YOUR LEGACY IS TARGETED: HOW TO AVOID THE WIDESPREAD SCAMS DESTRUCTING AMERICAN ESTATE PLANS

The most cynical financial truth is that fraud is not a modern invention. It is timeless.

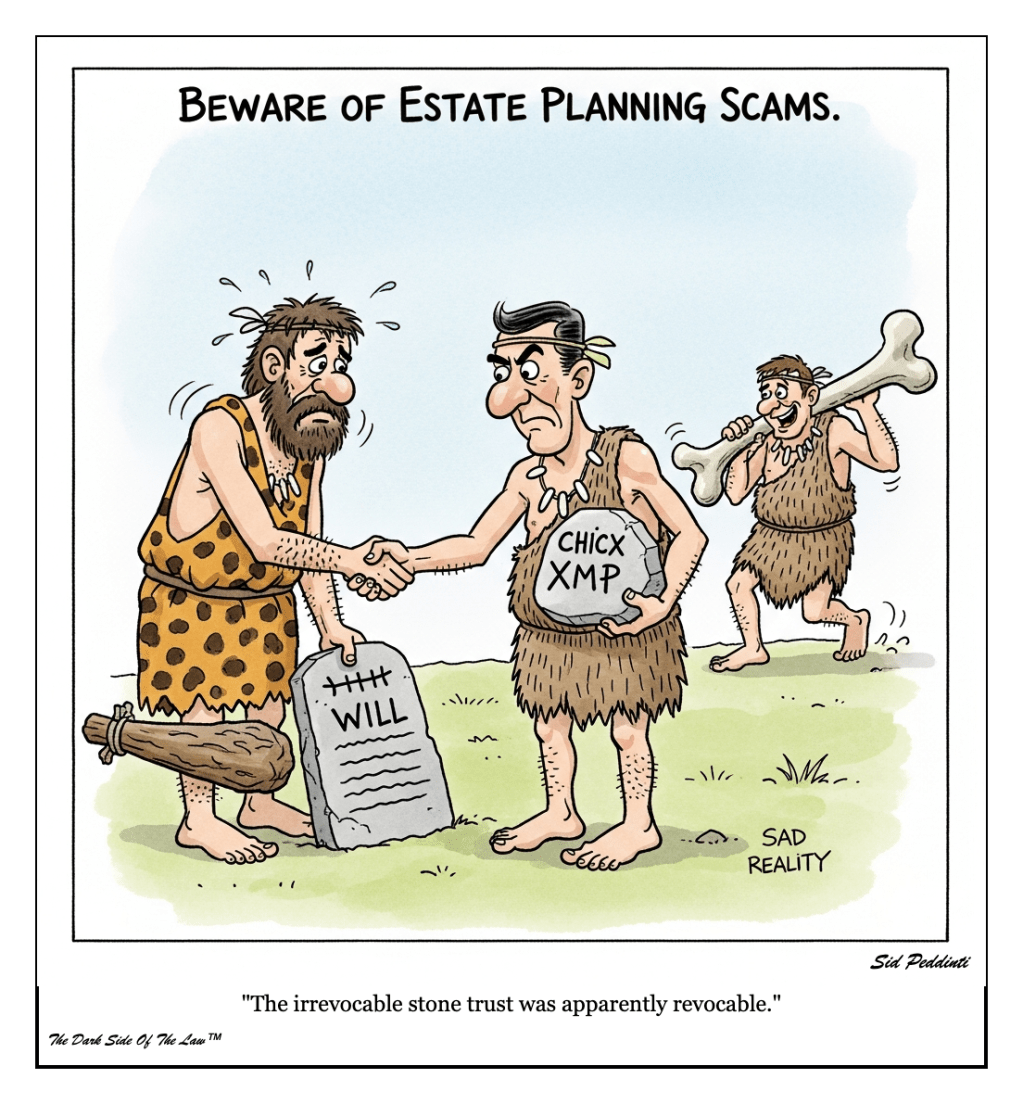

Consider a vintage cartoon sketch: A woolly mammoth grazes obliviously in the distance. In the foreground, one Stone Age man looks aghast at another, realizing his primary asset is gone. The caption reads: “The irrevocable stone trust was apparently revocable.”

