Law & Tax Scam Alert™ By The Legal Watchdog™, Sid Peddinti, Esq.

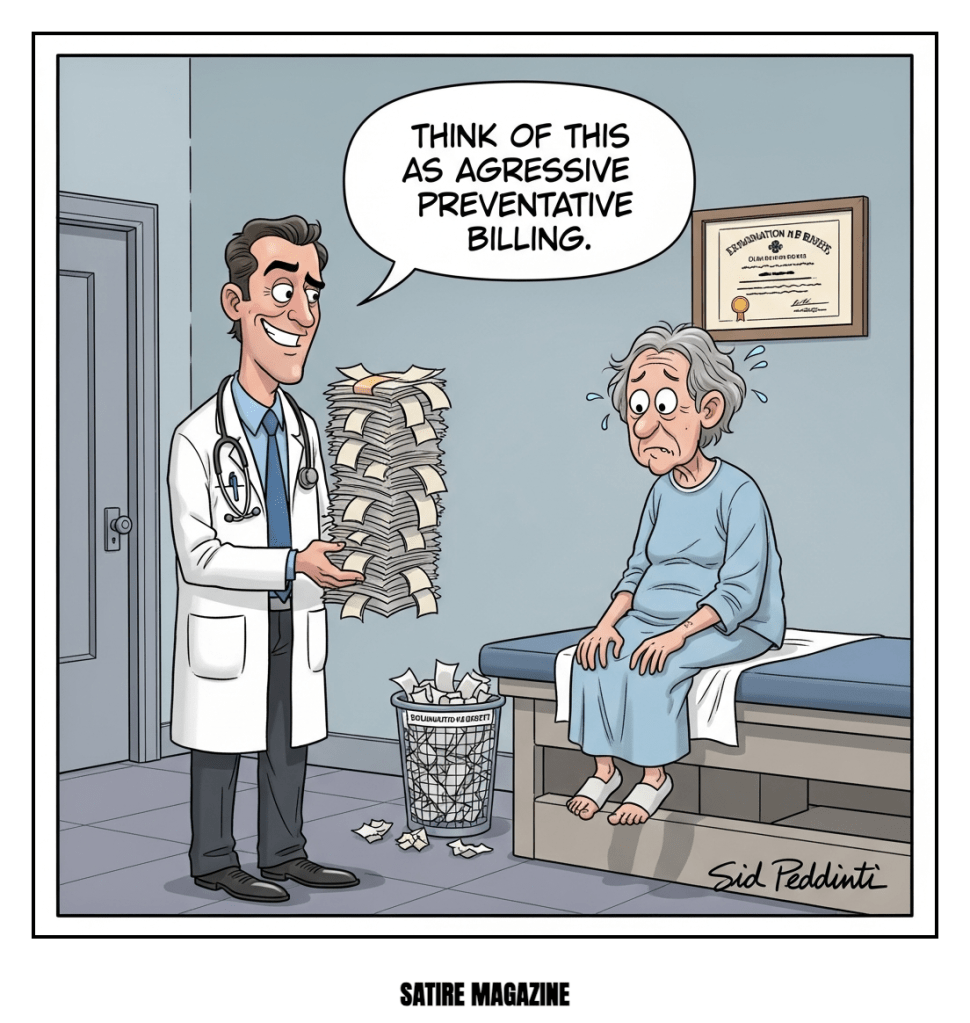

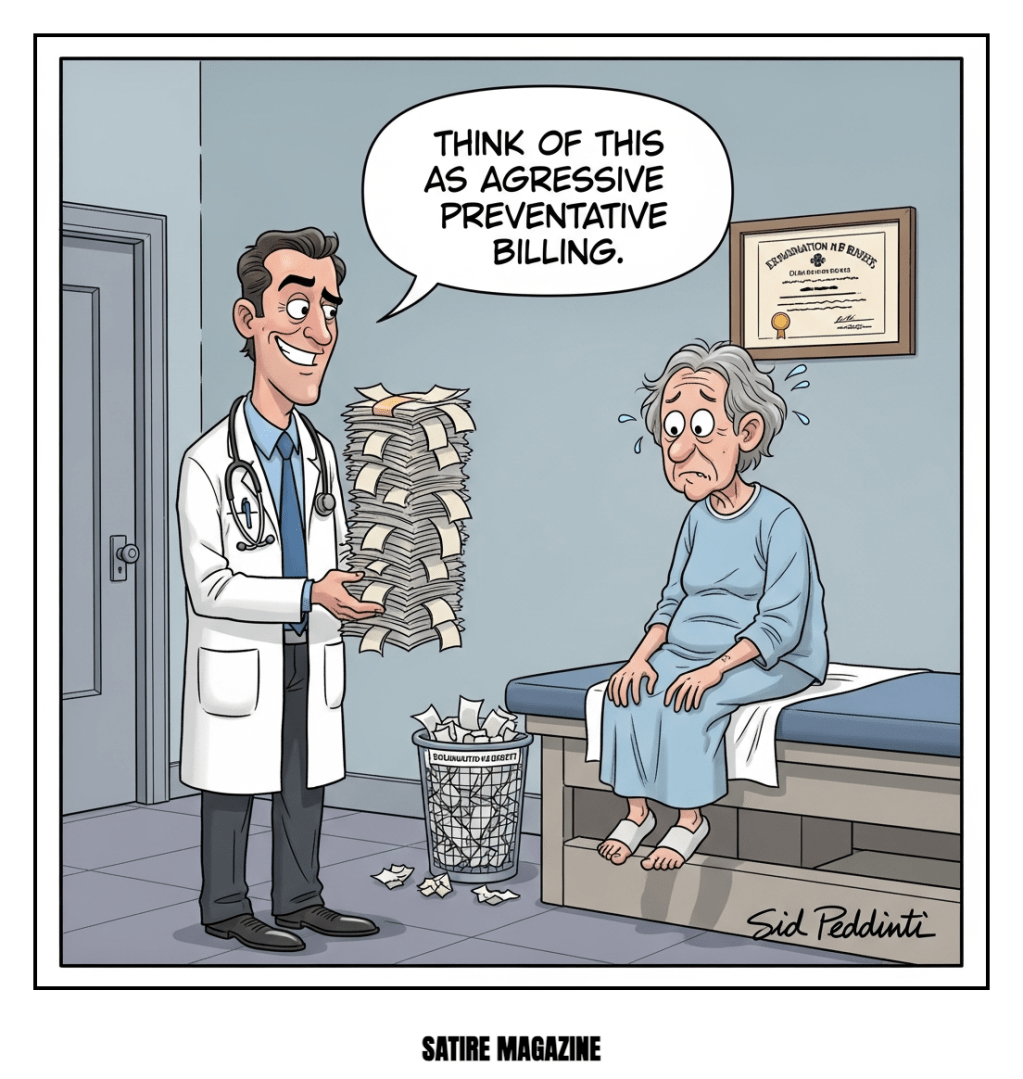

How to Spot & Report the New Medicare Scam: Decoding ‘Aggressive Preventative Billing’

By Sid Peddinti | Updated January 5, 2026

The landscape of financial fraud evolves faster than public awareness. While traditional phone scams targeting seniors persist, a newer, jargon-heavy tactic is emerging: Aggressive Preventative Billing (APB).

The term sounds official, perhaps even beneficial—who doesn’t want preventative care? But in the hands of fraudsters, APB is simply a complex excuse to bill Medicare (and sometimes the beneficiary) for high-cost medical services or equipment that are either unnecessary, never delivered, or billed well in advance of any legitimate service date.

This scam relies heavily on confusing language, high-pressure sales tactics, and the victim’s inherent trust in medical institutions. Here is your definitive guide to recognizing and dismantling this scheme.

