Why an Unfunded Trust Provides Zero Asset Protection Under Probate & Tax Law

Probate – twice.

Dear friends,

Sidhartha here.

Inventor, AI-Innovator, Tax Lawyer, and Legal Mythbuster™.

My journey didn’t start with success – it began with bankruptcy, lawsuits, and an unexpected business firesale that wiped everything out.

Two decades of rebuilding taught me the brutal truth behind legal, tax, and financial structures. Now I decode the law, expose what’s beneath the surface, and help others avoid the traps designed to take away what they’ve built.

I started this magazine and built several Law & Tax AI Tools™ to share everything we have with you – it’s better than sitting on my hard drives, bookmarks, and internal drives.

Our mission is to help you leverage the combination of law and technology so you can protect & preserve your hard-earned wealth from all sides. Okay, that’s it for now, here are the details of why a Revocable Trust

Executive Summary

This case study reveals:

- Why a revocable trust WITHOUT funding carries zero legal power.

- The statutory reason a will triggers probate in every U.S. state.

- How conflicting documents caused a second probate risk.

- The tax consequences: IRC §§ 2036, 1014, 2053, and basis issues.

- What the family could have done to bypass probate entirely.

- A step-by-step Mini Family Office™ approach to prevent this scenario.

Case Background: What the Family Believed

The family believed their revocable trust shielded their assets from:

- Probate

- Creditors

- Lawsuits

- Delays

- Public court proceedings

- And potentially estate taxes

But the truth was the opposite.

What Actually Happened

The trust was:

- Never funded

- Not properly titled

- Filed with conflicting documents

- Left with the decedent retaining full control of the assets

This created the perfect legal storm:

**Every asset went through probate.

Twice.**

WHY THIS HAPPENED (Legal Analysis)

IRAC Method (Legal Breakdown)

Core Issue

Does having an unfunded revocable trust protect assets from probate?

Rule of Law:

A revocable trust MUST be legally funded to bypass probate.

Authorities include:

- Uniform Probate Code (UPC §3-101) – probate required for assets titled in decedent’s name.

- Texas Estates Code §256.001 – will has no effect until admitted to probate.

- California Probate Code §7000 – probate required unless assets are non-probate titled.

- IRC §2036 – retained rights cause inclusion in taxable estate.

- IRC §1014 – basis step-up rules depend on estate inclusion and ownership.

Legal Analysis:

Because the trust was unfunded (assets were not transferred into the name of the trust):

- The assets remained in the decedent’s personal name.

- Under probate law, personal assets must go through probate.

- The trust page had no legal effect because there was no title transfer.

- Conflicting documents created ambiguity → triggering secondary probate exposure (Example: assets go through probate for person 1 and then again for person 2 before the transfer to the next generation).

- The IRS treated assets as personally controlled → triggering potential IRC §2036 inclusion.

- No properly structured assignment to trust = no bypass.

Conclusion

A revocable trust only works if funded.

Unfunded = useless.

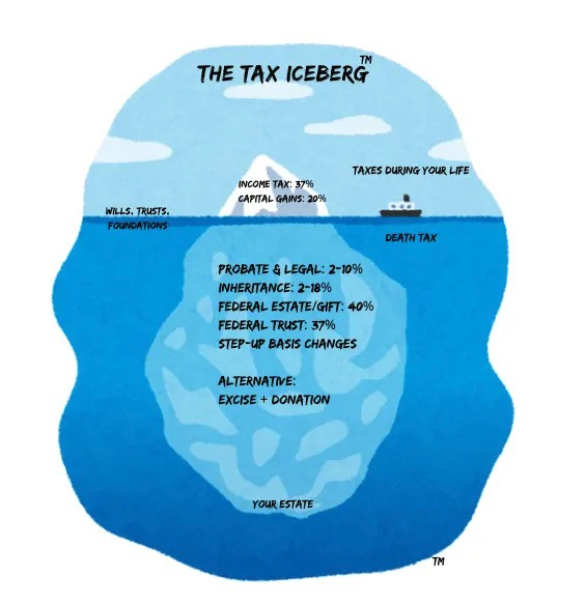

THE TAX ICEBERG™ [Exposing The Myth]

I developed the concept called the Tax Iceberg™ to explain how “hidden” costs and taxes lurk beneath the surface, and only surface AFTER your death.

Let’s walk through this model and examine what people “think” or “believe” to be true versus what the law says.

Above the Surface (What the family thought) – The Myth:

“We have a trust – we’re protected.”

“We won’t face probate costs, estate costs, or delays as we have a trust setup.”

Below the Surface (The real law)

- No funding of trust = incomplete trust = subject to probate

- Probate fees (2%–8% of estate value)

- 6–24 month delay

- Public announcement of the probate

- Executor bond & court reporting

- Estate tax exposure

- Lost planning opportunities

- Conflict among siblings

- Forced valuations

- Court supervision of asset transfers

- Loss of confidentiality

Most of the pain is below the surface – unseen until too late (after death).

REAL PROBATE DATA

- Average U.S. probate duration: 7–18 months (source: government court statistics)

- Average cost: 4–7% of gross estate (Nolo legal data + state figures)

- Over 50% of trusts are unfunded at death (estate planning surveys)

- Probate becomes mandatory the moment assets sit in personal name under state law

- Business interests face up to 40% valuation shrinkage due to forced liquidation

🧩 WHERE THE DOCUMENTS CONFLICTED

- Will left assets to individuals

- Trust claimed ownership (but had zero titled assets)

- No general assignment to trust

- No pour-over will executed

- Property deeds never recorded in trust name

- Bank and brokerage accounts left untitled

This created:

Double probate risk + double administrative cost + zero asset protection.

THE FIX: THE MINI FAMILY OFFICE™ APPROACH

Step 1 — Proper Trust Funding

- Deeds

- Assignments

- Beneficiary changes

- Entity ownership

- Personal property affidavits

- Investment accounts retitled

Step 2 — Asset Flow Mapping

Move assets OUT of personal name → INTO entities → INTO trust.

Step 3 — Trust + Foundation Integration

For high-net-worth estates:

- Irrevocable trusts

- Private foundation

- Donor-advised fund

- LLCs / FLPs

- Bypass trusts

- Dynasty trusts

Step 4 — Ongoing Consulting

- Annual legal and tax compliance

- Alignment of law, tax, and finance teams

CONCLUSION:

A will, trust, operating agreement, or other legal “documents” or “entities” work ONLY if you understand HOW to use them the right way and they are in compliance with the law.

Don’t assume estate plans can be setup, shelved, and left till death – that’s how these “probate nightmares” are triggered.

I’d love to know your thoughts – did you know assets could go through probate twice?

Cheers,

Sid Peddinti

Inventor, IP & Tax Lawyer, and AI Innovator

This article does not contain financial, legal, or professional advice. Every case is different and there are no guarantees in these cases.

If you would like a PRO BONO estate “assessment” to ensure there are no gaps in your estate – head over the Estate & Tax Hotline™ and fill out the short assessment form, and we’ll have one of our volunteer attorneys to reach out and offer a 100% free, no strings attached, AI-Powered estate and tax assessment.

#EstatePlanning #ProbateCosts #WealthPreservation #LegalBrief #TrustsAndEstates #Lawandtax #Revocabletrusts #IRS #Taxscams #LegalMistakes

Leave a comment