This satirical image captures a sad reality. From the earliest days of commerce to today’s complex digital world, there have always been predators targeting your most precious resources.

Today, those resources are your life savings and the legacy you built for your family. Estate planning is the necessary process of securing that future, but it has become a hotbed for sophisticated financial abuse.

The victims are rarely the rich or reckless. They are often seniors, driven by a responsible desire to plan, who are instead met by fraudsters masquerading as trusted advisors.

This is not just about avoiding poorly written documents. This is about recognizing a widespread, systemic exploitation of trust. If you are preparing your will, trust, or Power of Attorney, you need to understand the dark side of this industry.

THE INVISIBLE FRAUD: EXPLOITING VULNERABILITY

Estate planning fraud is insidious because it exploits three core psychological drivers: trust, fear, and inertia.

Seniors, often facing health concerns and a natural desire for simplicity, place immense faith in figures presented as authority. This trust is weaponized by scammers who use complex legal jargon to confuse and intimidate.

The fear of probate court and excessive taxation is the primary hook. A fraudster sells speed and simplicity, promising to circumvent the difficult, slow legal pathways they know people dread.

This leads to inertia. Once the initial documents are signed and the fees are paid, victims often fail to follow up or critically review the execution of the plan. They assume the hard work is done, which is exactly when the scammer makes their move.

The true cost of a deficient or fraudulent estate plan is paid in probate court, years after the scammer has vanished. It is the family that pays, not the initial victim.

FOUR RED FLAGS THAT REVOKE YOUR TRUST

While specific scams evolve, the mechanisms of deception remain constant. Financial planners and legal professionals must operate ethically, but when they prioritize commissions over fiduciary duty, the alarms must sound.

Here are four common scenarios where estate planning becomes predatory.

- High-Pressure, Door-to-Door Sales of Living Trusts

The pitch is convincing: avoid probate entirely with a cheap, standardized living trust package. These are often sold in seminars or home visits by non-attorneys who use fear tactics about state seizure of assets.

The issue is twofold. First, the standardized trust documents are often invalid in the victim’s state or improperly executed. Second, these companies frequently do not complete the essential step of funding the trust, meaning assets are never legally transferred into the trust’s ownership.

Result: The expensive trust is useless, and the assets end up right back in probate.

- Exploitation via Power of Attorney (POA) Abuse

A Power of Attorney is arguably the most powerful document in estate planning. It grants another person the immediate legal ability to manage your finances. This incredible power demands incredible trust.

POA abuse occurs when an agent uses their authority for self-dealing, diverting funds, changing beneficiary designations, or selling property for below-market rates to benefit themselves.

This is particularly dangerous because the abuse happens while the principal is still alive but incapacitated. It is a slow, methodical financial bleed that can be extremely difficult to reverse once discovered.

- The Annuity Overload or “Chainsaw Approach”

This scam targets existing assets, typically selling unnecessary, high-commission financial products disguised as estate solutions. The advisor convinces the client to liquidate low-fee investments (like mutual funds) to purchase high-fee, illiquid annuities.

The narrative is that these annuities offer superior creditor protection or tax benefits. In reality, the advisor receives a massive upfront commission, and the client is locked into a punitive surrender period, sacrificing liquidity for minimal gain.

This is less outright theft and more severe suitability malpractice, leaving the senior with fewer accessible resources in their later years.

- Deceptive Deeds and Property Transfer Fraud

Property is the cornerstone of many estates. Scammers have been known to exploit poor record-keeping or advanced age to execute fraudulent quitclaim deeds.

In some cases, the fraudster convinces the homeowner to sign documents under the pretense of “updating records,” which turn out to be ownership transfers. In others, they file imposter documents with county recorders to steal titles, creating complex and costly legal battles for the legitimate heirs years later.

WHY COMPLEXITY INVITES DECEPTION

Why does estate planning draw such widespread fraud? Because it operates at the intersection of law, finance, and profound personal sentiment. The rules are complex, the emotional stakes are high, and regulation is often fragmented.

