A Practical Guide for Financial Advisors and Insurance Agents

The Definitive Guide for Financial Advisors and Insurance Agents: How To Discuss Estate and Tax Planning Without Violating UPL, Triggering Compliance Problems, or Putting Your License at Risk

By Sidhartha Peddinti, Esq.

Believe it or now – clients actually expect you to be the first person to warn them about probate, wealth erosion, estate taxes, trust funding mistakes, capital gains exposure, and the long tail of their financial decisions.

And that’s where the problem starts.

The moment you start talking about wills, trusts, business entities, foundation strategies, or estate tax implications, you are walking along a narrow boundary line.

On one side is education.

On the other side is legal advice.

Many advisors do not know where the line is until they have crossed it.

The risk is enormous. A single misinterpreted comment can expose you to lawsuits, insurance claims, disciplinary actions, UPL (Unauthorized Practice of Law) charges, and in extreme cases, criminal investigations.

And, by the way, I’ve attached a list of cases, resources, and even criminal cases for you to read and explore in the footnotes section. If you are a financial advisor, insurance agent, or even an accountants who has ever considered offering estate planning in some capacity, or has faced these question by your clients – these are links are going to help you stay in compliance, out of trouble, and even out of jail.

This publication sets the record straight.

- It will become the internet’s master guide for professionals who want to educate clients properly, stay compliant, differentiate themselves, and position their practice as the center of a trusted professional ecosystem.

- I will deconstruct the legal boundaries, the regulatory landmines, and the business opportunities that most advisors miss.

- I will also break down the strategy used by elite advisors, PI firms, accounting firms, and family office ecosystems that use educational hubs, magazines, and nonprofit structures to create influence without giving legal advice.

- Finally, I’ll offer a suite of proprietary AI tools that we’re developing in close partnership and collaboration with Google’s AI Experts that are ready to fuel our innovation and improve the financial industry.

This is the playbook. Pay attention, take notes, and leverage the AI tools that can help you stay in compliance across multiple fronts.

The Definitive Guide for Financial Advisors and Insurance Agents

How To Discuss Estate and Tax Planning Without Violating UPL, Triggering Compliance Problems, or Putting Your License at Risk:

1. Understand the Legal Boundary:

What You Cannot Say or Do as an Advisor

Every advisor wants to help their clients avoid problems. But good intentions do not protect you from UPL consequences.

Here is what you cannot do:

- You cannot draft a trust, will, deed, or entity document.

- You cannot interpret an existing trust or estate plan.

- You cannot say or suggest what kind of trust someone needs.

- You cannot analyze or correct a client’s legal documents.

- You cannot set up an entity for legal reasons or asset protection reasons.

- You cannot advise on tax law positions, exemptions, elections, or legal strategies.

If a client asks whether an irrevocable trust will protect their assets from creditors, whether their revocable trust avoids estate taxes, or whether their S corp should convert before a sale, you cannot answer those questions directly.

I understand that this places you in a strange position, because:

- On one side, you risk losing the client to another advisor who provides that guidance or has an estate team that they work with

- On the other hand, your commission and revenue is directly tied to the amount they invest with you (which is where the estate & tax planning is required).

These are the top two reasons why many advisors and agents start encroaching into the world of estate and tax planning – and it makes complete business sense to do so.

Most UPL cases are not malicious. They stem from casual comments that sounded like advice. One conversation can be enough to land you in hot waters.

2. Understand the Business Risk:

You Can Get Sued for a Failed Estate Plan You Did Not Create

Courts have held that advisors may be liable when a client misunderstands their comments as legal direction.

Common lawsuits include:

- A trust that fails for lack of funding.

- A beneficiary designation conflict that causes probate.

- Assets titled incorrectly, triggering estate tax or litigation.

- A business succession plan that collapses due to missing documents.

- Capital gains consequences that could have been avoided.

Even if the advisor never drafted a single legal page, lawsuits often claim:

- Negligent misrepresentation

- Failure to warn

- Exceeding professional boundaries

- Unauthorized practice of law

Defense costs alone can destroy years of income. I’ve seen this play out multiple times over the years, and if you look at the Department of Justice’s press release section or the Federal Trade Commission’s press release section – it’s full of these charges. Links attached in the footnotes section.

