By Sid Peddinti, Esq. | November 2025

THE CRYPTO TERMINOLOGY TRAP: WHY FANCY WORDS KILL YOUR PORTFOLIO

Dear friend,

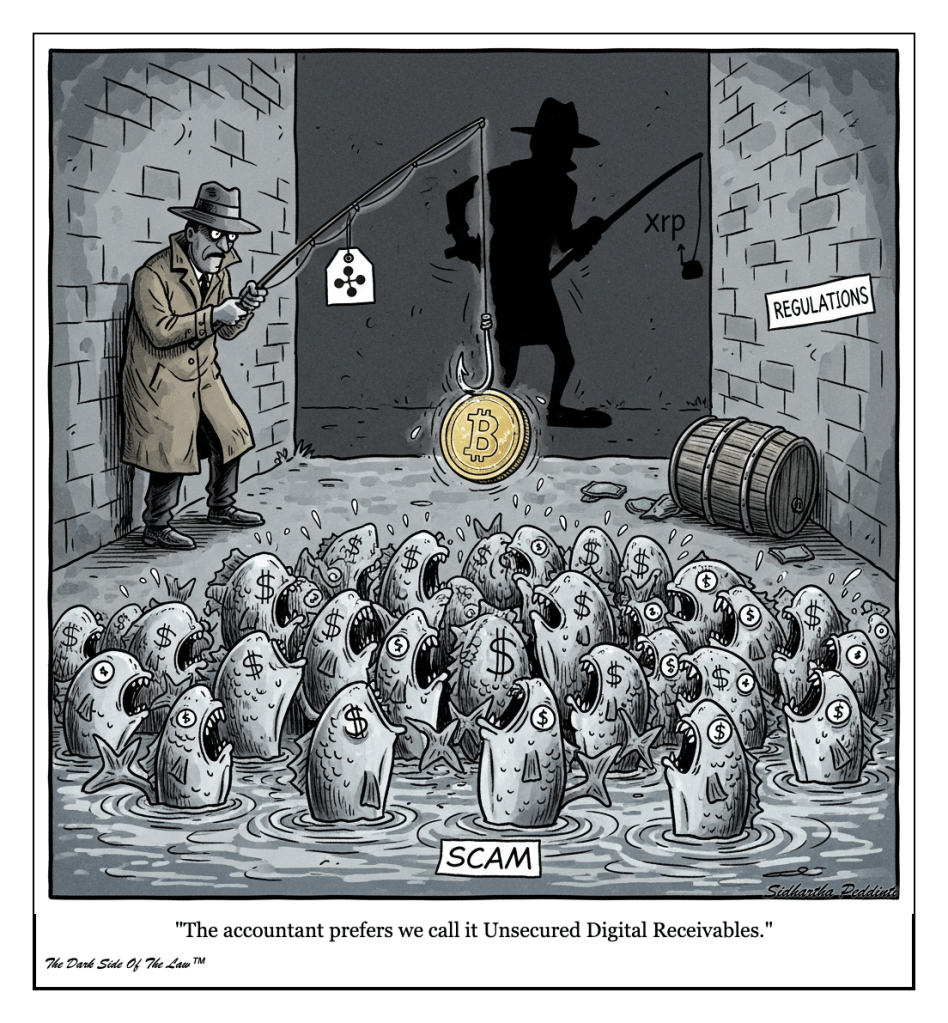

If you have been following the crypto ecosystem, you may have seen the vintage hand-drawn cartoon that we publish a few months ago that’s now making the rounds. It depicts a classic scam scenario, captioned with the punchline, “The accountant prefers we call it Unsecured Digital Receivables.”

This simple piece of satire captures the core danger of modern speculative finance: masking fundamental, catastrophic risk with polished, sophisticated jargon. For investors, particularly those chasing outsized yields associated with popular tokens, recognizing this linguistic shell game is the first step toward self-preservation.

THE LINGUISTIC SHELL GAME

The biggest threat to your investment capital is often not market volatility, but deliberate rationalization fueled by professional-sounding terms. When highly speculative and unregulated assets are rebranded using corporate language like “structured products,” “utility tokens,” or “digital receivables,” the average investor subconsciously lowers their guard.

This semantic shift is a powerful cognitive bias known as normalization of deviance. It allows promoters to bypass the innate financial skepticism reserved for common sense risks.

Sophisticated phrasing suggests complexity, and complexity implies institutional legitimacy. We assume that anything an accountant or lawyer spent hours naming must adhere to some established financial principle. This is frequently not the case in the wild west of decentralized finance.

IDENTIFYING THE UNSECURED DIGITAL RECEIVABLES

Scams flourish where regulation is ambiguous and “FOMO” is highest. Criminal operations frequently use the names of established, legally ambiguous cryptocurrencies to lend false legitimacy to their schemes. The focus is rarely on the underlying technology and always on guaranteed returns.

These schemes inevitably promise extraordinary yields that defy traditional banking logic. Remember the fundamental wisdom articulated by Warren Buffett: “Risk comes from not knowing what you are doing.” If you cannot explain the mechanism in one simple sentence, you should not invest in it.

Key characteristics of these leveraged scams are easy to spot if you ignore the fancy language and look at the structure:

- Unnaturally high, fixed annual percentage yields (APYs) exceeding 30 percent. These returns are mathematically unsustainable without constant new investor capital.

- Mandatory recruitment requirements or affiliate structures to unlock higher returns, a hallmark of pyramid structures.

- Lack of clear, verifiable third-party auditing or custodial documentation showing precisely where your funds are held.

- The pressure to “act now” before a fictional enrollment deadline expires.

YOUR DUE DILIGENCE CHECKLIST

Before committing capital to any digital asset platform claiming high returns or leveraging a popular crypto name, execute this four-step checklist. This approach forces you back to basics.

- Verify Custody: Determine precisely where your assets are held, not just mathematically, but legally. If the answer is vague or proprietary, walk away immediately.

- Assess Liquidity: Can you withdraw your principal and profits at any time without penalty? If withdrawals are locked, tiered, or dependent on external factors, that signals a liquidity crisis is imminent.

- Demand Documentation: Locate the governing legal documents, not the glossy marketing website. If they are poorly written, non-existent, or contain excessive disclaimers of responsibility, the investment is likely spurious.

- Simplify the Sales Pitch: Translate the promoter’s jargon back into plain English. If “Unsecured Digital Receivables” simply means “I lent highly volatile money to strangers who may never pay it back,” then your risk appetite should adjust accordingly.

THE BOTTOM LINE

Financial prudence requires deep skepticism, especially when the investment vocabulary becomes unnecessarily complex. Do not allow sophisticated phrasing to disguise fundamental risk and do not rely on legal ambiguity as a substitute for verifiable security.

That’s it for me. Thanks for reading.

Please leave a comment or two – have you seen these sophisticated scams on social media? Have you been caught up in these web of fancy “terms” that made sense – but are actually ticking time-bombs?

Talk soon,

Sid Peddinti

BA, BIA, LLB/JD, LLM

Researcher, Reporter, and The Legal Watchdog™.

Suggested Reading

- IRS Dirty Dozen Scams

- Securities and Exchange Commission Investor Alerts

- The Wall Street Journal

#CryptoScams #PersonalFinance #InvestmentRisk #FinancialLiteracy #Regulation #DueDiligence #TheDarkSideOfTheLaw #ForbesFinance #BusinessInsider

Author: Sid Peddinti

Firm: Law & Tax Magazine

Copyright: © 2025 SIDHARTHA PEDDINTI™

Disclaimer: This content is for informational and entertainment purposes only and does not constitute legal or financial advice.

Leave a comment