5 Red Flags That Signal ‘Aggressive Preventative Billing’

Fraudsters often target victims via unsolicited calls, emails, or even door-to-door visits disguised as “wellness checks.” Knowing these indicators is the first line of defense.

- Unsolicited Contact Regarding “Future Needs”: If a company you have never dealt with contacts you and insists that Medicare mandates a specific high-cost device (like a specialized back brace or genetic testing kit) to “prevent catastrophic future illness,” hang up immediately. Legitimate preventative screenings are typically coordinated through your primary care physician.

- The Requirement of Your Medicare ID Over the Phone: Scammers need your 11-digit Medicare Beneficiary Identifier (MBI) to submit fraudulent claims. They will often promise the service is “100% covered” if you just provide the number now. Never give out your MBI to unsolicited callers.

- Billing for Undelivered or Unnecessary Services: APB often involves billing Medicare before a product is even shipped or a service is scheduled. Check your Explanation of Benefits (EOM) closely. If you see charges for genetic testing or specialized durable medical equipment (DME) you haven’t received, you’ve been targeted.

- Pressure Tactics and Limited-Time Offers: A hallmark of any financial scam is manufactured urgency. They might claim, “This specialized preventative equipment is only covered for the next 48 hours,” or “Your coverage changes next month.” This is designed to prevent you from researching or contacting your trusted physician.

- The “Free Test” That Isn’t Free: Many APB schemes begin with an offer of a “free” genetic screening or health assessment. While the test may seem free to the patient, the billing entity charges Medicare hundreds or thousands of dollars for the interpretation of often useless or generic results.

The Data Behind the Danger

The transition to more complex billing scams is generating significant financial damage. According to the U.S. Department of Health and Human Services Office of Inspector General (HHS-OIG), attempted healthcare identity fraud reports targeting seniors saw an alarming 45% increase between 2023 and 2024.

Financial fraud analyst Dr. Elena Chavez points out that Americans lose an estimated $60 billion annually to various forms of financial fraud, a figure disproportionately borne by individuals over 65 who often lack the digital literacy to spot sophisticated billing schemes.

How to Report Aggressive Preventative Billing (APB)

If you suspect fraudulent billing or identify APB charges on your statement, immediate action is crucial to protecting yourself and taxpayers.

- Gather Your Evidence: Keep meticulous records of all calls, names, phone numbers, and dates. Crucially, circle the suspicious charge on your Medicare Summary Notice (MSN) or Explanation of Benefits (EOM).

- Call Your Medicare Provider: Contact the Medicare agency responsible for the item in question. If the charge relates to durable medical equipment (DME), call the DME supplier directly and state that you did not receive the item.

- Report to the Authorities: The most effective place to report this specific type of healthcare fraud is the HHS-OIG Hotline. You can call 1-800-HHS-TIPS or file a detailed report online. This enables the OIG to track fraudulent providers across state lines.

The Bottom Line: Be skeptical of any “preventative” offer that requires immediate action and demands your personal identification number. When in doubt, call your doctor first.

– Sid Peddinti, Esq.

Connecting law, tax, and finance with AI™ (Since 2015)

– Personal Note: Thanks for reading, I’d love to hear your thoughts on new scam tactics you’ve encountered or reported. Stay safe out there.

**Hashtags:** #MedicareScam #FinancialFraud #ConsumerProtection #AggressiveBilling #HHS-OIG #SeniorFinance #SatireMagazine

**Disclaimer:** This article is for informational and entertainment purposes only and does not constitute legal or financial advice.

© 2026 Satire Magazine™ | Law & Tax Magazine™ | The Legal WatchDog™

References and Sources

- Justice Department Release on Health Care Fraud Strike Force

- [Galeotti, M., 2025] Statement by Acting Assistant Attorney General on Sentencing.

- [Schrank, C., 2025] Statement by HHS-OIG Deputy Inspector General.

We would love to hear from you. Take a second to comment below.

Share this story on your social media and boost your profile, visibility, and empower your connections.

Leave a comment