The complexity of choosing between a Will, a Revocable Living Trust, a Testamentary Trust, or an Irrevocable Trust creates a knowledge gap. This gap is the fraudster’s playground.

A legitimate attorney or certified financial planner will spend extensive time educating the client about these distinctions. A scammer will simply insist that their single, overpriced product is the only solution.

The key professional distinction to remember is the difference between an insurance agent selling a product and a legal advisor offering tailored counsel. If the conversation starts and ends with a product sale, you are highly exposed.

THE TRUE COST OF A BAD PLAN

As Peter Drucker famously said, “There is nothing so useless as doing efficiently that which should not be done at all.”

A fraudulent estate plan is precisely that: efficiently executing a strategy that damages your future. The costs are astronomical, reaching far beyond the initial fees paid.

First, the financial cost: Heirs spend years fighting in court, paying attorney fees to undo fraudulent transfers or correct improperly funded trusts.

Second, the familial cost: Nothing drives a wedge between beneficiaries faster than perceived wrongdoing or ambiguity in a deceased parent’s wishes. Fraudulent plans introduce chaos, suspicion, and irreversible relational damage.

Third, the emotional cost: The knowledge that one’s final wishes were violated and used to enrich a stranger is a deep, profound injustice.

YOUR MOVE: A THREE-POINT VETTING CHECKLIST

You cannot eliminate risk, but you can minimize exposure through rigorous due diligence. Treat the selection of your estate planning team like hiring a CEO for your finances.

- Demand Fiduciary Standards

Always prioritize professionals bound by a fiduciary duty. This legal and ethical standard requires them to act solely in your best financial interest, placing it above their own commissions or compensation.

Ask directly: “Are you acting as a fiduciary in this transaction, and can you provide that commitment in writing?” Non-fiduciary sales agents can recommend products that are merely suitable, not optimal.

- Separate Counseling from Sales

Never buy an investment product (like an annuity or insurance policy) from the same person drafting your legal documents (the Will or Trust). Maintain two distinct professionals who can act as a check and balance on each other’s advice.

Your estate attorney should advise on legal structure. Your financial advisor should advise on asset allocation. If one person tries to perform both roles, proceed with extreme caution.

- Verify Credentials and References

Check state bar associations and FINRA Broker. Check to confirm the licensing and disciplinary history of all professionals involved. Look for consumer reviews, but pay closest attention to their standing with professional regulatory bodies.

Most importantly, obtain a third-party review. Once your trust documents are finalized, have a separate, independent estate attorney review the documents for correctness, compliance, and proper funding before you sign. Pay the extra fee; it is cheap insurance.

THE TAKEAWAY

The law is designed to protect your interests, but the systems around it are often abused. Your financial integrity depends on your vigilance.

Planning for the end of life requires facing difficult truths, but the most important truth is this: a proper estate plan must be designed solely for your benefit, not the benefit of the person selling it to you. Demand transparency, accountability, and fiduciary loyalty.

That’s it for me. Thanks for reading. I hope you leave inspired.

Don’t wait till it’s too late!

You won’t be around to battle your own estate.

Thanks,

Sid Peddinti

Suggested Reading:

- The Wall Street Journal

- Consumer Financial Protection Bureau (CFPB)

- Journal of Financial Planning

Author: Sidhartha Peddinti

Disclaimer: “This content is for informational and entertainment purposes only and does not constitute legal or financial advice.”

Share this article with your family, friends, customers, followers, and loved ones. Education is the key to change and to wealth protection.™

Thanks for reading,

Sid Peddinti, Esq.

Researcher. Attorney. AI Innovator.

#TaxLaw #EstatePlanning #WealthPreservation #FiduciaryDuties #TrustFunding #SuccessionPlanning #ProbateAvoidance #TaxStrategy

Sources:

- IRS Dirty Dozen List

- DOJ News

- SEC Actions

#EstatePlanning #Probate #PersonalFinance #FinancialLiteracy #ScamAlert #WealthManagement #RetirementPlanning #LegacyBuilding #TheDarkSideOfTheLaw #ConsumerProtection

Leave a comment