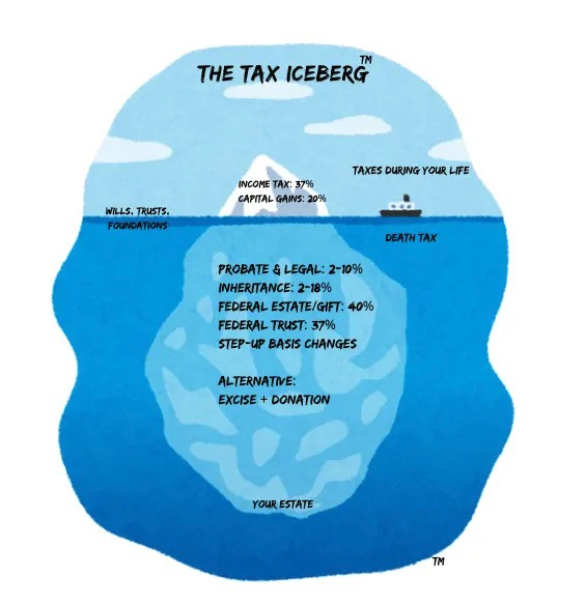

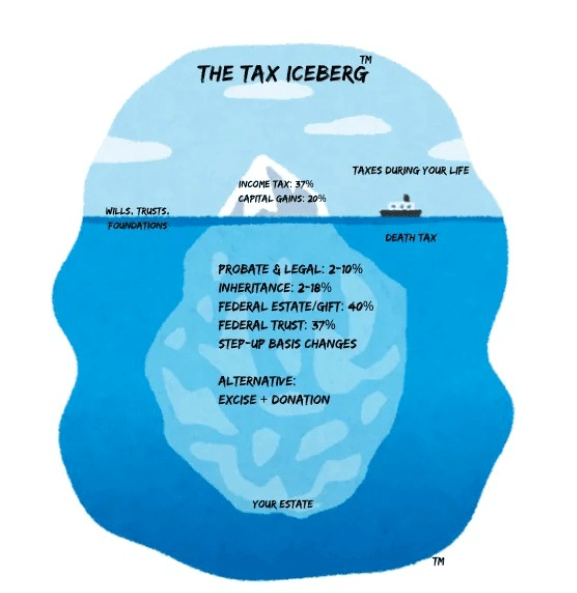

Explained Through The Tax Iceberg™ Model, Created & Taught By Sid Peddinti

The 5 Massive Money Drains That Will Decimate Your Loved Ones’ Inheritance (and How to Stop Them)

Dear friends,

Look, nobody likes thinking about death. It’s a total downer and it’s a really dark and morbid topic. I’ve had thousands of these morbid conversations with people over the past two decades.

But ignoring the financial cleanup after you’re gone is basically leaving a giant, expensive mess for your family to handle. It’s like an unexpected final bill, and the government and lawyers are the ones sending the invoice.

These “death taxes” and costs are sneaky. They can wipe out a huge chunk of your money – money you worked hard for and intended for your kids or grandkids. We’re breaking down the five biggest money-sinks that will impact your estate and telling you exactly what to do about them right now.

1: The Federal Estate Tax – The ~$14 Million Problem (For Now)

This is the big one that gets all the headlines. The Federal Estate Tax is a tax on your right to transfer property at your death. Think of it as a wealth transfer tax. The estate itself pays it before the money goes to your beneficiaries.

The good news? Most people don’t pay it. The bad news? If you do, it hits hard.

Key Point: The current exemption is super high, meaning your total estate value must exceed this huge number before the tax even kicks in. But this number is set to drop dramatically in the next few years, and you need to plan for that change now.

Action Step 1: Check Your Total Worth – Seriously

You need to add up everything. That means your house, your retirement accounts (IRA, 401k), your investment portfolios, your life insurance payout, and any business ownership. Don’t just guess – get a real number. For the federal tax, everything counts.

Action Step 2: Understand the “Use It or Lose It” Rule (Portability)

When one spouse dies, their unused portion of the federal exemption can be transferred to the surviving spouse. This is called “portability.” If you don’t file the right tax forms after the first spouse passes, you lose that huge exemption amount, which could be a disaster down the road.

