

Conclusion: Non-security crypto is exempt from the wash sale rule for now, but Congress is actively seeking to close this gap.

(Link to proposed legislation details: https://taxlawcenter.org/files/tpp_section1091_washsalerules_crypto.pdf)

3/7 STAKING INCOME: When to Report

Issue: When do I recognize income from staking rewards?

Rule: Staking rewards are considered gross income and are taxable as ordinary income.

Application: The income is recognized when you gain “dominion and control” over the new assets, valued at the fair market value at the time of receipt.

Conclusion: Report your staking rewards immediately as ordinary income, and this market value becomes your new cost basis. (Link to IRS FS-2024-12 FAQ on staking: https://www.irs.gov/pub/irs-news/fs-2024-12.pdf)

4/7 FBAR: Foreign Account Reporting

Issue: Must I report foreign crypto accounts on the Report of Foreign Bank and Financial Accounts (FBAR)?

Rule: FBAR (FinCEN Form 114) requires reporting if the total maximum value of all foreign financial accounts exceeds $10,000 at any time during the calendar year.

Application: Currently, FinCEN regulations do not explicitly define a virtual currency account as an FBAR-reportable financial account, but FinCEN has announced its intention to amend the regulations to include it.

Conclusion: While not currently mandated, monitoring future FinCEN guidance and considering reporting is the conservative approach.

(Link to FinCEN Guidance: https://www.fincen.gov/sites/default/files/2020-12/Notice-Virtual%20Currency%20Reporting%20on%20the%20FBAR%20123020.pdf)

5/7 FORM 8300: High-Value Business Payments

Issue: What reporting is required for businesses receiving large crypto payments?

Rule: Businesses must file Form 8300 for cash or cash-equivalent payments, including digital assets, over $10,000 received in one or related transactions.

Application: If a trade or business receives $10,000+ in cryptocurrency for a sale of goods or services, they must report the transaction to the IRS within 15 days.

Conclusion: Crypto is treated like physical cash for this specific business reporting requirement, imposing strict filing deadlines.

(Link to IRS Form 8300 Details: https://www.irs.gov/businesses/small-businesses-self-employed/form-8300-and-reporting-cash-payments-of-over-10000)

6/7 DEFI TAXABILITY: Navigating the Unknown

Issue: How are complex decentralized finance (DeFi) transactions (e.g., lending, liquidity pools) taxed?

Rule: All digital asset transactions are subject to tax, but the IRS has not provided specific guidance for every DeFi event type.

Application: Taxpayers must use the existing property-based rules (Notice 2014-21) to determine the tax treatment for swaps, loan interest, liquidity pool deposits, and token rewards.

Conclusion: The burden is on the taxpayer to track and report using general principles, making detailed record-keeping essential for all DeFi activity.

(Link to general IRS Digital Asset Guidance: https://www.irs.gov/newsroom/digital-assets)

7/7 SMART-CONTRACT GOVERNANCE: The DAO Problem

Issue: What is the tax classification and reporting obligation for a Decentralized Autonomous Organization (DAO) and its governance tokens?

Rule: A DAO, whose governance and execution are defined by smart contracts, must still fit into existing legal tax entity classifications (e.g., corporation, partnership).

Application: The legal and tax classification of the DAO itself is a major unresolved issue, which directly impacts how governance token holders are taxed on voting and other participation rewards.

Conclusion: The tax treatment for governance tokens and DAO participation remains complex, pending further IRS guidance on DAO entity classification.

(Link to an analysis of DAO tax issues: https://www.friedfrank.com/siteFiles/Publications/fried-frank-squaring-the-circle-smart-contracts-and-daos-as-tax-entities.pdf)

Here’s the final takeaway: You can expect CYRPTO regulations tighten up even more over the next few years – so strategic planning is going to become a non-negotiable.

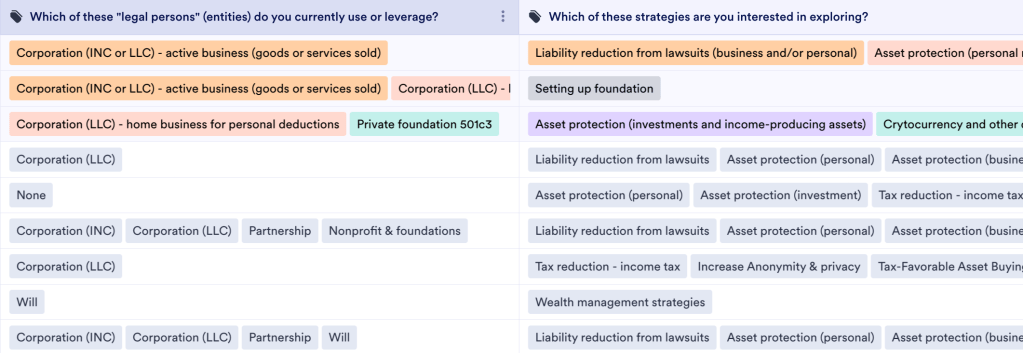

We build the Mini Family Office™ system to help families get the clarity they need to protect their crypto and other portfolio of assets from being diluted in taxes and court costs.

Schedule a complimentary call to discuss how we can help you get your “crypto” plans in order to avoid unnecessary taxes and costs.

Thanks for reading,

Sid Peddinti, Esq.

BA, BIA, LB/JD, LLM

#CryptoTax #IRAC #IRStax #DeFi #Notice201421 #TaxLossHarvesting

NO financial, legal, or tax advice contained – education and entertainment purposes only. This article provides general informational content only and does not constitute legal, financial, or tax advice. Trust laws are complex, highly state-specific, and constantly changing.

Readers should consult with a qualified estate planning attorney or financial advisor regarding their specific situation. The information provided herein is not a substitute for professional legal counsel.

Leave a comment