#Estateplanning #IDGT

#TLDR: The IDGT is a foundational strategy for high-net-worth succession planning. It strategically uses the Internal Revenue Code to freeze asset values for estate tax purposes, facilitating massive wealth transfer while growth occurs outside the taxable estate. Learn how decoupling income and estate tax liability provides unparalleled wealth preservation.

I. Introduction

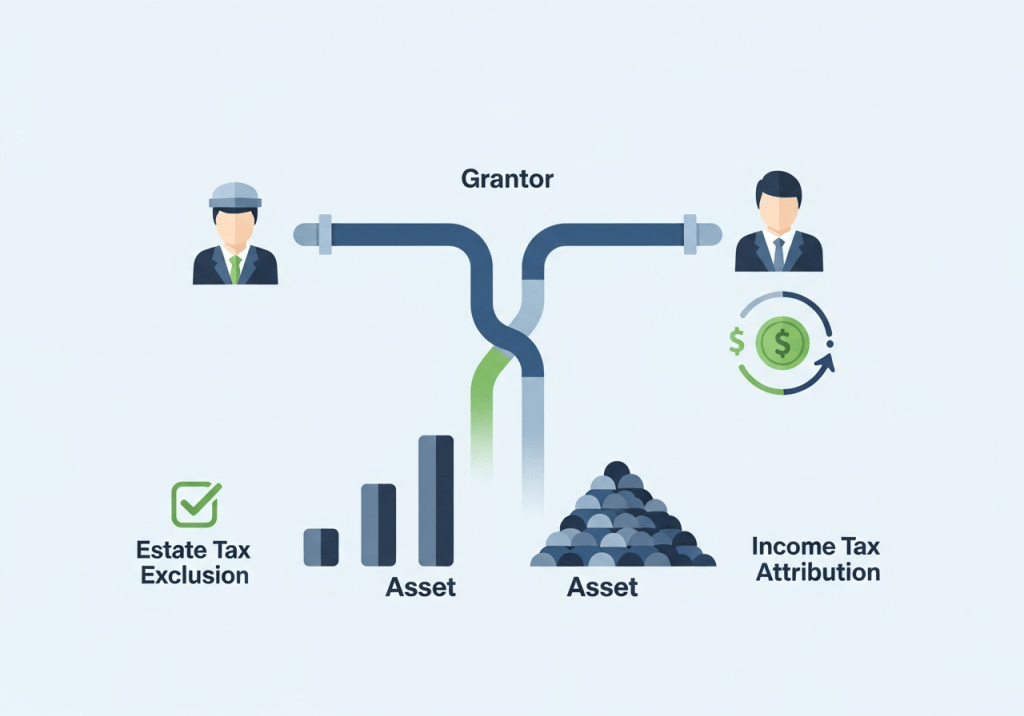

The Intentionally Defective Grantor Trust (IDGT) is a specialized technique designed to optimize intergenerational wealth transfer by decoupling income taxation from estate and gift taxation. The purpose of this memorandum is to analyze the operational mechanics and key tax consequences associated with the creation and funding of an IDGT structure.

This strategy relies on the intentional activation of specific statutory provisions under the Internal Revenue Code (IRC) to ensure that the Grantor remains liable for income tax purposes, while the trust assets are simultaneously excluded from the Grantor’s gross estate for estate tax purposes.

II. Mechanism and Structure

An IDGT is irrevocable from the standpoint of estate and gift tax, meaning the transfer of assets constitutes a completed gift or sale that removes the asset from the Grantor’s taxable estate under IRC Section 2036.¹ However, the governing instrument incorporates specific powers that render the Grantor the owner of the trust assets for income tax purposes under IRC Sections 671 through 679.²

Commonly employed ‘defects’ include the retention of a power to swap assets of equivalent value (a power of substitution) or certain administrative powers held in a non-fiduciary capacity.

Funding typically occurs through an initial seed gift to establish the trust’s economic viability, followed by a subsequent sale of high-appreciation assets to the trust. The trust purchases these assets from the Grantor in exchange for a carefully structured, interest-bearing promissory note.

III. Legal Analysis: Taxation and Wealth Transfer

The most critical benefit of the IDGT structure stems from the Internal Revenue Service’s recognition that a sale between a Grantor and their wholly owned Grantor Trust is disregarded for income tax purposes.³ This means the sale does not trigger taxable gain or loss for the Grantor, even if the assets have appreciated significantly.

This allows the Grantor to effectively freeze the asset’s value for estate tax calculation at the time of the sale, provided the promissory note interest rate meets the minimum applicable federal rate (AFR).

Furthermore, the Grantor, by statute, remains responsible for paying the income tax liability generated by the trust assets (e.g., capital gains, interest, or dividends). This payment of income tax by the Grantor constitutes a tax-free addition of value to the trust corpus.

If the trust document mandates or permits reimbursement of the income tax payment to the Grantor, the integrity of the estate exclusion may be compromised.⁴ To maximize wealth transfer, the terms generally prohibit such reimbursement.

IV. Strategic Implications and Fiduciary Duties

Proper trust funding is paramount. If the sale transaction is structured inadequately, or if the trust assets are insufficient to secure the promissory note, the IRS may recharacterize the transaction as a taxable gift of the entire asset value, defeating the estate freeze objective.

The Trustees of the IDGT hold stringent Fiduciary Duties to the beneficiaries, ensuring the promissory note is respected, interest payments are made, and prudent management of the trust corpus is maintained. Failure to adhere strictly to the terms of the sale agreement can result in the entire IDGT structure being dismantled for tax purposes.

IDGTs are also frequently structured to be generation-skipping transfer (GST) exempt, allowing the compounding growth to pass to grandchildren and subsequent generations free of additional estate, gift, or GST taxes, provided adequate exemption allocation is made upon funding.

This mechanism offers a powerful and legally sound methodology for minimizing the erosion of wealth due to federal estate tax exposure, particularly for assets expected to exhibit significant future growth.

V. Conclusion

The Intentionally Defective Grantor Trust remains a cornerstone of sophisticated wealth protection and succession planning. Its utility lies in the calculated use of the Grantor Trust rules to facilitate substantial, tax-efficient transfers of appreciating assets.

Thanks for reading.

I’d love to hear your thoughts on this structure.

Sid Peddinti, Esq.

IRC Section 2036.¹

I.R.C. § 2036. Transfers with retained life estate.²

I.R.C. §§ 671-679. Grantor Trusts.³

Rev. Rul. 85-13, 1985-1 C.B. 184 (holding that the grantor is treated as the owner of trust assets for income tax purposes, rendering the transaction nontaxable).⁴

Rev. Rul. 2004-64, 2004-2 C.B. 7. (Addresses the effect of the Grantor’s payment of income tax on the trust on the Grantor’s gross estate.)

Leave a comment