Action Step 3: Know the Top-End Tax Rate

If your estate goes over the exemption limit, the tax rate starts high and hits a massive 40% on the excess amount. Think about that – nearly half of everything over the limit goes straight to Uncle Sam. This is why complex estates must have a plan to use trusts and other tools to legally reduce that taxable amount.

Takeaway: This tax is for the super-rich today, but if you have a business, a lot of real estate, or high-value life insurance, or if the exemption goes down, your estate could suddenly be on the hook for millions. Don’t wait for the law to change to start planning.

2: State-Level “Death Taxes” – The Lower Threshold Trap

A lot of people breathe a sigh of relief when they realize they won’t hit the massive federal threshold, but then they get blindsided by their own state. There are two main types of state death taxes, and they are much nastier because their exemption limits are far lower than the federal one.

Sub-Point A: The State Estate Tax

This is the state version of the federal tax. It’s still paid by the estate, but in states that have it, the exemption often starts in the single-digit millions (or even less).

Example: A state might tax any estate value over $3 million. If your estate is worth $5 million, your estate pays a state tax on the $2 million difference. That can be a six-figure bill you didn’t see coming.

Key Strategy: If you live in one of the states that has this tax, you need to use tools like irrevocable trusts to move assets out of your taxable estate now. Waiting until your spouse dies or until you are older closes off some of your best options.

Sub-Point B: The Inheritance Tax (The Beneficiary Killer)

This is the absolute sneakiest one because it’s not paid by the estate. It’s paid by the person inheriting the money. Only a handful of states have this, but if you live in one of them, your loved ones could see a chunk of their inheritance disappear.

Rule to Know: The tax rate depends entirely on the relationship between the deceased and the person inheriting.

- Spouses/Children: Usually exempt or pay the lowest rate.

- Siblings/Nieces/Nephews: Often pay a moderate tax rate.

- Unrelated Friends/Distant Relatives: Can face the highest tax rates, sometimes reaching 15% or more.

Warning: You might live in a non-inheritance tax state, but if you own property in one of those states (like a vacation home), that property could still be subject to the inheritance tax when you pass away. You need specialized advice for multi-state property ownership.

Takeaway: Check your state right now. A few states have both an estate tax and an inheritance tax. If you live in one of these, you are in a tax trap, and simple estate planning is not enough.

3: The Probate Monster – Court, Lawyers, and Admin Fees

Even if your estate is small and you dodge all the taxes above, you still have to deal with the cost of settling the estate. If you only have a Will, or worse, no plan at all, your estate has to go through probate – the court process that validates the Will and transfers assets.

This is where the costs really pile up, and it’s not a fixed price tag – it’s a percentage drain on the whole thing.

Cost Component 1: Attorney Fees (The Big Bill)

Lawyers handle the probate process, and they charge for it. In some states, attorney fees are set by law (statutory fees) and are calculated as a percentage of the total estate value. Even if the work is simple, the fee can be fixed to a percentage. In other states, they charge hourly, which can balloon if the estate is complicated, heirs disagree, or assets are hard to find.

Cost Component 2: Executor/Administrator Fees

The person you name to manage your estate (the Executor) is entitled to be paid. This fee is often a percentage of the estate’s value and is paid out of the estate funds. If your spouse or child serves, they get paid and that payment is taxable income to them.

Cost Component 3: Court and Filing Fees

There are mandatory costs just to open the case, file paperwork, send notices, and finalize the transfer of property. While these are usually only a few hundred or a few thousand dollars, they are unavoidable.

Cost Component 4: Appraisals and Accounting

If you own real estate, a business, or valuable collectibles, the court requires an official appraisal to determine the value as of the date of death. You also often need specialized accountants to prepare the final tax filings. All of these professionals get paid from the estate.

Total Damage: Probate costs typically range from 2% to 7% of the total estate value. On a $1 million estate, that’s $20,000 to $70,000, and it adds insult to injury by delaying the inheritance process for months or even years.

Key Action: A Revocable Living Trust is the most common and effective way to bypass probate entirely, saving your family time, privacy, and thousands of dollars in fees.

4: Income Taxes – The Retirement Plan Trap

Most people think of death taxes as something that only applies to millionaires. But the income tax bill on inherited money can be a brutal surprise for regular families, especially involving retirement accounts.

The Sneaky Tax: Required Minimum Distributions (RMDs)

If you inherit a traditional IRA or 401k, you have inherited a pot of money that has never been taxed. When you pull the money out, it is treated as regular income and taxed at your normal income tax rate.