3. Understand the Regulatory Risk:

UPL Can Cost You Your License, Your Career, and Your Freedom

Every state bar treats unauthorized legal practice as a consumer protection issue. Consequences may include:

- License suspension

- Permanent disciplinary markings

- Loss of broker dealer or RIA affiliation

- Loss of insurance appointments

- Civil penalties

- Criminal charges

- Being barred from the financial industry entirely

Regulators are not interested in your intentions. They only care about consumer harm. If a client claims that your conversation influenced their estate structure or tax position, you could be held responsible.

4. Understand the Correct Way To Talk About Legal Topics

You are allowed to educate.

You are allowed to explain.

You are allowed to provide general financial literacy.

You are allowed to guide clients to ask the right questions.

You are allowed to refer clients to licensed providers.

You are not allowed to direct, recommend, or interpret legal strategy.

The correct language is:

- “Here is how these structures generally work.”

- “Here is the IRS definition.”

- “Here are the financial risks if this is not structured correctly.”

- “Here are questions to ask your attorney.”

- “Here are legal resources from the IRS or state websites.”

- “Here is a vetted list of professionals who can help.”

- “Here is an educational course that explains law, tax, and finance concepts.”

- “Here is an article that walks through various tax strategies.”

- “Here is a estate and tax pro-bono hotline service where an attorney can answer your questions.”

- “Here is a PDF, Newsletter, Podcast With Experts Series, or a Book that educates you on estate and tax planning.”

THE BOTTOM LINE: Educate & Empower.

Don’t advice, implement, promote, or sell.

When you stick to education, you stay compliant.

When you interpret or customize, you cross into UPL.

5. Use a Nonprofit Educational Platform To Stay Fully Compliant

This is the secret that high level advisors, thought leaders, and professionals use to stay safe while building massive influence.

A nonprofit education hub allows you to:

- Publish law, tax, finance, or investment news or updates.

- Analyze tax code changes and keep the market updated.

- Break down probate timelines and provide educational resources.

- Host interviews with attorneys and CPAs.

- Publish articles by licensed professionals on your educational platform.

- Link to IRS.gov, Treasury publications, and state law resources.

- Explain real cases without providing legal advice.

- Offer courses and webinars as pure education.

- Conduct and share pure research on these topics.

- Conduct “scientific and research experiments” using new law, tax, and finance tools BUT without offering suggestions, tips, or advice.

Because the publication is educational, not advisory, you stay within legal boundaries.

Your firm cannot publish half of the content a nonprofit can publish.

A nonprofit can publish nearly everything.

By the way – you also get to position yourself as an Educator, Innovator, Researcher, Reporter, Writer, Speaker, and Interviewer – each one bolstering and boosting your authority, credibility, and trust in your marketplace.

Stop and think for a second – How many of your direct competitors are running a Finance, Insurance, or Investment Nonprofit Educational Platform and sharing pure “gold nuggets” day-in and day-out.

If you want to stand out as the leader in your marketplace, a guardian of wealth, a reporter of news, and a community champion who is advocating for justice and transparency – this one more will check all those boxes for you!

