By Sidhartha Peddinti, Esq.

Philosopher. Legal Architect. Tax Mythbuster.

Modern conversations about loopholes, tax arbitrage, and regulatory gaps often feel new. They aren’t. The roots of today’s most problematic financial structures reach back more than two millennia — to a Roman system that perfected the economics of extraction long before corporate governance or modern tax codes existed.

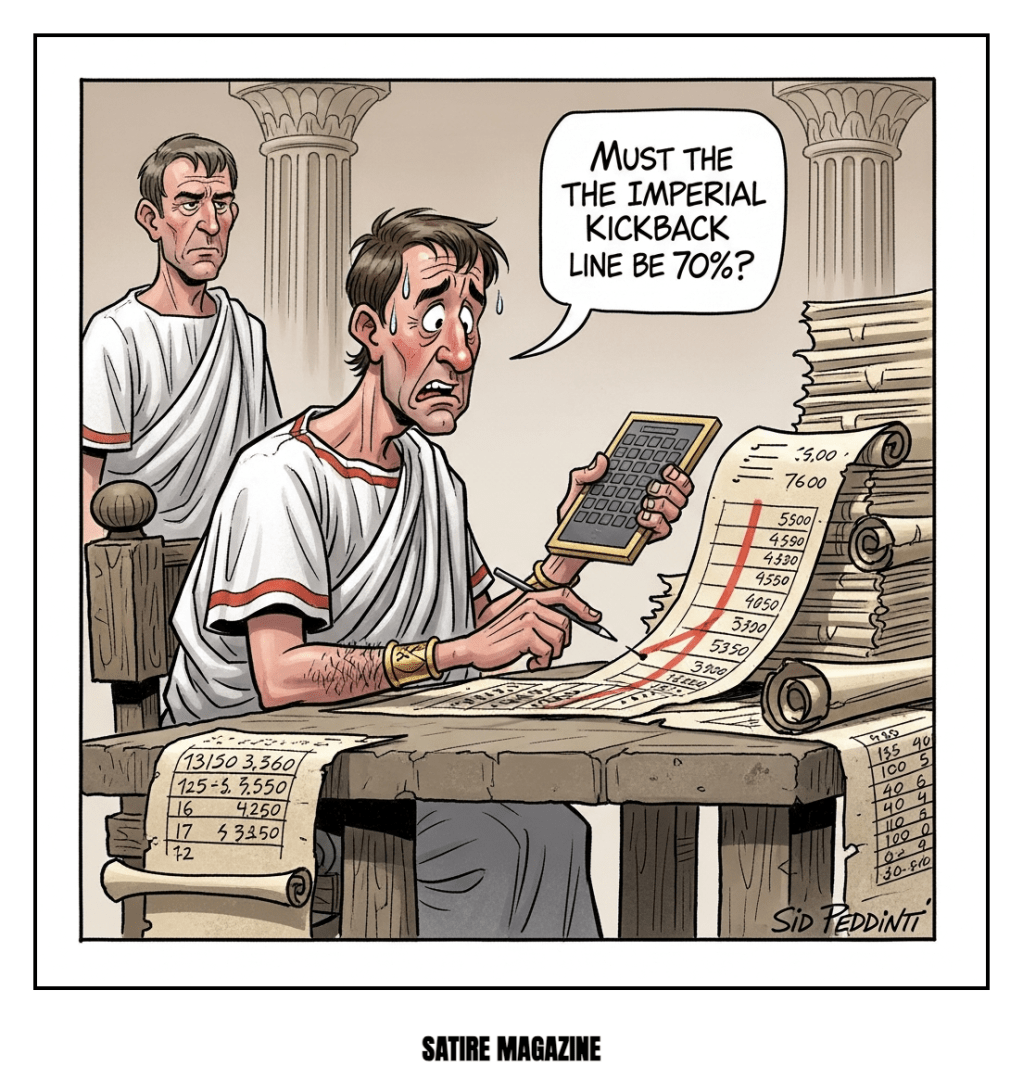

That system was tax farming, a privatized collection model that allowed Roman public contractors — the publicani — to keep up to 70% of the taxes they collected, so long as Rome received its guaranteed minimum. It became one of the earliest examples of a government outsourcing a critical function without designing controls, incentives, or ethical guardrails.

The result: structural corruption, economic instability, and ultimately, political revolt.

A Guaranteed Return for the Empire — and Unlimited Upside for Contractors

The Roman Senate auctioned regional tax rights to private syndicates. These groups paid Rome a fixed amount upfront, often equal to only a fraction of the actual tax base. In exchange, they were granted near-total autonomy.

Once the auction was won, the economic logic flipped:

- The Empire’s revenue was capped.

- The contractor’s profit was uncapped.

Historical accounts from Cicero and Josephus describe tax burdens routinely reaching 300–500% of the statutory rate. The “70% imperial kickback” was not a formal percentage written into law; it was the observable distribution of revenue — roughly 30% to Rome, 70% to private collectors.

Tax collectors were not civil servants. They were early private equity firms with political protection and military enforcement.

The Consequence: A System That Incentivized Abuse

This design flaw produced predictable downstream effects:

1. Governance Failure

With no centralized oversight, local officials and soldiers became partners in extraction.

2. Reputational Collapse

Tax collectors were despised across the Empire; whole regions viewed the Roman administration as predatory rather than stabilizing.

3. Economic Distortion

Publicani targeted the most vulnerable citizens and businesses, uprooting local economies to maximize short-term gain.

4. Political Instability

In Judea, abusive tax farming contributed directly to the revolts that destabilized Rome’s hold on the region.

Rome eventually abolished tax farming in several provinces — not out of moral clarity, but because the system became economically unsustainable.

Echoes in Today’s Financial Architecture

The Roman experience is more than historical trivia; it is a cautionary model for modern institutional design. The same extraction dynamics appear in:

- Insurance claims processes where intermediaries profit from delay.

- Probate and estate fees that strip generational wealth through administrative friction.

- Financial advisor conflicts, where commissions exceed client outcomes.

- Private equity in healthcare, where revenue maximization undermines public interest.

- Tax promoter schemes, where “unfair tax advantages” enrich marketers while exposing consumers to audit and penalties.

The lesson is simple but widely ignored: When incentives reward extraction, extraction becomes the dominant behavior.

What Modern Leaders Can Learn

Organizations — whether governmental, corporate, philanthropic, or regulatory — should study the Roman system not as antiquity, but as analysis. Roma taught us:

- Oversight is not optional.

Privatized systems without checks drift toward predation. - Incentive alignment determines behavior.

Design the incentive, and you design the outcome. - Reputation compounds.

Once stakeholders believe a system is corrupt, trust evaporates. - Short-term revenue maximization destroys long-term stability.

Rome’s publicani system delivered immediate cash but systemic decay.

In an era of AI-driven automation, proliferating financial products, and increasingly complex tax structures, the Roman 70% kickback model is a reminder that opacity invites extraction — and extraction invites collapse.

That’s it for this “interesting” and “satirical” take on the Roman tax system.

Leave your thoughts.

Thank you,

Sid Peddinti, Esq.

Lawyer – Writer – Legal Mythbuster

Leave a comment