The New Rules: The SECURE Act changed the rules for most non-spouse beneficiaries. They now have to empty the entire retirement account within 10 years. This forces a massive amount of taxable income into a short time window, potentially kicking the beneficiary into a much higher tax bracket.

Scenario: Grandma leaves her grandchild a $500,000 IRA. The grandchild has to take that half-million out over 10 years, adding about $50,000 a year to their income. If they already make $70,000, they are now taxed as if they make $120,000, and the IRS gets a huge payday.

Hidden Cost: Capital Gains Tax on Inherited Assets

This one is less of a death cost and more of a major money saver if planned correctly. When you sell an appreciated asset (like a stock or real estate) after someone dies, the cost basis (the value you use to calculate profit) is “stepped up” to the fair market value on the date of death.

Smart Move: If you have an asset with a low original cost (like stock bought 30 years ago), it is almost always better to pass it on through your estate than to sell it yourself and pay the capital gains tax. This step-up in basis can save the beneficiary huge amounts of money.

Takeaway: Your estate planning needs to focus on making sure your beneficiaries pull the retirement money out in the most tax-efficient way possible. For large retirement accounts, you need a strategy beyond just naming a beneficiary.

5: The Administration Drag – Time, Penalties, and Mess

These are the costs you incur simply by making the process slow, messy, or complicated. They are often called the “hidden costs” because they are not a single line-item tax, but rather the collective expense of inefficiency.

Messy Cost 1: Professional Fee Multipliers

If the deceased’s records are a disaster, assets are scattered across multiple banks, or there’s no clear list of debts, the professionals (lawyers, accountants, fiduciaries) have to spend dozens of extra hours locating and compiling everything. This is extra billing at hundreds of dollars an hour, all paid by the estate. A disorganized estate is an expensive estate.

Messy Cost 2: Tax Penalties

The estate has critical deadlines for filing final income taxes and, if applicable, the federal or state estate tax returns. Miss a deadline, even by a day, and the IRS or state tax authority can slap the estate with hefty late-filing penalties and interest. This is money that comes directly out of what would have been the inheritance.

Messy Cost 3: Property Maintenance and Insurance

While the estate is tied up in probate (which, again, can take 6-18 months), who pays to maintain the house? The mortgage, insurance, utilities, property taxes, and general upkeep still need to be paid. The Executor is responsible for this, and the money comes from the estate. If the estate doesn’t have enough liquid cash, the Executor might have to sell assets quickly or use their own money and wait for reimbursement.

Messy Cost 4: Family Fighting (Litigation)

If you didn’t name beneficiaries correctly, failed to update your Will after a life event, or didn’t clearly state your intentions, family members may contest the Will or the Trust. Lawsuits can easily cost the estate $50,000 to $200,000 or more in legal fees, eating up the inheritance completely. This is the single most destructive cost to an estate.

The Solution: The cost of creating a solid estate plan today is a tiny fraction of the cost your family will incur if you do nothing. A complete plan is your way of firing the “Probate Monster” and minimizing the government’s cut.

Look, the biggest takeaway here is simple: having a Will is a bare minimum. BUT – a will does NOT AVOID PROBATE – remember that.

To actually protect the money you spent your life building, you need a proper strategy that addresses all five of these financial drains – especially the state taxes and probate fees that hit regular families the hardest. You can’t fix this for your family after you’re gone. You have to do it now.

Which one of these costs surprised you the most – the massive federal tax exemption, or the sneaky state inheritance tax? Let us know in the comments!

Don’t leave your family guessing. Get the clarity and protection you need. I have complied an entire portfolio of law, tax, and finance professionals who can help you manage your wealth in a more calculated and planned manner.

The Tax Iceberg™ is the ultimate way to remember that there are hidden taxes lurking beneath the iceberg that surface after your death – and you’re not here to do anything about it.

Thanks for reading,

Sid Peddinti, Esq.

BA, BIA, LB/JD, LLM

Schedule a pro bono strategy session with us. We’ll help you find the right set of experts to help you navigate these complex laws with more confidence.

This article is for informational and educational purposes only and does not constitute legal or financial advice. Tax laws are complex, constantly changing, and vary significantly by state and individual circumstances. You should consult with a qualified estate planning attorney and tax professional to discuss your specific situation.

Leave a comment