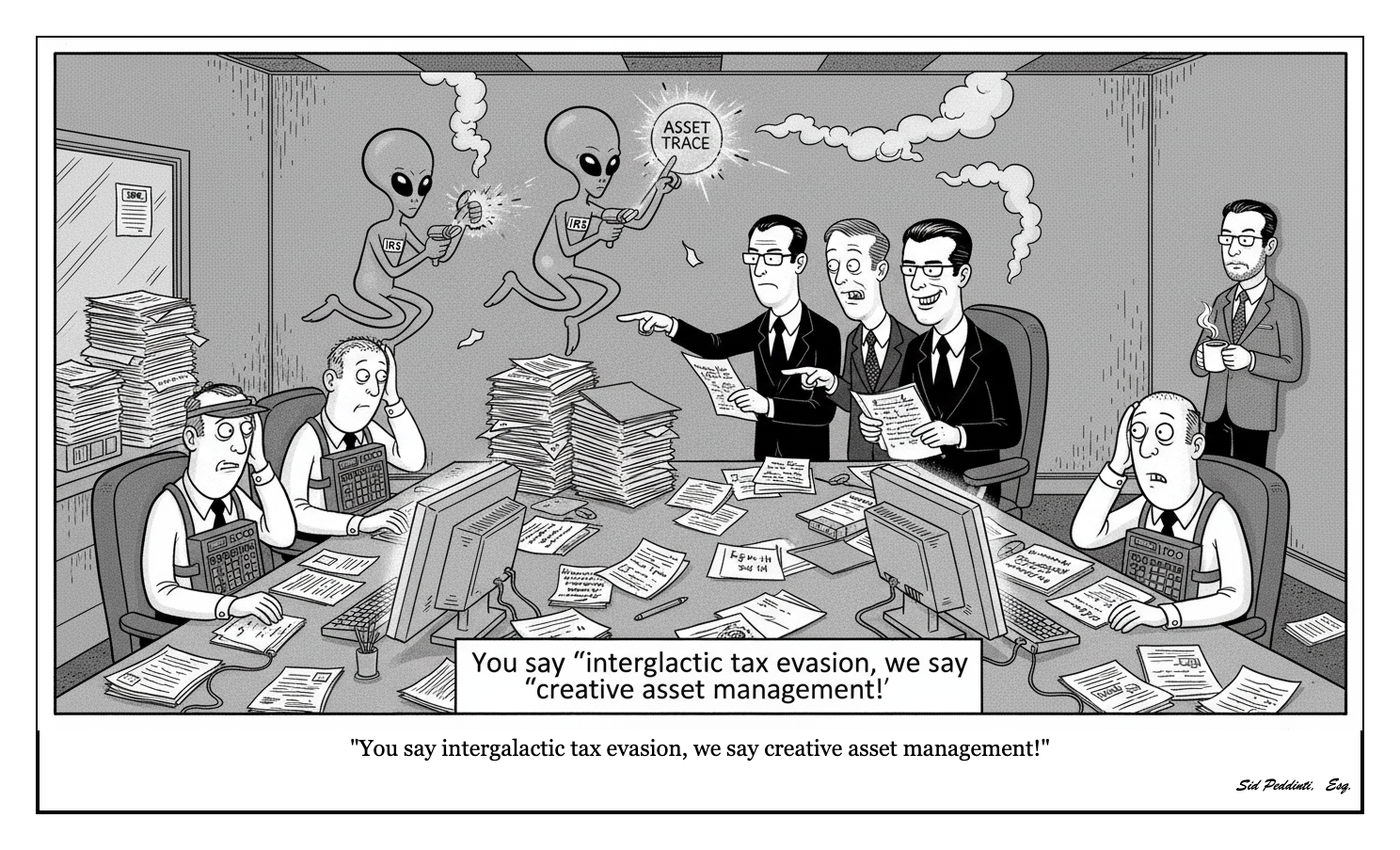

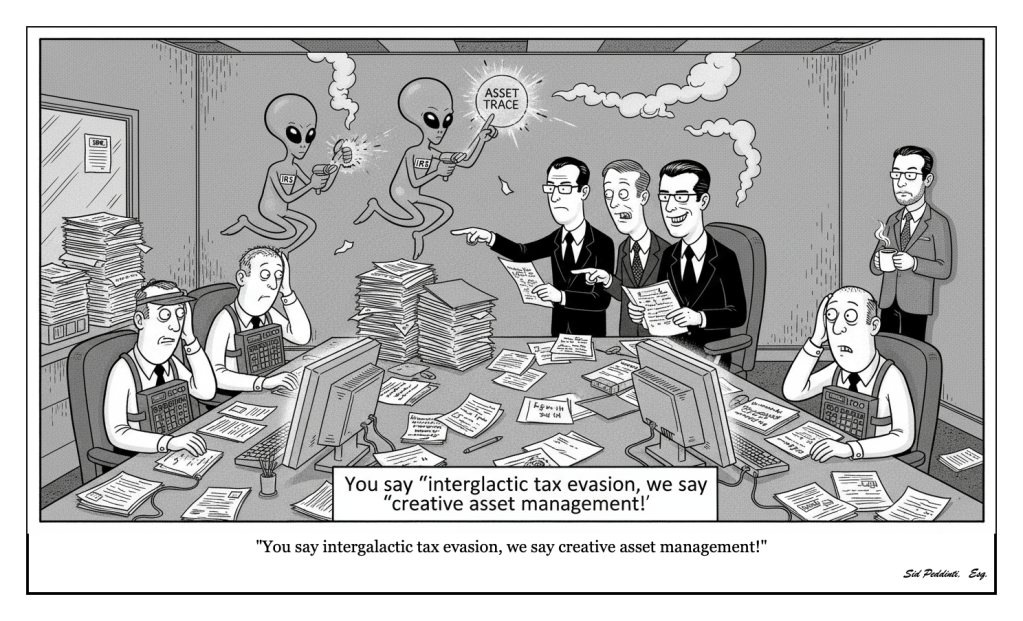

6. A Magazine Is the Perfect Neutral Platform for Law, Tax, Finance, Insurance, and “Wealth” Topics

Imagine leading the TOP publication in your marketplace – the official “knowledge source” for the topics that you cover.

A digital magazine allows you to:

- Provide general legal literacy without giving legal advice.

- Explain complex issues like probate, step-up, trust funding, gift tax, valuation, and succession.

- Share anonymous client stories.

- Provide humor, satire, infographics, and illustrations.

- Feature commentary from licensed attorneys without absorbing risk.

- Build goodwill with professionals who want exposure.

- Become the leading educator in your field.

- Control the flow of traffic – He/she who control the “tap”, control the “flow”.

- Develop new referral sources, affiliates, partners, sponsors, and even donors.

- Positioning it as a nonprofit platform also qualifies you to receive grants and donations from corporations, individuals, businesses, and the government.

It is far easier to attract lawyers, CPAs, and specialists to write for a publication than to write for an advisor’s company blog. The perception and credibility are completely different.

This is why publications outperform firm marketing by a wide margin.

7. You Can Build Authority Without Ever Touching Legal Advice

Once you create a publication powered by educational content, you:

- Become a trusted source of knowledge.

- Build a multi-million dollar brand simply through consistent education.

- Gain goodwill, influence, and referrals naturally.

- Create a platform attorneys and CPAs want to join.

- Turn every piece of content into a networking tool.

- Attract higher net worth clients who value literacy and transparency.

- And if you add AI tools and technologies – that’s massive IP that you control.

The best part:

No UPL exposure. No legal risk. No regulatory violations.

8. You Can Also Access My AI Tool Suite and Professional Network

I have partnered with Google’s advanced AI development team to build tools specifically for financial advisors, accountants, and insurance professionals.

These include:

- Estate and trust scanners

- Entity mapping tools

- Tax calculators

- Probate and estate tax simulators

- Portfolio visualization tools

- Scenario analysis tools

- Case study explainer engines

- Draft free educational content for your publication

You also gain access to a nationwide network of CPAs, tax attorneys, estate lawyers, business counsel, and planning professionals who offer pro bono review sessions for families.

You educate.

They handle legal matters.

Everyone stays compliant.

This is the future of advisory work.

Closing Thoughts

Advisors are no longer measured purely by performance or products.

They are measured by trust, literacy, transparency, and the ability to guide the public through complex issues without crossing boundaries.

A magazine or nonprofit educational platform is the single most effective way to:

- Stay compliant

- Build a brand

- Attract better clients

- Grow partnerships

- Create goodwill

- Stand out in a saturated market

- Offer deeper value without offering legal advice

Very few advisors will ever understand this strategy.

Even fewer will execute it.

But those who do become leaders in their field.

And – if you are looking for “insane” SEO + AIO, well, publishing 100s or even 1000s of pieces on content every year will help you outrank your competitors.

We have the suite of AI tools to help you publish high-quality content, worthy of publication in major magazines and platforms, and capable of converting high-net-worth clients – so don’t sweat that component as well.

You have our expertise to guide you, our team of experts to support your “law, tax, estate, trust, investment, nonprofit, or foundation” implementation, and our unique partnership with Google’s AI team to support you in this adventure!

I’d love to hear your comments below. Thanks for reading – but now, it’s time to implement.

Talk soon,

Sid Peddinti, Esq.

Writer – Speaker – Innovator – Attorney – Nonprofit Expert – AI Innovator – Reporter – Contributor.

Ps. these are titles that you can also leverage – helping you open doors that are not possible through your for-profit law, tax, financial, real estate, or insurance firm.

––––––––––––––––––

Disclaimer

This article is educational. It is not legal, tax, financial, or investment advice. Results depend on each person’s unique circumstances. Consult your own advisors before relying on any strategy.

Topics:

#EstatePlanning

#SupremeCourt

#RetirementAccounts

#BusinessSuccession

#ProbateAwareness

#TaxLaw

#InheritancePlanning

#WillAndTrust

Leave a comment